by Calculated Risk on 11/01/2011 11:45:00 AM

Tuesday, November 01, 2011

Construction Spending increased slightly in September

Catching up ... this morning from the Census Bureau reported that overall construction spending increased in September:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during September 2011 was estimated at a seasonally adjusted annual rate of $787.2 billion, 0.2 percent (±1.8%)* above the revised August estimate of $786.0 billion. The September figure is 1.3 percent (±1.9%)* below the September 2010 estimate of $797.3 billion.Private construction spending increased in September:

Spending on private construction was at a seasonally adjusted annual rate of $501.8 billion, 0.6 percent (±1.1%)* above the revised August estimate of $499.0 billion. Residential construction was at a seasonally adjusted annual rate of $228.3 billion in September, 0.9 percent (±1.3%)* above the revised August estimate of $226.3 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 66% below the peak in early 2006, and non-residential spending is 34% below the peak in January 2008.

Public construction spending is now 12% below the peak in March 2009.

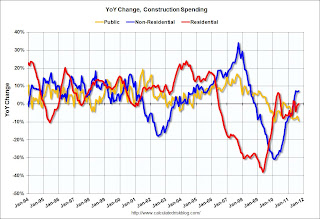

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is now falling on a year-over-year basis as the stimulus spending ends. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

Earlier:

• ISM Manufacturing index indicates slower expansion in October

ISM Manufacturing index indicates slower expansion in October

by Calculated Risk on 11/01/2011 10:00:00 AM

PMI was at 50.8% in October, down from 51.6% in September. The employment index was at 53.5%, down from 53.8%, and new orders index was at 52.4%, up from 49.6%.

From the Institute for Supply Management: October 2011 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in October for the 27th consecutive month, and the overall economy grew for the 29th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 50.8 percent, a decrease of 0.8 percentage point from September's reading of 51.6 percent, indicating expansion in the manufacturing sector for the 27th consecutive month. The New Orders Index increased 2.8 percentage points from September to 52.4 percent, indicating a return to growth after three months of contraction. The Prices Index, at 41 percent, dropped 15 percentage points, and is below the 50 percent mark for the first time since May 2009 when it registered 43.5 percent. Inventories decreased to 46.7 percent, which is 5.3 percentage points below the September reading of 52 percent. Comments from respondents are mixed, indicating positive relief from raw materials pricing and continuing strength in a few industries, but there is also more concern and caution about growth in this uncertain economy."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 52.0%, and suggests manufacturing expanded at a slightly slower rate in October than in September. It appears manufacturing employment expanded in October with the employment index at 53.5%. New orders were up, and prices fell sharply.

Greece Update

by Calculated Risk on 11/01/2011 08:38:00 AM

Some European bond yields are rising sharply ...

From the Financial Times: Referendum call sparks fears over Greek bail-out

The premier also raised the stakes by announcing a parliamentary vote of confidence ... The debate ... will start on Wednesday with a vote set for midnight on Friday.From the WSJ: Greek Vote Threatens Bailout

excerpt with permission

A "yes" vote in the referendum could deflate the massive street protests and strikes that threaten to paralyze Greece as it tries to enact a brutal austerity program to earn rescue loans from the euro zone and the International Monetary Fund.The Greek 2 year yield is up to 84.2% (up from 77.7% yesterday) The Greek 1 year yield is up to 194% (from 158%).

A "no" vote, however, could bring down the government and cut off international funding for Greece, leaving the country facing a financial meltdown. The government expects to hold the referendum in January.

The Portuguese 2 year yield is up to 19.6% (from 18.3% yesterday) and the Irish 2 year yield is up to 9.3% (from 8.8%).

The Spanish 10 year yield is at 5.6% and the Italian 10 year yield is up to 6.3% (from 6.1%).

The Belgian 10 year yield is at 4.4% and the French 10 year yield is down to 3.0%.

Monday, October 31, 2011

Gasoline Price Update

by Calculated Risk on 10/31/2011 10:27:00 PM

The graph below shows gasoline prices have been slowly moving down since peaking in early May.

Unfortunately, according to Bloomberg, Brent Crude is up to $109.12 per barrel, and WTI is up to $92.83.

According to the EIA, WTI is up from $79 per barrel at the end of September, and Brent is up from $105. It appears the gap between WTI and Brent is closing.

Note: This graph show oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Europe: Greece to Hold Referendum on Debt Deal in December or January

by Calculated Risk on 10/31/2011 06:14:00 PM

This was announced earlier today, but this story has the timing. From the NY Times: Greece to Hold Referendum on New Debt Deal

Prime Minister George Papandreou announced Monday night that his Socialist government would hold a rare national referendum on a new debt agreement for Greece ... Mr. Papandreou said that the decision on whether to adopt the deal, which includes fresh financial assistance for the country but also imposes unpopular austerity measures, belonged to the Greek people. “Let us allow the people to have the last word, let them decide on the country’s fate,” he said ... Government sources said that the confidence vote was expected by the end of the week, with the referendum much later, in December or even January.So there will be a vote of confidence by the end of this week, and then a general referendum later.

The Greek 2 year yield is down to 77.7%. The Greek 1 year yield is down to 158%.

The Portuguese 2 year yield is up to 18.3% and the Irish 2 year yield is up to 8.8%.

The Spanish 10 year yield is at 5.54% and the Italian 10 year yield is up to 6.1%.

The Belgian 10 year yield is at 4.4% and the French 10 year yield is down to 3.1%.