by Calculated Risk on 8/15/2011 09:44:00 PM

Monday, August 15, 2011

Misc: Europe and Summary

• From the Financial Times: ECB buys €22bn in eurozone bonds

The European Central Bank spent €22bn on government bonds last week ... The larger-than-expected display of fire-power highlights the scale of the challenge the central bank faces in keeping official borrowing costs under control for Italy and Spain ...• So far it is working ... here is a graph of the 10 year spread (Italy to Germany) from Bloomberg (currently 270). And for Spain to Germany (267).

excerpt with permission

• From the NY Times: Debt in Europe Fuels a Bond Debate

President Nicolas Sarkozy of France and Chancellor Angela Merkel of Germany are scheduled to meet in Paris on Tuesday but have vowed to avoid the issue of euro bonds altogether.It doesn't sound like anything significant will be announced following the meeting tomorrow.

Earlier:

• NAHB Builder Confidence index unchanged in August, Still Depressed

• Residential Remodeling Index at new high in June

• From the NY Fed Empire State Manufacturing Survey indicates contraction

• NY Fed Q2 Report on Household Debt and Credit

• Lawler Forecast: Existing Home Sales may "dip" in July

Lawler Forecast: Existing Home Sales may "dip" in July

by Calculated Risk on 8/15/2011 06:47:00 PM

Usually economist Tom Lawler sends me his forecast for existing home sales (and his forcasts have been very close). Tom has been extremely busy this month, but he sent me this short update today:

My early read of local MLS/association data suggests that national existing home sales as measured by the NAR may actually dip a bit on a seasonally adjusted basis in July -- of course, taking into account the lower business day count this July vs. last July.The NAR reported existing home sales at 4.77 million in June, and the consensus (from Bloomberg) is for sales of 4.92 million at a Seasonally Adjusted Annual Rate (SAAR) in July (the NAR will report on Thursday).

LA Port Traffic in July

by Calculated Risk on 8/15/2011 05:15:00 PM

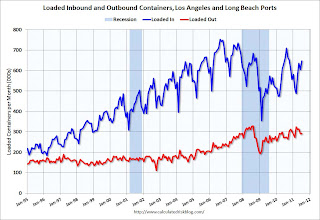

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for July. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a rolling 12 month basis, inbound traffic is down 0.2% from June, and outbound traffic is up 0.6%.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of July, loaded inbound traffic was down 2% compared to July 2010, and loaded outbound traffic was up 7% compared to July 2010.

Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but still below the peak in 2008.

Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but still below the peak in 2008.

Imports were down from last year, and are below the levels of July in 2006 and 2007 too. This is the 2nd month in a row with a year-over-year decline in imports - but there will probably be a surge in imports over the next couple of months as goods arrive for the holiday season.

DataQuick on SoCal: Lowest July Home Sales in Four Years

by Calculated Risk on 8/15/2011 03:14:00 PM

From DataQuick: Southland Housing Market's Vital Signs Remain Weak

Southern California home sales fell last month to the lowest level for a July in four years ... A total of 18,090 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in July. That was down 11.9 percent from 20,532 in June and down 4.5 percent from 18,946 in July 2010, according to San Diego-based DataQuick.About half the sales in SoCal are distressed (foreclosure resales or short sales) and about 24% of sales were to absentee homeowners (mostly investors).

...

"The latest sales figures look a bit worse than they really are, given this July was a fairly short month, but they still suggest some potential homebuyers got spooked. Reports on the economy became increasingly downbeat and, no doubt, some people fretted over the possibility the country would default on its obligations," said John Walsh, DataQuick president.

"If there's a shred of good news in the data it's that last month's sales weren't much worse than a year earlier. For the first time in many months, we get an apples-to-apples comparison to year-ago sales, given that in July 2010 the market lost its crutch -- federal homebuyer tax credits."

...

Overall home sales in July fell across all price categories compared with June. Sales declined 11.2 percent from June for homes priced below $200,000, while they fell 13.3 percent month-to-month for $300,000-to-$800,000 homes and fell 20.5 percent for homes over $800,000.

...

Foreclosure resales -- properties foreclosed on in the prior 12 months -- made up 32.5 percent of the Southland resale market in July ... Short sales, where the sale price fell short of what was owed on the property, made up an estimated 17.3 percent of Southland resales last month.

The NAR reports existing home sales for July on Thursday.

NY Fed Q2 Report on Household Debt and Credit

by Calculated Risk on 8/15/2011 12:15:00 PM

This report shows some minor household credit improvement, but that the pace of deleveraging has slowed.

From the NY Fed: New York Fed’s Quarterly Report on Household Debt and Credit Shows Continued Signs of Healing in Consumer Credit Markets

The Federal Reserve Bank of New York today released its Household Debt and Credit Report for the second quarter of 2011. Consistent with last quarter's findings, the report shows continued signs of healing in the consumer credit markets.Here is the Q2 report: Quarterly Report on Household Debt and Credit. Here are two graphs:

...

"Outstanding consumer debt remained essentially flat, down just $50 billion, in what was basically a repeat of the previous quarter. This is more evidence that the pace of consumer deleveraging that began in late 2008 has slowed," said Andrew Haughwout, vice president in the Research and Statistics Group at the New York Fed. "During the next few quarters we will gain a better understanding of whether this is a permanent or temporary break in the decline of total outstanding consumer debt."

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows aggregate consumer debt decreased slightly in Q2. From the NY Fed:

As of June 30, 2011, total consumer indebtedness was $11.4 trillion, a reduction of $1.08 trillion (8.6%) from its peak level at the close of 2008Q3, and $50 billion (0.4%) below its March 31, 2011 level. Mortgage

balances shown on consumer credit reports fell very slightly ($20 billion or 0.2%) during the quarter; home equity lines of credit (HELOC) balances fell by $20 billion (3.0%). ... Consumer indebtedness excluding mortgage and HELOC balances fell very slightly ($10 billion or about 0.4%) in the quarter.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Total household delinquency rates declined for the sixth consecutive quarter in 2011Q2. As of June 30, 9.9% of outstanding debt was in some stage of delinquency, compared to 10.5% on March 31 and 11.4% a year ago. About $1.1 trillion of consumer debt is currently delinquent, with $833 billion seriously delinquent (at least 90 days late or “severely derogatory”). Compared to a year ago, both delinquent and seriously delinquent balances have fallen 15%.There are a number of credit graphs at the NY Fed site.