by Calculated Risk on 9/08/2011 06:40:00 PM

Thursday, September 08, 2011

President Obama's Job Speech: 7:00 PM ET

Here are some excerpts (via the WSJ):

I am sending this Congress a plan that you should pass right away. It’s called the American Jobs Act. There should be nothing controversial about this piece of legislation. Everything in here is the kind of proposal that’s been supported by both Democrats and Republicans – including many who sit here tonight. And everything in this bill will be paid for. Everything.Cut payroll taxes in half? I'll be looking for details.

The purpose of the American Jobs Act is simple: to put more people back to work and more money in the pockets of those who are working. It will create more jobs for construction workers, more jobs for teachers, more jobs for veterans, and more jobs for the long-term unemployed. It will provide a tax break for companies who hire new workers, and it will cut payroll taxes in half for every working American and every small business. It will provide a jolt to an economy that has stalled, and give companies confidence that if they invest and hire, there will be customers for their products and services. You should pass this jobs plan right away.

WSJ: Greece's Recession Deepens

by Calculated Risk on 9/08/2011 04:48:00 PM

The Greek 2 year yield is at 55%!

From the WSJ: Greece's Recession Deepens

Greece's economy sank deeper into recession in the second quarter than previously forecast, with gross domestic product contracting by 7.3% on the year. ...Perhaps the headline should read "Greece's Depression Deepens".

Plunging domestic consumption was mostly responsible for the steep contraction rate ... With consumers bracing for the implementation of further austerity measures, promised in exchange for a fresh bailout to Greece ... Data showed Thursday that Greece's unemployment fell to 16% in June from 16.6% in May, but remained sharply above the rate of 11.6% a year earlier.

And there is more austerity to come, from the WSJ: Greek Officials Scramble to Find More Cuts

Greece's Socialist government is scrambling to cut public spending after receiving stark ultimatums from euro-zone governments that further rescue money will be withheld if Athens doesn't deliver on promises to reduce its budget deficit.The beatings will continue until morale improves.

The government now is looking at unprecedented public-sector layoffs and cuts in civil-service perks ...

Without the aid, Greece is expected to run out of money within weeks, say senior Greek government officials.

Bernanke: Inflation not "ingrained in the economy"

by Calculated Risk on 9/08/2011 01:30:00 PM

Note: Bernanke did not discuss monetary policy options.

From Fed Chairman Ben Bernanke: The U.S. Economic Outlook. Excerpts on inflation:

The Outlook for InflationBernanke is arguing inflation is not currently a problem - and that suggests the Fed will take action at the September meeting.

Let me turn now from the outlook for growth to the outlook for inflation. Prices of many commodities, notably oil, increased sharply earlier this year. Higher gasoline and food prices translated directly into increased inflation for consumers, and in some cases producers of other goods and services were able to pass through their higher costs to their customers as well. In addition, the global supply disruptions associated with the disaster in Japan put upward pressure on motor vehicle prices. As a result of these influences, inflation picked up significantly; over the first half of this year, the price index for personal consumption expenditures rose at an annual rate of about 3-1/2 percent, compared with an average of less than 1-1/2 percent over the preceding two years.

However, inflation is expected to moderate in the coming quarters as these transitory influences wane. In particular, the prices of oil and many other commodities have either leveled off or have come down from their highs. Meanwhile, the step-up in automobile production should reduce pressure on car prices. Importantly, we see little indication that the higher rate of inflation experienced so far this year has become ingrained in the economy. Longer-term inflation expectations have remained stable according to the indicators we monitor, such as the measure of households' longer-term expectations from the Thompson Reuters/University of Michigan survey, the 10-year inflation projections of professional forecasters, and the five-year-forward measure of inflation compensation derived from yields of inflation-protected Treasury securities. In addition to the stability of longer-term inflation expectations, the substantial amount of resource slack that exists in U.S. labor and product markets should continue to have a moderating influence on inflationary pressures. Notably, because of ongoing weakness in labor demand over the course of the recovery, nominal wage increases have been roughly offset by productivity gains, leaving the level of unit labor costs close to where it had stood at the onset of the recession. Given the large share of labor costs in the production costs of most firms, subdued unit labor costs should be an important restraining influence on inflation.

Mortgage Rates fall to Record Low

by Calculated Risk on 9/08/2011 12:11:00 PM

From Freddie Mac: Mortgage Rates Attain New All-Time Record Lows Again

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates, fixed and adjustable, hitting all-time record lows amid market and employment concerns and economic uncertainty. The previous record lows for fixed mortgage rates, and the 1-year ARM, were set the week of August 18, 2011. The 5-Year ARM matched its all-time low set last week at 2.96 percent.Here is a long term graph of 30 year mortgage rate in the Freddie Mac survey:

30-year fixed-rate mortgage (FRM) averaged 4.12 percent with an average 0.7 point for the week ending September 8, 2011, down from last week when it averaged 4.22 percent. Last year at this time, the 30-year FRM averaged 4.35 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The Freddie Mac survey started in 1971. Mortgage rates are currently at a record low for the last 40 years (mortgage rates were close to this range in the '50s).

The second graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

Refinance activity declined a little last week, but activity was up significantly in August compared to July.

Refinance activity declined a little last week, but activity was up significantly in August compared to July. With 30 year mortgage rates now at record lows, mortgage refinance activity will probably pick up some more in September - but so far activity is lower than in '09 - and much lower than in 2003.

Trade Deficit decreased sharply in July

by Calculated Risk on 9/08/2011 09:03:00 AM

The Department of Commerce reports:

[T]otal July exports of $178.0 billion and imports of $222.8 billion resulted in a goods and services deficit of $44.8 billion, down from $51.6 billion in June, revised. July exports were $6.2 billion more than June exports of $171.8 billion. July imports were $0.5 billion less than June imports of $223.4 billion.The trade deficit was well below the consensus forecast of $51 billion.

The first graph shows the monthly U.S. exports and imports in dollars through July 2011.

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in July (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to July 2010; imports are up about 13% compared to July 2010.

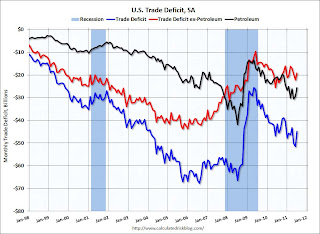

The second graph shows the U.S. trade deficit, with and without petroleum, through July.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $104.27 per barrel in July, down slightly from $106.00 per barrel in June. The trade deficit with China increased slightly to $26.95 billion; trade with China remains a significant issue.

The decline in the trade deficit was due to an increase in exports. Also the trade deficit for the first six months of the year was revised down - especially in Q2.