by Calculated Risk on 10/08/2011 12:04:00 AM

Saturday, October 08, 2011

Friday Night Europe

A couple more stories on Europe ...

From the NY Times: Europe Seems to Agree on Recapitalizing Banks — but How?

European leaders are finally coming around to the view that banks must be compelled to replenish their capital reserves if the euro area is ever to emerge from the debt crisis. But whether the politicians can make it happen in a convincing manner is another question ... In the first signs of a split, France wants to draw on the European bailout fund, the European Financial Stability Facility, to rebuild bank capital. German leaders think national governments should take the lead.And from the Financial Times: Investors turn bears on Germany and France

Investors are taking increasingly bearish bets on Germany and France ... The cost of protecting German government bonds against default surged to a fresh record this week.The next few weeks should be very interesting in Europe.

excerpt with permission

Here are the earlier employment posts (with graphs):

• September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• Employment graph gallery

Friday, October 07, 2011

Bank Failures #75 & 76 in 2011

by Calculated Risk on 10/07/2011 07:10:00 PM

Here are the earlier employment posts (with graphs):

• September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• Employment graph gallery

From the FDIC: Central Bank, Stillwater, Minnesota, Assumes All of the Deposits of the RiverBank, Wyoming, Minnesota

As of June 30, 2011, The RiverBank had approximately $417.4 million in total assets and $379.3 million in total deposits.From the FDIC: Great Southern Bank, Springfield, Missouri, Assumes All of the Deposits of Sun Security Bank, Ellington, Missouri

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $71.4 million. ... The RiverBank is the 75th FDIC-insured institution to fail in the nation this year

As of June 30, 2011, Sun Security Bank had approximately $355.9 million in total assets and $290.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $118.3 million. ... Sun Security Bank is the 76th FDIC-insured institution to fail in the nation this year, and the first in Missouri.

AAR: Rail Traffic increases in September

by Calculated Risk on 10/07/2011 06:40:00 PM

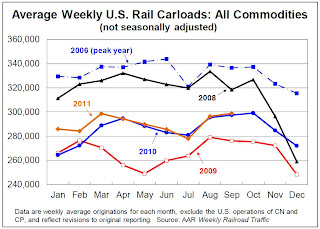

The Association of American Railroads (AAR) reports carload traffic in September 2011 1.1 percent compared with the same month last year, and intermodal traffic (using intermodal or shipping containers) increased 2.3 percent compared with September 2010. On a seasonally adjusted basis, carloads in were up 1.1% in September 2011 compared with August 2011; intermodal in September 2011 was up 1.0% from August 2011.

U.S. freight railroads originated 1,195,671 carloads in September 2011, an average of 298,918 carloads per week and up 1.1% over September 2010 (see charts below). During the last week of September — Week 39 of 2011 — U.S. railroads originated 312,170 carloads of freight, which is more carload traffic than in any week since Week 45 in November 2008.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows U.S. average weekly rail carloads (NSA).

Rail carload traffic collapsed in November 2008, and now, over 2 years into the recovery, carload traffic is only about half way back.

The second graph is for intermodal traffic (using intermodal or shipping containers):

U.S. rail intermodal traffic rose for the 22nd straight month in September 2011.1 U.S. railroads originated 949,606 containers and trailers for the month for an average of 237,402 units per week, up 2.3% from September 2010, up from an average of 235,968 in August 2011, and the highest weekly average for any month since October 2007 (see the chart on the top right of the next page). Week 39 of 2011, the last week of September, had intermodal volume of 250,864 intermodal units, the 12th highest-volume intermodal week ever for U.S. railroads and the highest of any week since Week 39 in September 2007.Rail traffic improved in September, and really picked up towards the end of the month.

excerpts with permission

Europe, again ...

by Calculated Risk on 10/07/2011 03:14:00 PM

Another day, same Europe.

• From Bloomberg: Fitch Cuts Spain, Italy Credit Ratings; Outlooks Negative

Spain had its foreign and local currency long-term issuer default ratings cut to AA- from AA+, while Italy had the same set of ratings to A+ from AA-, the company said in statements today. The outlook for both countries is negative. Fitch also maintained Portugal’s rating at BBB-, saying it would complete a review of that ranking in the fourth quarter.• From the WSJ: Moody's Cuts U.K. Lenders

Moody's Investors Service Friday downgraded 12 U.K. banks and building societies, and left the door open for further ratings cuts at three of the U.K.'s largest lenders as it reassesses the willingness of the U.K. government to support the institutions.• From the WSJ: EU Steps Up Crisis Response

European Commissioner for Economic Affairs Olli Rehn on Friday revealed among other things that there are talks to fast-forward plans for a permanent rescue vehicle while he expects a solution on recapitalizing European banks to come within a few days.Here are the earlier employment posts (with graphs):

"I am confident that the euro-zone summit and the European Council will be able to make a decision in mid-October on how a coordinated Europe can help to solve the distrust towards the banks' capitalization," Mr. Rehn told a conference in Helsinki.

His comments were echoed by German Chancellor Angela Merkel, who said Friday that EU leaders will discuss at the Oct. 17-18 summit how to proceed with possible bank recapitalizations.

• September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• Employment graph gallery

Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 10/07/2011 01:03:00 PM

Here are the earlier employment posts (with graphs):

• September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment graph gallery

And a few more graphs based on the employment report:

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.Two categories increased in August: The 27 weeks and more (the long term unemployed) increased to 6.242 million workers, or just over 4.0% of the labor force, and the less than '5 weeks' category increased slightly - this followed the recent increase in initial weekly unemployment claims.

The other two categories decreased. The decrease in the '15 to 26 weeks' group is probably from workers moving into the 27 weeks and more category.

The key point is the that number (and percent) of long term unemployed remains very high.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of job - as an example, a college graduate working at minimum wage would be considered "employed".

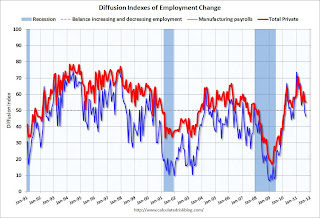

This is a little more technical. The BLS diffusion index for total private employment was at 55.4 in September, down slightly from 55.6 in August, and for manufacturing, the diffusion index decreased to 46.3 - the 2nd consecutive reading under 50.

This is a little more technical. The BLS diffusion index for total private employment was at 55.4 in September, down slightly from 55.6 in August, and for manufacturing, the diffusion index decreased to 46.3 - the 2nd consecutive reading under 50. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.This was the lowest diffusion index for total private employment since May, and the lowest for manufacturing since October 2010.

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s.