by Calculated Risk on 9/29/2011 01:45:00 PM

Thursday, September 29, 2011

Employment: Comment on preliminary annual benchmark revision

This morning the BLS released the preliminary annual benchmark revision of +192,000 payroll jobs. The final revision will be published next February when the January 2012 employment report is released February 3, 2012. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

Establishment survey benchmarking is done on an annual basis to a population derived primarily from the administrative file of employees covered by unemployment insurance (UI). The time required to complete the revision process—from the full collection of the UI population data to publication of the revised industry estimates—is about 10 months. The benchmark adjustment procedure replaces the March sample-based employment estimates with UI-based population counts for March. The benchmark therefore determines the final employment levels ...Using the preliminary benchmark estimate, this means that payroll employment in March 2011 was 192,000 higher than originally estimated. In February 2012, the payroll numbers will be revised up to reflect this estimate. The number is then "wedged back" to the previous revision (March 2010).

Click on graph for larger image.

Click on graph for larger image.This graph shows the impact of the preliminary benchmark revision on job losses in percentage terms from the start of the employment recession.

The red line on the graph is the current estimate, and the dotted line shows the impact of estimated coming benchmark revision. This puts the current payroll employment about 6.7 million jobs below the pre-recession peak in December 2007. Still very ugly.

For details on the benchmark revision process, see from the BLS: Benchmark Article and annual benchmark revision for the new preliminary estimate.

The following table shows the benchmark revisions since 1979.

| Year | Percent benchmark revision | Benchmark revision (in thousands) |

|---|---|---|

| 1979 | 0.5 | 447 |

| 1980 | -0.1 | -63 |

| 1981 | -0.4 | -349 |

| 1982 | -0.1 | -113 |

| 1983 | * | 36 |

| 1984 | 0.4 | 353 |

| 1985 | * | -3 |

| 1986 | -0.5 | -467 |

| 1987 | * | -35 |

| 1988 | -0.3 | -326 |

| 1989 | * | 47 |

| 1990 | -0.2 | -229 |

| 1991 | -0.6 | -640 |

| 1992 | -0.1 | -59 |

| 1993 | 0.2 | 263 |

| 1994 | 0.7 | 747 |

| 1995 | 0.5 | 542 |

| 1996 | * | 57 |

| 1997 | 0.4 | 431 |

| 1998 | * | 44 |

| 1999 | 0.2 | 258 |

| 2000 | 0.4 | 468 |

| 2001 | -0.1 | -123 |

| 2002 | -0.2 | -313 |

| 2003 | -0.2 | -122 |

| 2004 | 0.2 | 203 |

| 2005 | -0.1 | -158 |

| 2006 | 0.6 | 752 |

| 2007 | -0.2 | -293 |

| 2008 | -0.1 | -89 |

| 2009 | -0.7 | -902 |

| 2010 | -0.3 | -378 |

| 2011 | 0.1 | 192 (estimate) |

| * less than 0.05% | ||

Kansas City Manufacturing Survey: Manufacturing activity expands "modestly" in September

by Calculated Risk on 9/29/2011 11:00:00 AM

This is the last of the regional Fed surveys for September. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were weak in September, but not as weak as in August.

From the Kansas City Fed: Growth in Manufacturing Activity Edged Higher

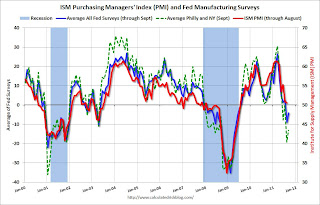

Growth in Tenth District manufacturing activity edged higher in September. Expectations moderated slightly, but producers on net still anticipated increased activity over the next six months. Price indexes moved up modestly, with slightly more producers planning to raise selling prices.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The month-over-month composite index was 6 in September, up from 3 in August and 3 in July ... The employment index increased for the second straight month, but the new orders for exports index fell slightly after rising last month.

“Factory activity in our region continues to grow modestly, and firms generally expect this trend to continue,” said Wilkerson. “Price indexes also edged higher this month after generally decelerating earlier in the summer.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

The ISM index for September will be released Monday, Oct 3rd and this suggests another weak reading in September.

Earlier:

• Weekly Initial Unemployment Claims decline sharply to 391,000

• Misc: GDP revised up, Employment to be revised up, Germany approves EFSF changes, Pending Home sales decline

Misc: GDP revised up, Employment to be revised up, Germany approves EFSF changes, Pending Home sales decline

by Calculated Risk on 9/29/2011 10:00:00 AM

• From the BLS: Current Employment Statistics Preliminary Benchmark Announcement

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued on February 3, 2012, with the publication of the January 2012 Employment Situation news release.Usually the final benchmark revision is pretty close to the preliminary revision.

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. ... The preliminary estimate of the benchmark revision indicates an upward adjustment to March 2011 total nonfarm employment of 192,000 (0.1 percent).

• The BEA reported that GDP increased at a 1.3% real annual rate in Q2 (third estimate), revised up from the previously reported 1.0% increase. It was still a weak quarter, but the internals were positive: the contributions from consumption and trade were revised up, and the contribution from "change in private inventories" was revised down.

• From the NAR: Pending Home Sales Decline in August

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, declined 1.2 percent to 88.6 in August from 89.7 in July but is 7.7 percent above August 2010 when it stood at 82.3. The data reflects contracts but not closings.• From Bloomberg: German Parliament Backs Euro Rescue Fund

The lower house of parliament passed the measure with 523 votes in favor and 85 against, granting the fund powers to buy bonds in secondary markets, enable bank recapitalizations and offer precautionary credit lines.A key point: German Chancellor Merkel's ruling coalition party backed the bill.

Weekly Initial Unemployment Claims decline sharply to 391,000

by Calculated Risk on 9/29/2011 08:30:00 AM

The DOL reports:

In the week ending September 24, the advance figure for seasonally adjusted initial claims was 391,000, a decrease of 37,000 from the previous week's revised figure of 428,000. The 4-week moving average was 417,000, a decrease of 5,250 from the previous week's revised average of 422,250.The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 417,000.

This is the lowest level for weekly claims since early April, although the 4-week average is still elevated.

Wednesday, September 28, 2011

Treasury: Mortgage loan fraud suspicious activity reports increased in Q2, Most occurred during bubble

by Calculated Risk on 9/28/2011 09:31:00 PM

From Treasury: Second Quarter Mortgage Loan Fraud Suspicious Activity Persists

The Financial Crimes Enforcement Network (FinCEN) today reported in its Second Quarter 2011 Analysis of mortgage loan fraud suspicious activity reports (MLF SARs) that financial institutions filed 29,558 MLF SARs in the second quarter of 2011 up from 15,727 MLF SARs reported in the same quarter of 2010.The most common mortgage loan fraud suspicious activity was the misrepresentation of income, occupancy, debts, or assets (about 30%). Some of the more current frauds are related to debt elimination and short sale fraud (unfortunately attempted short sale fraud is very common).

A large majority of the MLF SARs examined in the second quarter involved mortgages closed during the height of the real estate bubble. The upward spike in second quarter MLF SAR numbers is directly attributable to mortgage repurchase demands and special filings generated by several institutions. For instance, FinCEN noted that 81 percent of the MLF SARs filed during the quarter involved suspicious activities that occurred before 2008; 63 percent involved suspicious activities that occurred four or more years ago.

"We're continuing to see a large number of SARs filed on activity that occurred more than two years ago, an indication that financial institutions are uncovering fraud as they sift through defaulted mortgages," said FinCEN Director James H. Freis, Jr.

FinCEN has some Mortgage Fraud SAR Datasets breaking down the data by state, MSA and county. California was #1 in Q2 (Nevada or Florida have usually been #1). San Jose-Sunnyvale-Santa Clara, CA was the #1 MSA.

And in a related story from the AP: Santa Rosa Hells Angels leaders indicted on loan fraud. This involved a mortgage broker and false statement of income and assets to buy marijuana "grow houses". Oh my ...