by Calculated Risk on 9/14/2011 01:54:00 PM

Wednesday, September 14, 2011

Households Doubling Up and Housing

Yesterday David Johnson at the Census Bureau wrote: Households Doubling Up

In coping with economic challenges over the past few years, many of us have combined households with other family members or individuals. These “doubled-up” households are defined as those that include at least one “additional” adult – in other words, a person 18 or older who is not enrolled in school and is not the householder, spouse or cohabiting partner of the householder.David Johnson reported the numbers for spring 2007 and spring 2011. Here are the numbers for all years from spring 2007 through spring 2011. This is based on a survey of "roughly 78,000 households" as part of the Annual Social and Economic Supplement to the Current Population Survey. (Source: Census Bureau research, "Income, Poverty and Health Insurance Coverage in the United States" report)

The Census Bureau reported today that the number and share of doubled-up households and adults sharing households across the country increased over the course of the recession, which began in December 2007 and ended in June 2009. In spring 2007, there were 19.7 million doubled-up households, amounting to 17.0 percent of all households. Four years later, in spring 2011, the number of such households had climbed to 21.8 million, or 18.3 percent.

| Year | Doubled-up Households (000s)1 | Percent of Households2 |

|---|---|---|

| 2007 | 19,747 | 17.0% |

| 2008 | 19,956 | 17.1% |

| 2009 | 20,683 | 17.7% |

| 2010 | 22,000 | 18.7% |

| 2011 | 21,766 | 18.3% |

It appears the percent of households that are doubled-up peaked in 2010, and is starting to decline. This is probably part of the reason for the pickup last year in demand for rental units since most people leaving a doubled-up household probably rent as opposed to buy.

If there were a strong increase in employment, there would probably be a sharp increase in households - both from normal growth and from people moving out of doubled-up households. And that would help absorb the excess supply of housing units. Of course there probably won't be a strong increase in employment until more of the excess housing supply is absorbed!

Notes:

1 The increase in the number and percent of doubled-up households between 2007 and 2011 was significant. The increase in the number of doubled up households was significant at the 10% level between 2008 and 2009 and between 2009 and 2010. The change in the number of doubled-up households between 2010 and 2011 was not statistically significant. The number of doubled-up households did not change significantly between either 2007 and 2008 or 2010 and 2011.

2 The percentage point increase in doubled up households was significant at the 10% level between 2008 and 2009 and between 2009 and 2010. The percentage point decline in doubled-up households between 2010 and 2011 was also significant at the 10% level. The percentage of doubled-up households as a proportion of all households did not change significantly between 2007 and 2008.

LA Port Traffic in August: Imports decline

by Calculated Risk on 9/14/2011 11:35:00 AM

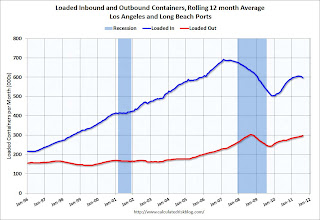

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for August. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a rolling 12 month basis, inbound traffic is down 0.9% from July, and outbound traffic is up 0.9%. Inbound traffic is "rolling over" and this suggests that retailers are cautious for the coming holiday season.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of August, loaded inbound traffic was down 9% compared to August 2010, and loaded outbound traffic was up 12% compared to August 2010.

Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but still below the peak in 2008.

Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but still below the peak in 2008.

Imports have been soft - this is the 3rd month in a row with a year-over-year decline in imports. This suggests a smaller trade deficit with Asian countries in August.

Retail Sales flat in August

by Calculated Risk on 9/14/2011 08:30:00 AM

On a monthly basis, retail sales were flat from July to August (seasonally adjusted, after revisions), and sales were up 7.2% from August 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $389.5 billion, virtually unchanged (±0.5%)* from the previous month and 7.2 percent (±0.7%) above August 2010.Retail sales excluding autos increased 0.1% in August. Sales for and June and July were revised down.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 17.1% from the bottom, and now 2.9% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.7% on a YoY basis (7.2% for all retail sales).

Retail sales ex-gasoline increased by 5.7% on a YoY basis (7.2% for all retail sales). The consensus was for retail sales to increase 0.2% in August, and for a 0.3% increase ex-auto.

This was another weak report for August.

MBA: Mortgage Purchase Application Index increases, Record Low Mortgage Rates

by Calculated Risk on 9/14/2011 07:29:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The seasonally adjusted Purchase Index increased 7.0 percent from one week earlier. ... The Refinance Index increased 6.0 percent from the previous week, stopping a run of three consecutive weekly decreases.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.17 percent from 4.23 percent, with points decreasing to 0.97 from 1.04 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate also decreased from last week. The 30-year fixed contract rate is the lowest in the history of the survey, with the previous low being 4.21 percent in the week ending October 8, 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.August was an especially weak month for this index. This increase was pretty small, and although this doesn't include the large number of cash buyers, this suggests fairly weak home sales in September and October.

Note: Existing home sales will probably increase in August compared to July (sales are counted at closing), but this suggests another decline in September and October.

Tuesday, September 13, 2011

Misc: Household Income declines, Poverty increases, Austerity leads to contraction

by Calculated Risk on 9/13/2011 08:55:00 PM

The Census Bureau released the 2010 Income, Poverty, and Health Insurance Coverage in the United States report. Here is the press release, the report (long), and the slide deck with graphs. A couple of articles:

• From the WSJ: Income Slides to 1996 Levels

The income of the typical American family ... has dropped for the third year in a row and is now roughly where it was in 1996 when adjusted for inflation.• From the WaPo: U.S. poverty rate reaches 15.1 percent

The income of a household considered to be at the statistical middle fell 2.3% to an inflation-adjusted $49,445 in 2010, which is 7.1% below its 1999 peak, the Census Bureau said.

The nation’s poverty rate spiked to 15.1 percent in 2010, the highest level since 1993, the Census Bureau reported on Tuesday ... About 46.2 million Americans lived in poverty last year, marking an increase of 2.6 million over 2009 and the fourth consecutive annual increase in poverty.• And an IMF report that analyzes austerity program, from the WaPo: IMF: Austerity boosts unemployment, lowers paychecks

In a new paper for the International Monetary Fund, Laurence Ball, Daniel Leigh and Prakash Loungani look at 173 episodes of fiscal austerity over the past 30 years—with the average deficit cut amounting to 1 percent of GDP. Their verdict? Austerity “lowers incomes in the short term, with wage-earners taking more of a hit than others; it also raises unemployment, particularly long-term unemployment.”Under an austerity program, high income earners usually do better than lower income earners, and profits tend to bounce back faster than wages. Sounds like the current situation.

More specifically, an austerity program that curbs the deficit by 1 percent of GDP reduces real incomes by about 0.6 percent and raises unemployment by almost 0.5 percentage points. What’s more, the IMF notes, the losses are twice as big when the central bank can’t cut rates (a good description of the present.) Typically, income and employment don’t fully recover even five years after the austerity program is put in place ... if multiple countries are all carrying out austerity at the same time, the overall pain is likely to be greater.