by Calculated Risk on 10/24/2011 11:22:00 AM

Monday, October 24, 2011

Moody's: Commercial Real Estate Prices increased 2.4% in August

From Bloomberg: Moody’s U.S. Commercial Property Index Rose 2.4% in August

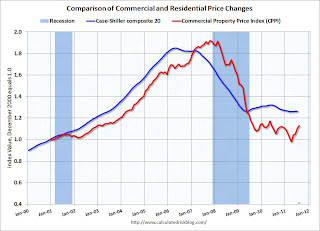

The Moody’s/REAL Commercial Property Price Index advanced 2.4 percent from July. It’s up 7.2 percent from a year earlier ... Moody’s doesn’t see “significant” price gains in the near term as loan originations based on commercial-mortgage backed securities slow and demand for vacant space continues to “languish,” the company said. ... The share of distressed deals was 21.7 percent, the lowest since January 2010.Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are up 7.2% from a year ago, and down about 41% from the peak in 2007. This index is very volatile because there are relatively few transactions - and some of the recent increase was due to fewer distressed sales - and some of the increase was probably seasonal.

NY Fed President Dudley: More action needed to stabilize the housing sector

by Calculated Risk on 10/24/2011 09:07:00 AM

From NY Fed President William Dudley: The National and Regional Economic Outlook

Stabilizing the housing sector is particularly important because housing equity is an important part of household wealth. This calls for a comprehensive approach to housing policy, starting with an urgent effort to remove the obstacles that make it difficult for all borrowers to refinance at today's low mortgage rates, but extending beyond this to tackle other problems weighing on housing. Taken together, such efforts could help shift people's expectations about future house prices. If prospective homeowners no longer fear that prices could decline further, they will be more willing to enter the market to take advantage of reduced prices and low financing costs, and existing homeowners will feel more confident about spending. A vicious cycle could be replaced by a virtuous circle, in which stabilization in house prices supports spending, growth and jobs.This suggests a "comprehensive" plan is in the works.

The new refinance plan will be announced today, see from Nick Timiraos at the WSJ: Home Lending Revamp Planned

The plan will streamline the refinance process by eliminating appraisals and extensive underwriting requirements for most borrowers, as long as homeowners are current on their mortgage payments ... Fannie and Freddie have also agreed to waive some fees that made refinancing less attractive for some.And two more possibilities ...

1) Last week Fed Vice Chairman Janet Yellen, and Fed Governor Daniel Tarullo discussed a possible new MBS buying program at the Fed. See Fed Is Poised for More Easing and Fed Official Hints at Possible Effort to Boost Economy.

2) As I noted yesterday, I'm hearing rumors that a new REO disposition program for the FHA, Fannie and Freddie might be announced soon (probably selling REO to investors in bulk with a rental program for current occupants).

Weekend:

• Schedule for Week of Oct 23rd

• Summary for Week ending Oct 21st

Chicago Fed: Economic activity improved in September

by Calculated Risk on 10/24/2011 08:30:00 AM

This is a composite index from the Chicago Fed: Index shows economic activity improved in September

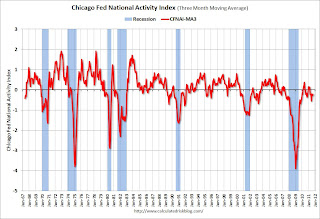

Led by improvements in employment-related indicators, the Chicago Fed National Activity Index increased to –0.22 in September from –0.59 in August.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

...

The index’s three-month moving average, CFNAI-MA3, edged up to –0.21 in September from –0.28 in August, but remained negative for the sixth consecutive month. September’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. Likewise, the economic slack reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was still growing in September, but below trend.

Weekend:

• Schedule for Week of Oct 23rd

• Summary for Week ending Oct 21st

Sunday, October 23, 2011

WSJ: Details on New FHFA Refinance Program, No LTV Limit, Eliminate appraisals

by Calculated Risk on 10/23/2011 11:51:00 PM

From Nick Timiraos at the WSJ: Home Lending Revamp Planned

Federal regulators on Monday plan to unveil a major overhaul of an under-used mortgage-refinance program ... The overhaul will, among other things, let borrowers refinance regardless of how far their homes have fallen in value ...This is more aggressive than I expected and there will probably be a significant pickup in refinancing. This only applies to loans that are current and guaranteed by Fannie and Freddie.

The plan will streamline the refinance process by eliminating appraisals and extensive underwriting requirements for most borrowers, as long as homeowners are current on their mortgage payments ... Fannie and Freddie have also agreed to waive some fees that made refinancing less attractive for some.

...

Pricing details won't be published until mid-November, and lenders could begin refinancing loans under the retooled program as soon as Dec. 1 ... Loans that exceed the current limit of 125% of the property's value won't be able to participate until early next year. The program's expiration date ... will be extended through 2013. HARP is only open to loans that Fannie and Freddie guaranteed as of June 2009.

Yesterday:

• Schedule for Week of Oct 23rd

• Summary for Week ending Oct 21st

Housing: Zillow forecast for Case-Shiller, FHFA Refinance Plan and a Rumor

by Calculated Risk on 10/23/2011 05:30:00 PM

• On Tuesday, the S&P/Case-Shiller House Price Index for August will be released (really a 3 month average of June, July and August). The consensus is for prices to increase 0.2% in August. Here is Zillow's forecast of Case-Shiller:

• Case-Shiller 20-City Composite indexBecause of seasonally distortions related to foreclosures, S&P reports the NSA numbers. But even with those distortions, I track the SA numbers - and those will probably show a month-over-month decline in August.

... Not-seasonally adjusted: -3.7% year-over-year, -0.1% month-over-month

... Seasonally adjusted: -3.8% year-over-year, -0.3% month-over-month

• Case-Shiller 10-City Composite index

... Not-seasonally adjusted: -3.4% year-over-year, +0.2% month-over-month

... Seasonally adjusted: -3.5% year-over-year, -0.2% month-over-month

• The FHFA is expected to release changes to the HARP refinance plan this week. From Reuters: U.S. readies stronger lifeline for homeowners

Homeowners who owe more than their houses are worth will get new help to refinance in a government plan to be unveiled as early as Monday to support the battered housing sector ... the Federal Housing Finance Agency, intends to loosen the terms of the two-year-old Home Affordable Refinance Program, which helps borrowers who have been making mortgage payments on time but who have not been able to refinance as their home values have dropped.• And a rumor: Back in August, the FHFA, Treasury and HUD put out a request for input on the disposition of Fannie, Freddie and FHA REOs. The three entities own about 250,000 properties and approximately 800,000 homes backed by Fannie, Freddie and the FHA are in some stage of foreclosure. I've heard a rumor that an RTC like disposition program for Fannie/Freddie/FHA properties is in the works and might be announced in the next couple of weeks (this is a rumor only!). This would probably involve selling REOs in bulk to investors and include some sort of plan to rent them to the current occupants.

HARP is currently open to borrowers whose mortgages are owned or guaranteed by Fannie Mae or Freddie Mac as long as their loans do not exceed 125 percent of their homes' values.

The sources said FHFA will lift that threshold ... Another change may include the possibility of easing the fees tied to mortgages refinanced under HARP, according to the sources.

Yesterday:

• Schedule for Week of Oct 23rd

• Summary for Week ending Oct 21st