by Calculated Risk on 9/11/2011 10:30:00 PM

Sunday, September 11, 2011

Sunday Night: Europe and Futures

Once again the focus is on Europe ...

• From the NY Times: Investors Brace as Europe Crisis Flares Up Again

Despite repeated pledges by Chancellor Angela Merkel to keep Europe together, the cacophony of dissent within Germany has been rising. That is creating fresh doubt — justified or not — about the nation’s commitment to the euro.• From the WSJ: Woes at French Banks Signal a Broader Crisis

Moody's Investors Service Inc. is expected to cut the ratings of BNP Paribas SA, Société Générale SA and Crédit Agricole SA because of the banks' holdings of Greek government debt ... Political brinksmanship over Greece, coupled with the darkening economic outlook across the Continent, has fueled a selloff in European bank shares in recent weeks• From the LA Times: Greece unveils more austerity measures

Under intense pressure from international lenders, Greece on Sunday announced a new set of austerity measures to meet deficit reduction targets ... The measures, which include a two-year property tax, are intended to make up for revenue shortfalls that come to about $3 billion this year alone.• From the WSJ: French Minister: Won't Lend To Greece If Efforts Insufficient

"The [bailout] plan has two aspects; aid to Greece with the guarantees, but also a Greek recovery plan. They have a privatization program, a spending-cut program, a program for taxing revenues. Greece must make efforts, otherwise we won't lend to them," [French budget minister and government spokeswoman Valerie Pecresse] said in an interviewThe Asian markets are red tonight with the Nikkei down 2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is down about 12 points, and Dow futures are down about 100 points.

Oil: WTI futures are down to $86 and Brent is down under $112.

Yesterday:

• Schedule for Week of Sept 11th

• Summary for Week ending September 9th

Distressed House Sales using Sacramento Data

by Calculated Risk on 9/11/2011 03:22:00 PM

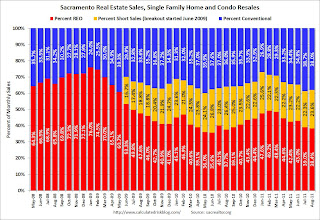

I've been following the Sacramento market to see the change in mix over time (conventional, REOs, and short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

As I've written before: "I'm not sure what I'm looking for, but I'll know it when I see it!" (hopefully) At some point, the number (and percent) of distressed sales should start to decline without market distortions.

The percent of distressed sales in Sacramento increased in August compared to July. In August 2011, 62% of all resales (single family homes and condos) were distressed sales. This is up from 61.3% in July, and down from 64.0% in August 2010.

Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

Total sales were up 14.8% over August 2010 (sales fell last July after the tax credit expired, so a year-over-year increase was expected). Sales were up 11% compared to August 2009.

Active Listing Inventory is down 22.6% from last August - we are seeing a sharp decline in inventory in many areas - something to watch. Once the foreclosure delays end, this data might be helpful in determining when the market is improving.

Yesterday:

• Schedule for Week of Sept 11th

• Summary for Week ending September 9th

Greece Government announces new property tax

by Calculated Risk on 9/11/2011 12:20:00 PM

From Reuters: Greece opts for property levy to boost budget revenue

Greece on Sunday announced a new tax on real estate ... "It is a special levy on property which will be collected through electricity bills," Finance Minister Evangelos Venizelos [said].The tax is €4 per square meter (about $0.50 per sq. feet). The government is projecting this levy will make up for the revenue shortfall due to the sharper than expected contraction in the Greek economy.

The Greek 2 year yield is at 57%. The Portuguese 2 year yield is up to 15.7% (after falling below 12% in August). Also the Irish 2 year yield is at 9.3% (below 8% in August).

The next few weeks are "make or break" for the next Greek bailout.

Yesterday:

• Schedule for Week of Sept 11th

• Summary for Week ending September 9th

A Day of Remembrance

by Calculated Risk on 9/11/2011 09:35:00 AM

I remember where I was – and everything I did on 9/11. Mostly I remember the overwhelming sense of shock and sadness, and the discussions of the events of that day with family and friends.

I wish everyone the best.

Saturday, September 10, 2011

Unofficial Problem Bank list declines to 986 Institutions

by Calculated Risk on 9/10/2011 08:51:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 9, 2011.

Changes and comments from surferdude808:

As anticipated, it was a quiet week for changes to the Unofficial Problem Bank List. This week, there were two removals and one addition, which leaves the list with 986 institutions and assets of $402.7 billion. A year ago, there were 849 institutions with assets of $415.3 billion.Earlier:

The removals were the failed The First National Bank of Florida, Milton, FL ($297 million) and Clarkston State Bank, Clarkston, MI ($111 million Ticker: HRTB), which had its actions terminated by the FDIC. The addition is Community Pride Bank, Isanti, MN ($92 million), which has been subject to a Consent Order by the State of Minnesota and not the FDIC since May 2010. This action just came to light when the Federal Reserve issued a Written Agreement against the bank's parent holding company.

Next week, we anticipate the OCC will release its actions through mid-August, which should contribute to more changes to the list.

• Schedule for Week of Sept 11th

• Summary for Week ending September 9th