by Calculated Risk on 9/13/2011 05:27:00 PM

Tuesday, September 13, 2011

Europe Update

There are two key meetings this week: 1) a video conference tomorrow with German Chancellor Angela Merkel, French President Nicolas Sarkozy and Greek prime minister, George Papandreou, and 2) a meeting of European finance ministers on Friday with Timothy Geithner making an appearance.

Also Greece is expected to resume talks with the trioka - European Commission, IMF and ECB officials - in the next day or so.

From the WSJ: Merkel Quells Speculation on Greek Default

German Chancellor Angela Merkel ... stressed that Germany remains committed to financing Greece through the euro zone's bailout funds until Greece can repair its own finances through austerity measures. She gave a thinly veiled rebuke to German politicians, including her own economics minister and Deputy Chancellor Philipp Rösler, who have suggested in recent days that Greece should be allowed to go bust.And from the NY Times: Europe Scrambles to Ease Greek Debt Crisis

"I think we will do Greece the biggest favor by not speculating much, but instead encouraging Greece to implement the commitments it has made," Ms. Merkel told RBB Inforadio

[T]he president of France and the chancellor of Germany will hold a video conference call Wednesday evening with the Greek prime minister, George A. Papandreou, officials announced Tuesday, with the prospect of a further restructuring of Greek debt hovering in the air.The Greek 2 year yield is at 76.7%. The Greek 1 year yield is at 134.6%. Ouch.

...

Timothy F. Geithner [will] make a rare, if not unprecedented, appearance at a meeting of European finance ministers, to be held Friday in Wroclaw, Poland.

Olick: "Huge Surge in Bank of America Foreclosures"

by Calculated Risk on 9/13/2011 02:02:00 PM

From Diana Olick at CNBC: Huge Surge in Bank of America Foreclosures

Bank of America is ramping up its foreclosure processing, sending out far more notices of default to borrowers in August than in previous months ... Mortgage and housing analyst and strategist Mark Hanson alerted me to unusually high legal default filing activity ... [BofA responded to Olick]As Olick notes, this might be a short term pickup. However other servicers have told me they are staffing up - and we will probably see foreclosure activity pickup late this year or early in 2012.

"It appears the numbers you noted to me this afternoon generally track with our own numbers for key categories. It should be noted it’s driven more in key states like California and Nevada than overall, and certainly the progress we’re seeing is limited to non-judicial states. Judicial states continue to move very slowly, with key states like New Jersey only beginning to start processing foreclosures again this month."

RealtyTrac ... is also confirming a surge in overall notices of default in its August numbers

CoreLogic: 10.9 Million U.S. Properties with Negative Equity in Q2

by Calculated Risk on 9/13/2011 10:15:00 AM

CoreLogic released the Q2 2011 negative equity report today.

CoreLogic ... released Q2 negative equity data showing that 10.9 million, or 22.5 percent, of all residential properties with a mortgage were in negative equity at the end of the second quarter of 2011, down very slightly from 22.7 percent in the first quarter. An additional 2.4 million borrowers had less than five percent equity, referred to as near-negative equity, in the second quarter. Together, negative equity and near-negative equity mortgages accounted for 27.5 percent of all residential properties with a mortgage nationwide. The new report also shows that nearly three-quarters of homeowners in negative equity situations are also paying higher, above-market interest on their mortgages.Here are a couple of graphs from the report:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the distribution of negative equity. The more negative equity, the more at risk the homeowner is to losing their home.

Close to 10% of homeowners with mortgages have more than 25% negative equity. This is trending down slowly - the decline is apparently mostly due to homes lost in foreclosure.

The second graph from CoreLogic shows the cumulative distribution of mortgage rates for borrowers with positive and negative equity.

The second graph from CoreLogic shows the cumulative distribution of mortgage rates for borrowers with positive and negative equity. From CoreLogic: "Negative equity significantly limits the ability of borrowers to capture the benefit of the low-rate environment. There are nearly 28 million outstanding mortgages that have above market rates and are in theory refinanceable1. Twenty million borrowers with positive equity, or 53 percent of all above-water borrowers, have above market rates. Eight million borrowers with negative equity, or nearly 75 percent of all underwater borrowers, have above market rates."

1 "The definition of an above market rate was 5.1%, which is roughly the current mortgage rate of 4.1% plus a 100 basis point refinance trigger."

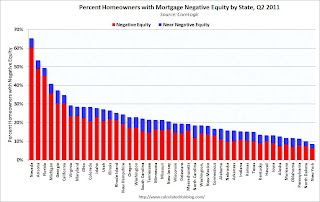

The third graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

The third graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.From CoreLogic: "Nevada had the highest negative equity percentage with 60 percent of all of its mortgaged properties underwater, followed by Arizona (49 percent), Florida (45 percent), Michigan (36 percent) and California (30 percent).

The negative equity share in the hardest hit states has improved. Over the past year, the average negative equity share for the top five states has declined from 41 percent to 38 percent. Nevada had the largest decline over the last year, with the negative equity share dropping from 68 percent to 60 percent. The reason for the Nevada decline is the high number of foreclosures that led to lower numbers of remaining negative equity borrowers."

Ceridian-UCLA: Diesel Fuel index declined in August

by Calculated Risk on 9/13/2011 09:00:00 AM

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Remains in Idle – Down 1.4 Percent in August

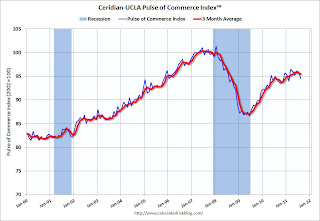

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), issued today by the UCLA Anderson School of Management and Ceridian Corporation fell 1.4 percent in August on a seasonally and workday adjusted basis, following a 0.2 percent decline in July.

“The August number supports the pattern of sluggish economic growth coming out of a recession, which is something that we’ve seen in the past. What we’re experiencing is the ‘new normal,’ where the U.S. economy will continue to stumble forward until a new growth engine is identified. Essentially, the economy is in need of an innovation burst.” [said Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and director of the UCLA Anderson Forecast.]

“The PCI continues to prove its value in providing insight into the U.S. economy. While previously being flat, recent, seven-day-average diesel volumes have dropped by 2 percent from July 23 to August 19, excluding the holiday impact. However, the last week of August suggests some improvement.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the index since January 2000.

The weakness in the PCI over the last several months called for a zero percent change in the July Industrial Production – the initial release of 0.9% was stronger, although subject to revisions. Due to the continued weakness evident in the PCI, the forecast for August Industrial Production is a 0.26 percent decline when released on September 15.This index has declined for two consecutive months after increasing slightly earlier in the year. The little bit of good news was the reported improvement during the last week of August.

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

Note: This index does appear to track Industrial Production over time (with plenty of noise).

NFIB: Small Business Optimism Index declines in August

by Calculated Risk on 9/13/2011 07:54:00 AM

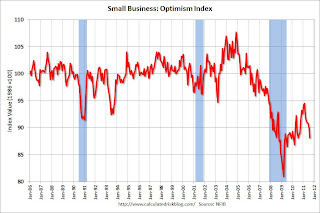

From the National Federation of Independent Business (NFIB): Small Business Confidence Takes Huge Hit: Optimism Index Now in Decline for Six Months Running

Confidence in the economy among small-business owners tumbled in August, as NFIB’s monthly Small-Business Optimism Index dropped a whopping 1.8 points, settling at a disturbingly low 88.1. The Index has now been in decline for a full six months. Unlike previous months, August’s decline comes in the immediate aftermath of the debt ceiling debate ...Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Sales remain the largest problem for small firms—a full quarter identifying “poor sales” as their top business problem.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the small business optimism index since 1986. The index decreased to 88.1 in August from 89.9 in July.

Optimism has declined for six consecutive months now.

The second graph shows the net hiring plans for the next three months.

Hiring plans were still low in August, but positive and improving.

Hiring plans were still low in August, but positive and improving. According to NFIB: “While the readings remain historically weak, we can find a grain of encouragement as we look at hiring prospects. Over the next three months, 11 percent plan to increase employment (up 1 point), and 12 percent plan to reduce their workforce (also up 1 point), yielding a seasonally adjusted net 5 percent of owners planning to create new jobs, which is a 3 point improvement over July."

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in August.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.The optimism index declined sharply in August due to the debt ceiling debate. This index has been generally slow to recover and has declined for six consecutive months - probably due to a combination of the recent economic weakness, and also the high concentration of real estate related companies in the index.