by Calculated Risk on 8/12/2011 08:30:00 AM

Friday, August 12, 2011

Retail Sales increased 0.5% in July

On a monthly basis, retail sales increased 0.5% from June to July (seasonally adjusted, after revisions), and sales were up 8.5% from July 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $390.4 billion, an increase of 0.5 percent from the previous month, and 8.5 percent above July 2010. ... The May to June 2011 percent change was revised from +0.1 percent to +0.3 percent.Retail sales excluding auto also increased 0.5% in July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales seemed to stall in March, but are now moving higher again.

Retail sales are up 17.4% from the bottom, and now 3.2% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.9% on a YoY basis (8.5% for all retail sales).

Retail sales ex-gasoline increased by 6.9% on a YoY basis (8.5% for all retail sales). The consensus was for retail sales to increase 0.6% in July, and for a 0.3% increase ex-auto.

The reported increase was slightly below expectations for total retail sales, however including the upward revision for June, this was a solid report.

Thursday, August 11, 2011

Gasoline Prices expected to decline sharply

by Calculated Risk on 8/11/2011 10:52:00 PM

Since I haven't posted on gasoline prices in some time ... from Ronald White at the LA Times: Gas prices expected to fall

"If oil remains low, the national average for gasoline will fall to $3.25 to $3.40 in the next two to three weeks as retailers slowly lower their prices to reflect their drop in cost," said Patrick DeHaan, senior energy analyst for GasBuddy.com, a website that lists retail gasoline prices.Another price decline would be good news, but it just takes us back close to the late February and early March levels - and March is when Personal Consumption Expenditure (PCE) growth slowed, and consumer sentiment fell sharply.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Distressed House Sales using Sacramento data

by Calculated Risk on 8/11/2011 06:51:00 PM

I've been following the Sacramento market to see the change in mix over time (conventional, REOs, and short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

I'm not exactly sure what I'm looking for, but hopefully I'll know it when I see it! As some point, the number (and percent) of distressed sales will start to decline without foreclosure moratoria, homebuyer tax credits or other distortions.

The percent of distressed sales in Sacramento declined in July compared to June. Some of this decline could be seasonal, and some could be due to further foreclosure delays. In July 2011, 61.3% of all resales (single family homes and condos) were distressed sales. This is down from 65.2% in June, and down from 63.0% in July 2010.

Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer.

Note: Prior to June 2009, it is unclear if short sales were included as REO or as "conventional" - or some of both. The tax credits might have also boosted conventional sales in 2009 and early 2010.

Total sales were up 15.1% over July 2010 (sales fell last July after the tax credit expired, so a year-over-year increase was expected). Sales are down 13% compared to July 2009 and 19% compared to July 2008 - mostly due to fewer distressed sales.

Active Listing Inventory is down 21.1% from last July - we are seeing a decline in inventory in most areas. Once the foreclosure delays end, this data might be helpful in determining when the market is improving.

Misc: Dow up 400+, S&P 500 up 4.6%

by Calculated Risk on 8/11/2011 04:26:00 PM

Below is a stock market graph from Doug Short, but first a few stories ...

UPDATE: Regulators Bans some short selling in Belgium, France, Italy and Spain. From European Securities and Markets Authority: ESMA promotes harmonised regulatory action on short-selling in the EU

• From the NY Times: Europe Considers Ban on Short-Selling

The European Securities and Markets Authority, a body that coordinates the European Union’s market policies, has been requesting information from member states about ... short-sales ... “We are discussing with national authorities and together we will decide whether we need coordinated action,” Victoria Powell, a spokeswoman for the authority, said Thursday.Banning short sales always looks like desperation.

• From MarketWatch: Second-quarter GDP view cut after trade data. With the higher than expected trade deficit in June it looks like Q2 real GDP growth might have been below 1% for the 2nd straight quarter. The 2nd estimate of Q2 GDP will be released on August 26th.

• From MasterCard: Total U.S. Retail Sales for July Up 8.7% Year-over-Year

Excluding auto sales retail sales grew by 8.7% year-over-year. Retail sales are on par with the average growth of the previous 3 months, and have held onto their momentum despite concerns from other areas of the economy.Retail sales for July will be released tomorrow.

Michael McNamara, VP of Research and Analysis for MasterCard Advisors SpendingPulse, noted: “Since March, non seasonally-adjusted retail sales have topped 8% year-over-year. However, much of the 8.7 percent growth is from commodity based inflation in areas such as gasoline, food and cotton prices. While the headline year-over-year increase resembles periods of strong economic growth, when you take a closer look at the comp environment and the year-over-year inflation, it tempers the enthusiasm that would normally accompany this level of year-over-year increase.”

Click on graph for larger image.

A crazy week with four straight days of 400+ point swings for the Dow.

U.S. Births Decline in 2010

by Calculated Risk on 8/11/2011 03:07:00 PM

This provisional data for 2010 was released in June and shows a possible impact of the serious recession ...

From the National Center for Health Statistics: Recent Trends in Births and Fertility Rates Through 2010. The NCHS reports (provisional):

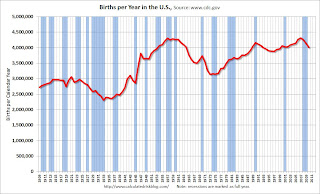

The provisional count of births in the United States for 2010 (12-month period ending December 2010) was 4,007,000. This count was 3 percent less than the number of births in 2009 (4,131,019) and 7 percent less than the all-time high of 4,316,233 births in 2007.Here is a long term graph of annual U.S. births through 2010 ...

The provisional fertility rate for 2010 was 64.7 births per 1,000 women aged 15–44. This was 3 percent less than the 2009 preliminary rate of 66.7 and 7 percent less than the 17-year high of 69.5 in 2007.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Births have declined for three consecutive years, and are now 7% below the peak in 2007. I suspect certain segments of the population were under stress before the recession started - like construction workers - and even more families were in distress in 2008 through 2011. Of course it takes 9 months to have a baby, so families in distress in 2010 probably put off having babies in 2011 too.

Notice that the number of births started declining a number of years before the Great Depression started. Many families in the 1920s were under severe stress long before the economy collapsed. By 1933 births were down by almost 23% from the early '20s levels.

Of course economic distress isn't the only reason births decline - look at the huge decline following the baby boom that was driven by demographics. But it is not surprising that the number of births slow or decline during tough economic times - and that appears to be happening now.

I don't think the percentage decline in births will be anything like what happened during the Depression, but a 7% decline is pretty significant.