by Calculated Risk on 10/06/2011 12:21:00 PM

Thursday, October 06, 2011

Freddie Mac: Mortgage Rates below 4%

Another record ... from Freddie Mac: 30-Year Fixed Mortgage Rate Falls Below 4 Percent

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the average rate for the conventional 30-year fixed mortgage dropping below 4 percent for the first time in history amid increasing global economic concerns. The 15-year fixed, a popular refinancing option, also fell to the lowest level on record for the sixth consecutive week.

...

"Average 30-year conventional fixed mortgage rates fell below 4 percent for the first time in history this week following a sharp drop in 10-year Treasuries early in the week as concerns over a global recession grew. Average 15-year fixed rates fell to a record low in the PMMS as well. Interest rates for 1-year ARMs, however, rose, as the Fed began replacing $400 billion of its short-term Treasury securities, which serve as benchmarks for many ARMs." [said Frank Nothaft, vice president and chief economist, Freddie Mac]

...

30-year fixed-rate mortgage (FRM) averaged 3.94 percent with an average 0.8 point for the week ending October 6, 2011, down from last week when it averaged 4.01 percent. Last year at this time, the 30-year FRM averaged 4.27 percent.

15-year FRM this week averaged 3.26 percent with an average 0.8 point, down from last week when it averaged 3.28 percent. A year ago at this time, the 15-year FRM averaged 3.72 percent.

CoreLogic: Home Price Index declined 0.4% in August

by Calculated Risk on 10/06/2011 10:19:00 AM

Notes: This CoreLogic Home Price Index report is for August. The Case-Shiller index released last week was for July. Case-Shiller is currently the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of June, July and August (August weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® August Home Price Index Shows Month-Over-Month and Year-Over-Year Decline

CoreLogic ... today released its August Home Price Index (HPI) which shows that home prices in the U.S. decreased 0.4 percent on a month-over-month basis, the first monthly decline in four months. According to the CoreLogic HPI, national home prices, including distressed sales, also declined on a year-over-year basis by 4.4 percent in August 2011 compared to August 2010. This follows a decline of 4.8 percent in July 2011 compared to July 2010. Excluding distressed sales, year-over-year prices declined by 0.7 percent in August 2011 compared to August 2010 and by 1.7 percent in July 2011 compared to July 2010. ...

“Although the calendar says August, the end of the summer traditionally marks the beginning of ‘fall’ for the housing market as it begins to prepare for ‘winter.’ So the slight month-over-month decline was predictable, particularly given the renewed concerns over a double-dip recession, high negative equity, and the persistent levels of shadow inventory. The continued bright spot is the non-distressed segment of the market, which is only marginally lower than a year ago and continues to exhibit relative strength,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.4% in August, and is down 4.4% over the last year, and off 30.4% from the peak - and up 4.8% from the March 2011 low.

As Mark Fleming noted, some of this decrease is seasonal (the CoreLogic index is NSA). Month-to-month prices changes will probably remain negative through February or March 2012 - the normal seasonal pattern. It is likely that there will be new post-bubble lows for this index late this year or early in 2012.

Weekly Initial Unemployment Claims increase to 401,000

by Calculated Risk on 10/06/2011 08:30:00 AM

The DOL reports:

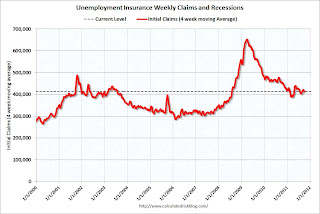

In the week ending October 1, the advance figure for seasonally adjusted initial claims was 401,000, an increase of 6,000 from the previous week's revised figure of 395,000. The 4-week moving average was 414,000, a decrease of 4,000 from the previous week's revised average of 418,000.The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 414,000.

This is the lowest level for the 4-week average of weekly claims since August, and this was below the consensus forecast of 410,000. Still elevated, but some improvement.

Reis: Apartment Vacancy Rate falls to 5.6% in Q3

by Calculated Risk on 10/06/2011 12:04:00 AM

Reis reported that the apartment vacancy rate (82 markets) fell to 5.6% in Q3 from 6.0% in Q2. The vacancy rate was at 7.1% in Q2 2010 and peaked at 8.0% at the end of 2009.

From the WSJ: Landlords Push Up Apartment Rents

The vacancy rate for the third quarter, which wraps up the prime leasing season, fell to 5.6% from 7.1% a year earlier. That is the lowest since 2006.

The increased demand follows several years that saw little new apartment development. About 8,200 units came online during the third quarter, one of the lowest quarterly figures since Reis began tracking the data in 1999.

...

Average effective apartment rents, the amount paid after discounting, rose to $1,004 nationwide in the third quarter, up 2.4% from a year earlier ... In the third quarter, 36,000 net units were filled, down from 42,000 in the second quarter.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

A few key points we've been discussing:

• Apartment vacancy rates are falling fast.

• A record low number of multi-family units will be completed this year (2011). Only 8,200 apartments came on the market in Q3 (in the Reis survey area).

• Multi-family starts are increasing, and that is helping both GDP and employment growth this year. These new starts will not be completed until 2012 or 2013, so vacancy rates will probably continue to decline.

Earlier:

• Reis: Office Vacancy Rate declines slightly in Q3 to 17.4%

• ADP: Private Employment increased 91,000 in September

• ISM Non-Manufacturing Index indicates expansion in September

• Europe Update: New Stress Tests and Bank Recapitalisation

• Employment Situation Preview: Another Weak Report

Wednesday, October 05, 2011

Open Thread

by Calculated Risk on 10/05/2011 08:58:00 PM

A rare open thread for discussion - and a few articles on the passing of Steve Jobs ...

• From the LA Times: Steve Jobs: More than a turnaround artist

• From the NY Times: Steve Jobs, Apple’s Visionary, Dies at 56

• From the WSJ: Apple's Steve Jobs Is Dead

• From CNBC: Apple Says Former CEO Steve Jobs Has Passed Away

Earlier:

• Reis: Office Vacancy Rate declines slightly in Q3 to 17.4%

• ADP: Private Employment increased 91,000 in September

• ISM Non-Manufacturing Index indicates expansion in September

• Europe Update: New Stress Tests and Bank Recapitalisation

• Employment Situation Preview: Another Weak Report