by Calculated Risk on 10/23/2011 02:10:00 PM

Sunday, October 23, 2011

Merkel: No Decisions Today, Announcement expected Wednesday

From MarketWatch: Final agreement on package of measures expected Wednesday

“Today, we will not undertake any decisions, but will undertake preparatory work,” German Chancellor Angela Merkel told reporters Sunday in a joint news conference with French President Nicolas Sarkozy after a meeting of heads of state from all 27 European Union nations.Yesterday:

“A broad agreement is taking shape,” Sarkozy said, emphasizing that leaders aim to reach final agreement on a deal on Wednesday.

The fight over the EFSF is seen by economists as the most difficult issue. ... Merkel said European finance ministers on Saturday weighed two options for leveraging the EFSF, but that neither involved the ECB.

• Schedule for Week of Oct 23rd

• Summary for Week ending Oct 21st

Report: European Banks need to raise €108bn in new capital

by Calculated Risk on 10/23/2011 08:44:00 AM

The final details will be released on Wednesday. This is just one part of the agreement (details on Greece and the EFSF also need to be worked out).

From the Financial Times: Banks must find €108bn in new capital

According to two people involved with the negotiations, the European Banking Authority’s final emergency stress test identified a total of €108bn to be raised by Europe’s banks ...From the WSJ: Bank Recapitalizations May Reach €108 Billion

excerpt with permission

European governments likely will seal an agreement to set aside between €107 billion-€108 billion ($150.01 billion) to boost the cash reserves of banks weakened by their exposure to sovereign debt ... there would be no final agreement on the capital ratio and the size of the recapitalization until the full crisis package is worked out. The deadline for that is a European summit Wednesday.Yesterday:

• Schedule for Week of Oct 23rd

• Summary for Week ending Oct 21st

Saturday, October 22, 2011

Europe Update

by Calculated Risk on 10/22/2011 09:59:00 PM

Although there will probably be an announcement on Sunday, the deadline has been moved to Wednesday ... it is pretty clear that Greece bondholders will take a much larger haircut than the original 21%.

From the NY Times: European Finance Ministers Shaping Greek Rescue and Effort to Aid Banks

European finance ministers said on Saturday that they were near a deal to strengthen capital reserves for their troubled banks — the first part of a package of measures meant to stem the worsening European debt crisis.Alphaville at the Financial Times has excerpts from the grim report on Greece: Greek haircuts and Greek myths — the details

... the ministers also said that holders of Greek bonds would have to take much bigger losses than the 21 percent originally agreed to in July, though ... no agreement was near on write-offs that could reach as high as 60 percent.

The ministers also reported that France and Germany had made progress on a third issue, how to increase the firepower of a rescue fund for the euro zone.

To get the debt down further would require a larger private sector contribution (for instance, to reduce debt below 110 percent of GDP by 2020 would require a face value reduction of at least 60 percent and/or more concessional official sector financing terms).From the Telegraph: Europe's leaders threaten Greek default if banks won't take haircut and accept losses of £120bn

Europe's leaders are threatening to trigger a formal default on Greek debt and risk a “credit event” if banks refuse to accept losses of up to €140bn (£120bn) on their holdings.

Hardline eurozone members, backed by the International Monetary Fund (IMF), delivered the ultimatum this weekend ... Vittorio Grilli, a senior EU official, travelled to Rome yesterday to present the “take it or leave it” deal to the Institute of International Finance, which is leading the negotiations for the banks. “The only voluntary element for the banks now is to take a 50pc haircut or face a credit event, a default,” said an EU diplomat.

Unofficial Problem Bank list declines to 976 Institutions

by Calculated Risk on 10/22/2011 06:42:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 21, 2011. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

With four removals and one addition, the Unofficial Problem Bank List finished the week at 976 institutions with assets of $401.9 billion. For comparative purposes, the list had 871 institutions with assets of $402.2 billion last year.Earlier:

Failure was the cause for the four removals that include Community Banks of Colorado, Greenwood Village, CO ($1.4 billion); Old Harbor Bank, Clearwater, FL ($216 million Ticker: OHBK); Decatur First Bank, Decatur, GA ($192 million); and Community Capital Bank, Jonesboro, GA ($181 million).

The two failures in Georgia push that state's total to 73 at a cost of $9.3 billion since the on-set of the crisis in 2008. In all, the FDIC's Atlanta Region has seen 154 failures at a cost of $27.7 billion. Perhaps these figures would be lower if the supervision team in that region had taken seriously the many warnings it received long before the on-set of the crisis on the riskiness of the C&D lending exposures. As an aside, it is interesting how many of the involved principals still hold high level positions at the FDIC or have gone on to lucrative consulting jobs. As the OWS movement wants Wall Street executives held accountable for the economic dislocations they caused, how about a movement to hold the regulatory agency executives accountable for their failings that contributed to those dislocations.

The addition this week is Town Center Bank, Frankfort, IL ($130 million). Again, we applaud the disclosure of this action by the Illinois State Banking Department, which is the most transparent department among all of the states.

The OCC used to release its monthly enforcement action activity on the Friday subsequent to the 15th day of the month. However, the OCC has not released on that schedule the past two months. We guess the OCC will release some information next week.

• Schedule for Week of Oct 23rd

• Summary for Week ending Oct 21st

Schedule for Week of Oct 23rd

by Calculated Risk on 10/22/2011 02:15:00 PM

Earlier:

• Summary for Week ending Oct 21st

This is a key week for Europe, starting with the European leaders summit meeting on Sunday.

The key U.S. economic report for the coming week is the Q3 advance GDP report to be released on Thursday. There are also two important housing reports to be released early in the week: Case-Shiller house prices on Tuesday and New Home sales on Wednesday.

Several high frequency releases will be closely watched: weekly initial unemployment claims, consumer sentiment (final) and two more regional Fed manufacturing surveys.

European Union leaders will hold a summit meeting.

8:30 AM ET: Chicago Fed National Activity Index (September). This is a composite index of other data.

8:45 AM: New York Fed President William Dudley speaks on "Regional and National Economic Outlook" at Fordham University Gabelli School of Business. Following the recent speeches by Fed Vice Chairman Janet Yellen and Fed Governor Daniel Tarullo, discussing the possibility of more Fed MBS purchases, this speech by Dudley will be closely watched.

Expected: The Moody's/REAL Commercial Property Price Index (commercial real estate price index) for August.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The consensus is for prices to increase 0.2% in August. The CoreLogic index showed a 0.8% decrease in August (NSA). Based on the other price indexes, the Case-Shiller index could show a decrease in August.

10:00 AM: Conference Board's consumer confidence index for October. The consensus is for an increase to 46.0 from 45.4 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October. The consensus is for the index to be at -1, up from -6 in September (below zero is contraction).

10:00 AM: FHFA House Price Index for August 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.9% decrease in durable goods orders after decreasing 0.1% in August.

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for a slight increase in sales to 300 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 295 thousand in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a slight increase to 405,000 from 403,000 last week. The 4-week average is still above 400,000, however the average has declined recently to the lowest level since early April.

8:30 AM: Q2 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 2.5% annualized in Q3.

8:30 AM: Q2 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 2.5% annualized in Q3.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The blue column is the forecast for Q3 GDP.

10:00 AM: Pending Home Sales Index for September. The consensus is for a 0.1% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for October. The consensus is for an increase to 8 in October from 6 in September (slight expansion).

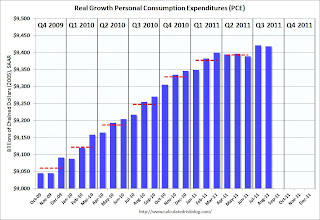

8:30 AM: Personal Income and Outlays for September. The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars).

8:30 AM: Personal Income and Outlays for September. The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars). PCE increased 0.2 in August, and real PCE decreased slightly as the price index for PCE increased 0.2 percent in August.

The consensus is for a 0.3% increase in personal income in August, and a 0.6% increase in personal spending, and for the Core PCE price index to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for a slight increase to 58.0 from the preliminary reading of 57.5.