by Calculated Risk on 9/08/2011 12:11:00 PM

Thursday, September 08, 2011

Mortgage Rates fall to Record Low

From Freddie Mac: Mortgage Rates Attain New All-Time Record Lows Again

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates, fixed and adjustable, hitting all-time record lows amid market and employment concerns and economic uncertainty. The previous record lows for fixed mortgage rates, and the 1-year ARM, were set the week of August 18, 2011. The 5-Year ARM matched its all-time low set last week at 2.96 percent.Here is a long term graph of 30 year mortgage rate in the Freddie Mac survey:

30-year fixed-rate mortgage (FRM) averaged 4.12 percent with an average 0.7 point for the week ending September 8, 2011, down from last week when it averaged 4.22 percent. Last year at this time, the 30-year FRM averaged 4.35 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The Freddie Mac survey started in 1971. Mortgage rates are currently at a record low for the last 40 years (mortgage rates were close to this range in the '50s).

The second graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

Refinance activity declined a little last week, but activity was up significantly in August compared to July.

Refinance activity declined a little last week, but activity was up significantly in August compared to July. With 30 year mortgage rates now at record lows, mortgage refinance activity will probably pick up some more in September - but so far activity is lower than in '09 - and much lower than in 2003.

Trade Deficit decreased sharply in July

by Calculated Risk on 9/08/2011 09:03:00 AM

The Department of Commerce reports:

[T]otal July exports of $178.0 billion and imports of $222.8 billion resulted in a goods and services deficit of $44.8 billion, down from $51.6 billion in June, revised. July exports were $6.2 billion more than June exports of $171.8 billion. July imports were $0.5 billion less than June imports of $223.4 billion.The trade deficit was well below the consensus forecast of $51 billion.

The first graph shows the monthly U.S. exports and imports in dollars through July 2011.

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in July (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to July 2010; imports are up about 13% compared to July 2010.

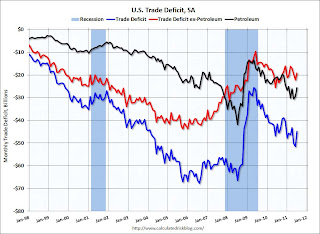

The second graph shows the U.S. trade deficit, with and without petroleum, through July.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $104.27 per barrel in July, down slightly from $106.00 per barrel in June. The trade deficit with China increased slightly to $26.95 billion; trade with China remains a significant issue.

The decline in the trade deficit was due to an increase in exports. Also the trade deficit for the first six months of the year was revised down - especially in Q2.

Weekly Initial Unemployment Claims increase to 414,000

by Calculated Risk on 9/08/2011 08:30:00 AM

The DOL reports:

In the week ending September 3, the advance figure for seasonally adjusted initial claims was 414,000, an increase of 2,000 from the previous week's revised figure of 412,000. The 4-week moving average was 414,750, an increase of 3,750 from the previous week's revised average of 411,000.The following graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 414,750.

Weekly claims increased slightly, and the 4-week average is still elevated - and remains above the 400,000 level.

Wednesday, September 07, 2011

WSJ: Fed Prepares to Act

by Calculated Risk on 9/07/2011 08:33:00 PM

From Jon Hilsenrath at the WSJ: Fed Prepares to Act

Federal Reserve officials are considering three unconventional steps to revive the economic recovery and seem increasingly inclined to take at least one as they prepare to meet this month."QE3" remains an option, but it appears the first step would be to extend the maturity of the Fed's portfolio. We might get more hints tomorrow when Fed Chairman Ben Bernanke speaks on the economic outlook at 1:30 PM ET.

...

One step getting considerable attention inside and outside the Fed would shift the central bank's portfolio of government bonds so that it holds more long-term securities and fewer short-term securities.

...

A second step under consideration at the Fed, one getting mixed reviews internally, would reduce or eliminate a 0.25% interest rate the Fed currently is paying banks that keep cash on reserve with the central bank.

...

A third step Fed officials are debating would involve using their words to make their economic objectives and plans for interest rates more clear.

CBO: An Evaluation of Large-Scale Mortgage Refinancing Programs

by Calculated Risk on 9/07/2011 06:33:00 PM

Some economists have proposed a large scale mortgage refinancing program for homeowners with loans owned or guaranteed by Fannie, Freddie or the FHA, and who are current on their mortgages but who can't refinance - usually because of Loan-to-values (LTV) much greater than 100%. Some economists have suggested this program could be used by 30 million borrowers and deliver $70 billion in annual savings - at essentially no cost.

Tom Lawler and I have pointed out that these economists (who missed the housing bubble) seem to be overlooking current programs - and also the offsetting losses for investors.

The CBO has analyzed a proposal for a large scale refinancing program: An Evaluation of Large-Scale Mortgage Refinancing Programs (ht mort-fin). Some key findings:

We analyze a stylized large-scale mortgage refinancing program that would relax current income and loan-to-value restrictions for borrowers who wish to refinance and whose mortgages are currently insured by Fannie Mae, Freddie Mac, or the Federal Housing Administration. The analysis relies on an estimate of the volume of incremental refinancing that would occur and an estimate of how future default and prepayment behavior would be affected by such refinancing. Relative to the status quo, the specific program analyzed here is estimated to cause an additional 2.9 million mortgages to be refinanced, resulting in 111,000 fewer defaults on those loans and estimated savings for the GSEs and FHA of $3.9 billion on their credit guarantee exposure, measured on a fair-value basis. Offsetting those savings, federal investors in MBSs, including the Federal Reserve, the GSEs, and the Treasury, would experience an estimated fair-value loss of $4.5 billion. Therefore, on a fair-value basis, the specific program analyzed here would have an estimated cost to the federal government of $0.6 billion.After a quick read, this analysis seems reasonable.

...

We also discuss the impact of this program on various stakeholders, including homeowners, non-federal mortgage investors, mortgage lenders, mortgage service providers, private mortgage insurers, and subordinated mortgage holders. For example, non-federal investors would experience an estimated fair-value loss of $13 to $15 billion; most of that wealth would be transferred to borrowers.

...

From the borrowers’ perspective, savings from lower mortgage payments is projected to total $7.4 billion in the first year of the program; the associated effect on consumption would decline significantly over time as borrowers pay off those loans.

...

The program has the potential to provide economic stimulus by increasing the resources households have available to spend because of the reduction in the size of their mortgage payments. However, those effects would be partially offset by a reduction in spending by investors as a result of their losses from the program. In aggregate, the fair-value loss to both federal and non-federal investors is equivalent to the gain experienced by borrowers from the decline in their interest payments (less transaction costs for both parties). Nevertheless, because a significant share of investors is composed of foreigners and the U.S. government, and because private investors would be expected to reduce spending in response their losses by less than the increase in spending by borrowers in response to their lower interest payments as well as their lower mortgage principal payments, the net effect would be an economic stimulus. ... We have not quantified the potential stimulus in our analysis, but it is likely to be small relative to GDP while large relative to the net federal cost of the program.

With respect to the housing market, the overall impact of the program is also small; the 111,000 homeowners saved from foreclosure by virtue of lower monthly mortgage payments will have a minor impact on the path of future home prices. Because this program is directed toward current homeowners, it would do little to alleviate the tighter underwriting standards and increased credit pricing for purchase loans. In addition, it would not create much demand for homes, because all of its participants would already have at least one property.