by Calculated Risk on 9/20/2011 08:30:00 AM

Tuesday, September 20, 2011

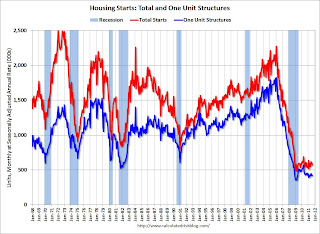

Housing Starts decline in August

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 571,000. This is 5.0 percent (±10 6%)* below the revised July estimate of 601,000 and is 5.8 percent (±12.0%)* below the August 2010 rate of 606,000.

Single-family housing starts in August were at a rate of 417,000; this is 1.4 percent (±10.3%)* below the revised July figure of 423,000. The August rate for units in buildings with five units or more was 148,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 620,000. This is 3.2 percent (±1.0%) above the revised July rate of 601,000 and is 7.8 percent (±1.4%) above the August 2010 estimate of 575,000.

Single-family authorizations in August were at a rate of 413,000; this is 2.5 percent (±0.9%) above the revised July figure of 403,000. Authorizations of units in buildings with five units or more were at a rate of 178,000 in August.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Total housing starts were at 571 thousand (SAAR) in August, down 5.0% from the revised July rate of 601 thousand (revised from 604).

Single-family starts declined 1.4% to 417 thousand in August.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for about two years and a half years - with slight ups and downs due to the home buyer tax credit.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for about two years and a half years - with slight ups and downs due to the home buyer tax credit.Multi-family starts are increasing in 2011 - although from a very low level. This was below expectations of 592 thousand starts in August, but permits increased in August suggesting a slight increase for starts in September.

Still "moving sideways".

Monday, September 19, 2011

Europe: Greece Officials Optimistic, Italy's Credit Rating Downgraded

by Calculated Risk on 9/19/2011 09:10:00 PM

From the WSJ: Greece Strikes Optimistic Note on Aid Talks

Greece said it had "a productive and substantive discussion" with its official creditors on Monday ... and a Greek finance ministry official said an agreement was close. ... A Greek official said an announcement was likely on Wednesday.From Bloomberg: Italy Rating Lowered by S&P, Outlook ‘Negative’

...

"We will publish this week decisions on the restructuring of public bodies," [Finance Minister Evangelos Venizelos] told a business conference Monday. "In light of the new budget, it is clear that our emphasis will be on the spending side."

Italy’s credit rating was cut by Standard & Poor’s on concern that weakening economic growth and a “fragile” government mean the nation won’t be able to reduce the euro-region’s second-largest debt burden.

The rating was lowered to A from A+, with a negative outlook, S&P said in a statement.

Lawler on August Existing Home Sales: Regional Reports Point to Above-Consensus Gain

by Calculated Risk on 9/19/2011 05:30:00 PM

From economist Tom Lawler:

Based on a fair amount of data from local realtor associations/boards/MLS across the country, I project that existing home sales as estimated by the National Association of Realtors will come in at a seasonally adjusted annual rate of about 4.92 million for August, up 5.4% from July and up 15.8% from last August. Unadjusted sales should show a higher YOY gain – over 18% -- reflecting the higher business day count/seasonal factor this August vs. last August.

This estimate is significantly above the “consensus” forecast of 4.75 million SAAR, but it is what the local data available suggest. A sizable number of markets showed YOY gains of 20% or more (in some cases by a lot), including (but not limited to) a fair number of markets in the middle of the country. Of course, sales in many of those markets were extremely weak last August, which was pretty soon following the expiration of the homebuyer tax credit.

On the inventory side, there is absolutely no doubt that the inventory of homes for sale fell from the end of July to the end of August, and was down significantly from a year ago nationwide. E.g., the “Department of Numbers” website (formerly and more appropriately named “HousingTracker”) shows that active residential listings in the 54 metro markets it covers declined by 2.6% (monthly average of weekly data) from July to August, and were down 14.1% from last August. While these 54 metro areas don’t generally represent the US as a whole, other markets not in this report that I follow on average had similar, though somewhat smaller, declines. NAR inventory figures do not always follow what MLS listing reports might suggest, however. Moreover, NAR inventory numbers this year have not shown the same YOY % declines as various aggregated listings reports.

A “best guess” would be that the NAR’s inventory number for August will be down 2.5% from July, and down 13.5% from last August. If that turns out to be the case, then August’s “months’ supply” number (unadjusted inventory divided by seasonally adjusted monthly sales!) would come in at 8.7 months, down from 9.4 months in July, and 11.7 months last August.

CR Note: The NAR is scheduled to report August existing home sales on Wednesday at 10 AM ET.

Greece: Conference Call with EU and IMF has started

by Calculated Risk on 9/19/2011 03:36:00 PM

From Bloomberg: Greece’s Next Aid Payment in the Balance as Review Resumes

European Union and International Monetary Fund inspectors began a teleconference today at 7:22 p.m. Athens time [12:22 PM ET] with Finance Minister Evangelos Venizelos and other officials to judge whether the government is eligible for an aid payment due next month...We might not hear anything for a few days.

No official announcement will be made after the call, which may last until the early morning and could resume tomorrow or at a later time, the Athens-based Finance Ministry said in an e- mailed statement. There is no Greek Cabinet meeting scheduled tomorrow ...

"The only thing that is on the table is full compliance with the agreed targets. No more, no less," [European Commission economics spokesman Amadeu Altafaj] said, adding that only after today's conference call will the commission "be in a position to communicate further on the next steps." ...

Greece is now looking to the next meeting of euro-area finance ministers, on Oct. 3, for a decision on the release of the installment. The loan would be disbursed by mid-October, enabling the government to pay its bills through the end of the year.

The Greek 2 year yield increased to 61.4%. The Greek 1 year yield increased to 126%.

"The bigger the loan, the longer to foreclose"

by Calculated Risk on 9/19/2011 01:10:00 PM

From Eric Wolff at the North County Times: The bigger the loan, the longer to foreclose

When it comes to foreclosing, lenders see some delinquent homeowners as more equal than others.Eric Wolff discusses several possible reasons including accounting rules, legal issues and lenders being more careful with larger loan amounts.

Mortgage debt of more than a half-million dollars seems to get lenders to look the other way for an extra month compared with those who owe far less, according to a North County Times analysis of foreclosure records.

...

"Just like any other business, when you have larger losses, you're going to be more cautious when you make any decisions than with a smaller loss," said Dustin Hobbs, a spokesman for the California Mortgage Bankers Association, an industry group. "There's no policy in place at any of the servicers I talked to ---- not anything top down."