by Calculated Risk on 9/02/2011 06:15:00 PM

Friday, September 02, 2011

Bank Failures #69 & 70: Two more Georgia Banks

Past war cry once often heard

Now gone with the wind.

by Soylent Green is People

From the FDIC: Georgia Commerce Bank, Atlanta, Georgia, Acquires All the Deposits of Two Georgia Banks

As of June 30, 2011, Patriot Bank of Georgia had approximately $150.8 million in total assets and $111.2 million in total deposits; and CreekSide Bank had total assets of $102.3 million and total deposits of $96.6 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Patriot Bank of Georgia will be $44.4 million and for CreekSide Bank, $27.3 million. Compared to other alternatives, Georgia Commerce Bank's acquisition of the two institutions was the least costly resolution for the FDIC's DIF.

The closings are the 69th and 70th FDIC-insured institutions to fail in the nation so far this year and the eighteenth and nineteenth in Georgia.

FHFA Sues 17 Firms to Recover Losses to Fannie Mae and Freddie Mac

by Calculated Risk on 9/02/2011 05:05:00 PM

From the FHFA: FHFA Sues 17 Firms to Recover Losses to Fannie Mae and Freddie Mac

The Federal Housing Finance Agency (FHFA), as conservator for Fannie Mae and Freddie Mac (the Enterprises), today filed lawsuits against 17 financial institutions, certain of their officers and various unaffiliated lead underwriters. The suits allege violations of federal securities laws and common law in the sale of residential private-label mortgage-backed securities (PLS) to the Enterprises.Here are the links to the legal filings for each bank.

An excerpt from the filing against BofA:

This action arises out of Defendants’ actionable conduct in connection with the offer and sale of certain residential mortgage-backed securities to Fannie Mae and Freddie Mac (collectively, the “Government Sponsored Enterprises” or “GSEs”). These securities were sold pursuant to registration statements, including prospectuses and prospectus supplements that formed part of those registration statements, which contained materially false or misleading statements and omissions. Defendants falsely represented that the underlying mortgage loans complied with certain underwriting guidelines and standards, including representations that significantly overstated the ability of the borrowers to repay their mortgage loans.

...

Between September 30, 2005 and November 5, 2007, Fannie Mae and Freddie Mac purchased over $6 billion in residential mortgage-backed securities (the “GSE Certificates”) issued in connection with 23 BOA-sponsored and/or BOA-underwritten securitizations.

Europe Update: Greek Bond Yields move Sharply Higher

by Calculated Risk on 9/02/2011 04:22:00 PM

From the NY Times: Sovereign Debt Worries Flare Again in Europe

Concerns about the euro zone’s ability to cohesively respond to its debt crisis resurfaced Friday after talks between Greece and its foreign creditors were interrupted and the head of the European Central Bank warned Italy to stick to its austerity program.From the WSJ: Greek Bonds Plunge on Aid Deal Worries

A Greek official had said earlier Friday that a visiting troika of international inspectors has been suspended amid a dispute over the country's ability to meet its deficit targets,The Greek 2 year yield is at 47.2% and the 10 year yield increased to 18.3% today.

The delegation of European Union, International Monetary Fund and European Central Bank officials is expected to return in about 10 days after the Greek government has prepared the draft outlines of its 2012 budget, the official added.

Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany. The Italian spread is up to 327 and the Spanish spread is at 311. Both up sharply.

The Portuguese 2 year yield is up a little to 12.8%. And the Irish 2 year yield is up slightly to 8.1%.

Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 9/02/2011 01:15:00 PM

Here are the earlier employment posts (with graphs):

• August Employment Report: 0 Jobs (unchanged), 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment graph gallery

And a few more graphs based on the employment report:

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.Two categories declined in August: The 27 weeks and more (the long term unemployed) declined slightly to 6.0 million workers, or just under 4.0% of the labor force, and the '5 to 14 weeks' category edged down slightly.

The other two categories increased, especially the '15 to 26 weeks' group that increased to 2.24 million or almost 1.5% of the labor force - the highest level since January.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of job - many college graduates are underemployed.

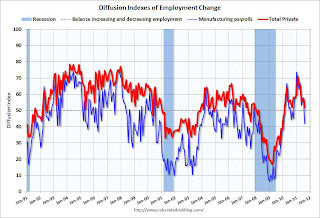

This is a little more technical. The BLS diffusion index for total private employment was at 52.2 in August, down from 57.7 in July, and for manufacturing, the diffusion index decreased sharply to 42.0.

This is a little more technical. The BLS diffusion index for total private employment was at 52.2 in August, down from 57.7 in July, and for manufacturing, the diffusion index decreased sharply to 42.0. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.This was the lowest diffusion index for total private employment since last September, and the lowest for manufacturing since January 2010.

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

by Calculated Risk on 9/02/2011 10:21:00 AM

This was a very weak report, so let's start with a few positives:

• August is over. Just like in June, when employment was impacted by the tsunami in Japan, employment in August was impacted by the debt ceiling debate in August. As I noted yesterday, the BLS survey reference week includes the 12th of the month, and that was just after the economy froze up due to the D.C. debate, and also after the European crisis flared up again.

• The Verizon labor dispute subtracted 45,000 payroll jobs. This dispute is over and these jobs will be added back in the September report. From the BLS: "45,000 workers in the telecommunications industry were on strike and thus off company payrolls during the survey reference period."

• The household survey showed an increase of (edit) 331,000 jobs in August. This increase in the household survey kept the unemployment rate from rising, even as more people participated in the workforce. The unemployment rate was unchanged at 9.1%, and the participation rate increased to 64.0%. The employment population ratio also increased slightly to 58.2%.

But overall this was a very weak report. There were no jobs added in August (0 total and 17,000 private sector).

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased to 16.2%; this is at the high for the year.

The BLS revised down the June and July payrolls. "The change in total nonfarm payroll employment for June was revised from +46,000 to +20,000, and the change for July was revised from +117,000 to +85,000."

The average workweek declined slightly to 34.2 hours, and average hourly earnings decreased. "In August, average hourly earnings for all employees on private nonfarm payrolls decreased by 3 cents, or 0.1 percent, to $23.09. This decline followed an 11-cent gain in July. Over the past 12 months, average hourly earnings have increased by 1.9 percent."

Through the first eight months of 2011, the economy has added 872,000 total non-farm jobs or just 109 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.9 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1,162,000 private sector jobs this year, or about 145 thousand per month.

There are a total of 13.967 million Americans unemployed and 6.0 million have been unemployed for more than 6 months. Very grim.

Although there were special factors - the debt ceiling shock to the economy and the Verizon strike - overall this was another very weak report. The economy has only added 158 thousand jobs over the last four months.

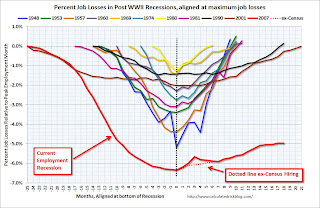

Percent Job Losses During Recessions

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

In terms of lost payroll jobs, the 2007 recession was by far the worst since WWII.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) rose from 8.4 million to 8.8 million in August. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased to 8.826 million in August from 8.396 million in July.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.2% in August from 16.1% in July.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.034 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 6.185 million in July. This is very high, and long term unemployment is one of the defining features of this employment recession.

• Earlier Employment post: August Employment Report: 0 Jobs (unchanged), 9.1% Unemployment Rate