by Calculated Risk on 7/27/2011 07:47:00 AM

Wednesday, July 27, 2011

MBA: Mortgage Purchase Application Index Lowest Since February

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 5.5 percent from the previous week. The seasonally adjusted Purchase Index decreased 3.8 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.57 percent from 4.54 percent, with points increasing to 1.14 from 0.98 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index is at best moving sideways at about 1997 levels.

Of course this doesn't include the large number of cash buyers ... but this suggests purchase activity remains fairly weak.

Mortgage Servicer Settlement Update

by Calculated Risk on 7/27/2011 01:44:00 AM

Not many details, but this story suggests the banks are now fighting with each other.

From the WSJ: Banks Spar Over Loan Settlement

U.S. banks trying to negotiate a settlement over the home-foreclosure mess have hit a new hurdle: They are squabbling over how to split the tab.It isn't clear what this means - and what will be included as part of the settlement.

...

All sides have agreed to a framework that would govern how banks meet their obligations once a deal is reached. Those include principal reductions on certain mortgages, forgiveness of second-lien loans, restitution to borrowers and dealing with foreclosure-related blight.

...

Citigroup is pushing to keep its part of any settlement at about $1 billion ... Wells Fargo ... is discussing a range of $4 billion to $5 billion.

On June Home Sales:

• New Home Sales in June at 312,000 Annual Rate

• Existing Home Sales in June: 4.77 million SAAR, 9.5 months of supply

• Home Sales: Distressing Gap

• Graph Galleries: New Home Sales and Existing Home Sales

On House Prices:

• Case Shiller: Home Prices increase in May

• Real House Prices and Price-to-Rent

• Graph Galleries: Home Prices

Tuesday, July 26, 2011

ATA Trucking index increased 2.8% in June

by Calculated Risk on 7/26/2011 07:20:00 PM

From ATA Trucking: ATA Truck Tonnage Index Jumped 2.8% in June

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.8% in June after decreasing a revised 2.0% in May 2011. May’s drop was slightly less than the 2.3% ATA reported on June 27, 2011. The latest gain put the SA index at 115.8 (2000=100) in June, up from the May level of 112.6 and the highest since January 2011.

...

Compared with June 2010, SA tonnage jumped 6.8%, the largest year-over-year gain since January 2011. In May, the tonnage index was 3% above a year earlier.

“Motor carriers told us that freight was strong in June and that played out in the data as well,” ATA Chief Economist Bob Costello said. Tonnage recovered all of the losses in April and May when the index contracted a total of 2.6%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's Fore-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.Unfortunately July will probably be weak based on some comments from UPS, from the WSJ:

United Parcel Service Inc., explaining its expectation of flat U.S. package volume in the third quarter, is citing the stalemate over the debt ceiling as a factor.

In a post-earnings conference call with analysts Tuesday, UPS Chief Executive Scott Davis said the economy had become extremely uncertain and that "economic growth expectations have slowed."

He blamed the ongoing political debate over whether to raise the U.S. debt ceiling, among other factors, for contributing to the uncertainty.

"Consumer confidence is down because of it," he said.

He described his outlook on the upcoming peak fall shipping season as "cautious" so far, saying early indications don't show much of a buildup.

Home Sales: Distressing Gap

by Calculated Risk on 7/26/2011 02:45:00 PM

The following graph shows existing home sales (left axis) and new home sales (right axis) through June. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Then along came the housing bubble and bust, and the "distressing gap" appeared due mostly to distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

I expect this gap to close over the next few years once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different. Also the National Association of Realtors (NAR) is working on a benchmark revision for existing home sales numbers and I expect significant downward revisions to sales estimates for the last few years - perhaps as much as 10% to 15% for 2009 and 2010. Even with these revisions, most of the "distressing gap" will remain.

On June Home Sales:

• New Home Sales in June at 312,000 Annual Rate

• Existing Home Sales in June: 4.77 million SAAR, 9.5 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

On House Prices:

• Case Shiller: Home Prices increase in May

• Real House Prices and Price-to-Rent

• Graph Galleries: Home Prices

Update: Real House Prices and Price-to-Rent

by Calculated Risk on 7/26/2011 12:24:00 PM

Note: New Home sales NSA fixed in graph gallery.

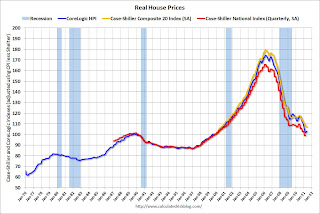

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through May) and CoreLogic House Price Indexes (through May) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to March 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to August 2000, and the CoreLogic index back to March 2000.

In real terms, all appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through May).

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through May).

This graph shows the price to rent ratio (January 1998 = 1.0).

Note: the measure of Owners' Equivalent Rent (OER) was mostly flat for two years - so the price-to-rent ratio mostly followed changes in nominal house prices. In recent months, OER has been increasing - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is back to October 2000 levels, and the CoreLogic index is back to March 2000.

Earlier ...

• New Home Sales in June at 312,000 Annual Rate

• Case Shiller: Home Prices increase in May

• Graph Galleries: Home Prices and New Home Sales