by Calculated Risk on 11/04/2011 10:11:00 AM

Friday, November 04, 2011

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

This was a weak report, and the headline number was slightly below consensus forecasts. However some of the underlying data was a little more encouraging (with emphasis on "little").

There were only 80,000 jobs added in October. There were 104,000 private sector jobs added, and 24,000 government jobs lost.

However the change in total employment was revised up for August and September. "The change in total nonfarm payroll employment for August was revised from +57,000 to +104,000, and the change for September was revised from +103,000 to +158,000."

The household survey showed an increase of 277,000 jobs in October. This increase in the household survey pushed the unemployment rate down slightly, even as more people participated in the workforce (labor force increased by 181,000). The unemployment rate declined to 9.0%, and the participation rate was unchanged at 64.2%. The employment population ratio also increased to 58.4% from 58.3%. This is the third straight monthly increase in the employment population ratio from the low in July at 58.1%.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 16.2% - and this is very high. The low for the year was 15.7% in March, and the high was 16.5% in September. U-6 was in the 8% range in 2007.

The average workweek was unchanged at 34.3 hours, and average hourly earnings increased slightly. "The average workweek for all employees on private nonfarm payrolls was unchanged at 34.3 hours in October... In October, average hourly earnings for all employees on private nonfarm payrolls increased by 5 cents, or 0.2 percent, to $23.19. ... Over the past 12 months, average hourly earnings have increased by 1.8 percent." This is sluggish earnings growth, and earnings are being impacted by the large number of unemployed and marginally employed workers.

Through the first ten months of 2011, the economy has added 1.256 million total non-farm jobs or just 125 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.47 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1.529 million private sector jobs this year, or about 153 thousand per month.

There are a total of 13.9 million Americans unemployed and 5.9 million have been unemployed for more than 6 months. Very grim.

Overall this was another weak employment report and suggests sluggish economic growth.

Percent Job Losses During Recessions

Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

In terms of lost payroll jobs, the 2007 recession was by far the worst since WWII.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) decreased by 374,000 to 8.9 million in October.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) decreased to 8.896 million in October from 9.27 million in September. This just reverses some of the increase last month.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 16.2% in October from 16.5% in September.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.876 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 6.242 million in September. This is still very high, but near the low for the year. Long term unemployment remains a serious problem.

• Earlier Employment post: October Employment Report: 80,000 Jobs, 9.0% Unemployment Rate

October Employment Report: 80,000 Jobs, 9.0% Unemployment Rate

by Calculated Risk on 11/04/2011 08:30:00 AM

From the BLS:

Nonfarm payroll employment continued to trend up in October (+80,000), and the unemployment rate was little changed at 9.0 percent, the U.S. Bureau of Labor Statistics reported today.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

...

The change in total nonfarm payroll employment for August was revised from +57,000 to +104,000, and the change for September was revised from +103,000 to +158,000.

Click on graph for larger image.

Click on graph for larger image.The unemployment rate declined to 9.0% (red line).

The Labor Force Participation Rate was unchanged 64.2% in October (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio increased to 58.4% in October (black line).

Note: the household survey showed another strong gain in jobs, and that is why the unemployment rate could decline with few payroll jobs added - and the employment population ratio increase.

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring. The red line is moving slowly upwards - and I'll need to expand the graph soon.

This was still a weak report, and slightly below consensus. There were decent upwards revisions to the August and September reports. I'll have much more soon ...

Thursday, November 03, 2011

Thursday Night Futures: Jobs, jobs, jobs ... and Greece

by Calculated Risk on 11/03/2011 11:25:00 PM

The confidence vote in Greece is tomorrow ... and it seems the story keeps changing:

From the BBC: Greece PM Papandreou faces fresh call to resign

Greece's centre-right opposition has demanded Prime Minister George Papandreou resign, throwing into disarray plans for a unity government.From the Athens News: Parties enter coalition talks

Opposition leader Antonis Samaras also called for snap elections before leading his MPs in a dramatic walkout of parliament.

Mr Papandreou's government faces a crucial confidence vote on Friday.

Prime Minister George Papandreou has proposed the formation of a coalition government by announcing that the planned referendum will no longer take place and that his party has entered into talks with New Democracy leader Antonis Samaras.The Asian markets are up tonight. The Nikkei is up 1.25%, the Hang Seng is up 3.0%.

...

During an impassioned parliamentary speech, however, Samaras once again demanded general elections “within weeks” and said that the prime minister was mistaken if he believed he would co-govern with him.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is down about 4 points, and Dow futures are down about 40 points.

On the employment report tomorrow: Employment Situation Preview: Another Weak Report

Survey: Small Business Owners report small reduction in employment, hiring plans slightly positive

by Calculated Risk on 11/03/2011 07:28:00 PM

Note: NFIB’s monthly small business survey for October will be released on Tuesday, November 8, 2011.

From the National Federation of Independent Business (NFIB): NFIB Jobs Statement: October Brought Early Snow but Not New Jobs

Chief economist for the National Federation of Independent Business (NFIB) William C. Dunkelberg, issued the following statement ...Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

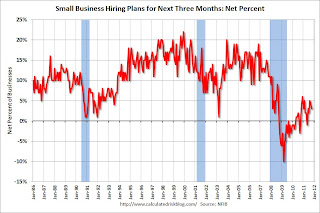

“The cold has set in, and it looks like it might be a long winter for small-business owners. Still hunkering down, small-business owners reported a small, but overall reduction in employment, posting an average reduction of 0.1 employees per firm in October. ... The good news is that October’s jobs numbers are better than September’s (which showed a net decrease of 0.3 employees per firm), but still not good enough to lower the unemployment rate. ... Over the next three months ... a seasonally adjusted net three percent of owners planning to create new jobs. This is down 1 point from September and 2 points below August, the month that has, thus far, posted the strongest reading for 2011. For some context, in an expansion, this number should exhibit double digit readings."

Here is a graph of the net hiring plans for the next three months since 1986.

Here is a graph of the net hiring plans for the next three months since 1986.Hiring plans were low in October, but still positive and the trend is up.

It is no surprise that small businesses are struggling due to the high concentration of real estate related companies in the survey. As Dunkelberg noted, "the good news is that October’s jobs numbers are better than September’s".

• On the employment report tomorrow: Employment Situation Preview: Another Weak Report

Employment Situation Preview: Another Weak Report

by Calculated Risk on 11/03/2011 03:35:00 PM

On Friday the BLS will release the October Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 90,000 payroll jobs in October, and for the unemployment rate to remain unchanged at 9.1%.

Overall the economic data for October was fairly weak, though slightly better than in August and September. The BLS reported 57,000 jobs added in August, and 103,000 added in September. Of course, the Verizon labor dispute subtracted 45,000 payroll jobs in August, and those jobs were added back in the September report. The average of those two months was 80,000 jobs added, and if the economy was a little "better" in October, we'd expect a few more jobs added.

Here is a summary of recent data:

• The ADP employment report showed an increase of 110,000 private sector payroll jobs in October. Unfortunately ADP hasn't been very useful in predicting the BLS report. Also note that government payrolls have been shrinking by about 30,000 on average per month this year, so this suggests around 110,000 private nonfarm payroll jobs added, minus 30,000 government workers - or around 80,000 total jobs added in September.

• The ISM manufacturing employment index decreased slightly to 53.5% from 53.8% in September. Based on a historical correlation between the ISM index and the BLS employment report for manufacturing, this reading suggests no change in private payroll jobs for manufacturing in October.

The ISM non-manufacturing employment index increased 4.6 percentage points to 53.3. A historical correlation suggests this indicates about 150,000 service jobs added in October.

• Initial weekly unemployment claims averaged about 404,000 per week in October, down from 418,000 per week in September and 411,000 average in August.

• Initial weekly unemployment claims averaged about 404,000 per week in October, down from 418,000 per week in September and 411,000 average in August.

For the BLS reference week (includes the 12th of the month), initial claims were at the lowest level since April - and in April the BLS reported 217,000 jobs added.

• The final October Reuters / University of Michigan consumer sentiment index increased to 60.9 from 59.4 in September. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. In general this low level would suggest a weak labor market - but slightly better than in August and September.

• And on the unemployment rate from Gallup: U.S. Unemployment Improves in October

Unemployment, as measured by Gallup without seasonal adjustment, is at 8.4% at the end of October, down from 8.7% in September and 9.2% in August. Unemployment was at 8.3% in mid-October -- its lowest level since Gallup began continuous monitoring in January 2010. Gallup's unemployment measure is also now much lower compared with a year ago -- it stood at 9.4% at the end of October 2010.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. Usually the NSA unemployment rate declines in October, and the seasonally adjusted rate is higher - so this would suggest little change in the unemployment rate from September.

There always seems to be some randomness to the employment report, but my guess is the BLS will report above the consensus of 90,000. The ADP report would suggest around 80,000 jobs added, and consumer sentiment is very poor suggesting even fewer jobs. However the rebound in the ISM non-manufacturing survey is encouraging, and so is the decline in initial weekly unemployment claims. But 100,000 jobs added is a weak report - heck, even 200,000 jobs added would be a poor month with so many people unemployed.

Caveat: my track record when I take the under has been very good - but recently I've been mostly wrong when I've taken the over (although I correctly took the over last month)!