by Calculated Risk on 7/21/2011 10:23:00 PM

Thursday, July 21, 2011

Greek Default and more

Earlier today:

• Philly Fed Survey: "Regional manufacturing remained weak in July"

This is a day to remember - Greece will now default - so this is probably worth one more post (I haven't seen a rating agency downgrade them yet). For details: STATEMENT BY THE HEADS OF STATE OR GOVERNMENT OF THE EURO AREA

AND EU INSTITUTIONS.

Note: The history of the European bailouts is deny first, then act later. So naturally the following denial of additional defaults just raises the question of "when" for many observers:

"As far as our general approach to private sector involvement in the euro area is concerned, we would like to make it clear that Greece requires an exceptional and unique solution.And here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of July 20th). The spreads have declined sharply since the Euro Zone announcement.

...

All other euro countries solemnly reaffirm their inflexible determination to honour fully their own individual sovereign signature and all their commitments to sustainable fiscal conditions and structural reforms."

From the Atlanta Fed:

In recent days, Italy has become the next euro-area member to come under financial market pressure. Along with Greece, Portugal, Spain, and Ireland, Italian bond spreads (over German bonds) have continued to widen.Note: I added arrows pointing to the various bailouts starting with the first bailout for Greece, followed by Ireland, Portugal and then Greece again.

• Early last week, amid political uncertainty over intra-euro zone negotiations, Italian bond spreads spiked higher. Since the June FOMC meeting, the 10-year Italian-to-German bond spread has widened by nearly 108 bps through July 19. The spreads for Ireland and Portugal have soared higher by 276 bps and 262 bps, respectively, over the same period.

• Greek bond spreads remain extremely elevated, 140 bps higher since the June FOMC meeting, at 16.3 percent over German bonds. Spain’s spread also rose 80 bps

Other House Price Indexes

by Calculated Risk on 7/21/2011 05:45:00 PM

In addition to Case-Shiller and CoreLogic, I follow the following house price indexes: : RadarLogic (based on a house price per square foot method), FNC Residential Price Index (a hedonic price index), Clear Capital, Altos Research and Zillow.

CoreLogic already reported that the CoreLogic HPI increased 0.8% in May.

• FNC reported:

Based on the latest data on non-distressed home sales (existing and new homes), FNC’s Residential Price Index™ (RPI) indicates that single-family home prices were up again in May at a seasonally unadjusted rate of 0.8%.You can see the FNC composite indexes, and prices for 30 cities here.

...

Minneapolis, Boston, Charlotte, Portland, Chicago, and Washington D.C. show the strongest price momentum – rising month-over-month since March by a cumulative total of 9.2%, 7.1%, 5.7%, 5.5%, 5.3% and 3.5% respectively. Orlando and Phoenix, on the other hand, lead the nation in home price declines during 2011–having lost close to 5.0% over the last five months, followed by Las Vegas, New York, and Miami at about 3.0%.

• The FHFA (GSEs only): FHFA House Price Index Rises 0.4 Percent in May; Second Consecutive Monthly Increase

U.S. house prices rose 0.4 percent on a seasonally adjusted basis from April to May, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.8 percent increase in April was revised to a 0.2 percent increase. For the 12 months ending in May, U.S. prices fell 6.3 percent.• From RadarLogic Weak Fundamentals Undermine Seasonal Strength in Home Prices:

While the RPX Composite increased somewhat during April and gained 1.2 percent month-over-month in May, these gains have barely offset declines inAnd RadarLogic's prediction for Case-Shiller Not Seasonally Adjusted:

January. In contrast to this year’s performance to date, the RPX Composite Price increased significantly over the same period during seven of the past ten years.

Home prices usually increase in the spring due to seasonal factors, and the bulk of the gains typically occur by May. The lackluster performance of the RPX Composite Price to date means that we are almost assured to see new post-bust lows in the fall, when seasonal strength comes to an end and softening demand pulls housing prices downward.

Last month, we predicted that the S&P/Case-Shiller 10-City composite for April 2011 would be about 153 and the 20-City composite would be roughly 140. In fact, the 10-City composite was 152.51 and the 20-City composite was 138.84.This suggests a slight increase for the Case-Shiller index on a seasonally adjusted basis.

This month, we expect the May 2011 10-City composite index to be about 154 and the 20-City index to be roughly 141.

Overall this suggests most of the recent increase in prices is seasonal, and we'd expect to see declines again late this year. The Case-Shiller index for May will be released Tuesday, July 26th at 9 AM ET.

European Summit Statement Approved

by Calculated Risk on 7/21/2011 03:03:00 PM

UPDATE2: STATEMENT BY THE HEADS OF STATE OR GOVERNMENT OF THE EURO AREA

AND EU INSTITUTIONS

Update: Herman Van Rompuy said "Private sector involvement is for Greece and Greece only" (paraphrase). The lower interest rates are for Greece, Portugal and Ireland.

From Herman Van Rompuy, President of the European Council "Statement by the heads of state or government of the Euro area & EU institutions is approved. More details at the press conference."

Just a few resources ...

• The Guardian is providing live updates.

• The Telegraph is also providing live updates.

• There will be European Council press conference later today. The time is still uncertain. Here is the video feed Meeting of Heads of State or Government of the Euro area - press conference (time TBD).

• European Commission - Audiovisual services

• The press release should be available here.

• Any statement from the ECB will probably be here.

Europe Update: Some Details, More Later

by Calculated Risk on 7/21/2011 12:15:00 PM

The details are sketchy - it appears the EFSF will have new powers, terms will be extended for Greece, Portugal and Ireland at lower rates - and "selective default" for Greece will be allowed.

The announcement will be later today.

From the NY Times: Greek Rescue Plan May Allow for Default on Some Debt

According to the draft declaration, euro zone leaders gathered in Brussels are set to agree on a series of measures to lighten the burden on Greece, Ireland and Portugal ... the euro zone leaders were also being asked to give wide-ranging new powers to the region’s bailout fund, the European Financial Stability Facility, by allowing it to buy government bonds on the secondary market and to help recapitalize banks where necessary.From the WSJ: Euro Zone Moves Toward Greek Deal

...

According to the draft, the maturity of European loans to Greece would be extended from the current 7.5 years to a minimum of 15 years and at interest rates of around 3.5 percent.

Similar help through reduced borrowing costs would be extended to Portugal and Ireland.

Some of the options to ease Greece's debt to bondholders would probably cause losses to banks and others, and trigger a temporary assessment of default against Greece by credit-rating agencies.The Greek 2 year yield is down to 33.8% (was above 39%).

Finance Minister Jan Kees de Jager said Thursday that euro-zone governments seem to have accepted that Greece will be put into "selective default" when the country gets a new financial-aid package.

The Portuguese 2 year yield is down to 17.1% (was above 20%)

The Irish 2 year yield is down to 19.1% (was above 23%).

The Italian 2 year yield is down to 3.6%. And the Spanish 2 year yield is down to 3.8%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Philly Fed Survey: "Regional manufacturing remained weak in July"

by Calculated Risk on 7/21/2011 10:00:00 AM

From the Philly Fed: July 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased to 3.2 from -7.7 [any reading above zero is expansion]. The demand for manufactured goods, as measured by the current new orders index, improved from last month but suggests flat demand: The index rose 8 points to a reading of zero ...This indicates a little expansion in July. This was about at the consensus of 5.0.

Firms’ responses suggest a slight improvement in the labor market compared to June. The current employment index increased 5 points and remained positive for the 11th consecutive month. ...

Diffusion indexes for prices paid and prices received were lower this month and suggest a continued trend of moderating price pressures. The prices paid index declined 2 points, following a sharp drop of 22 points last month.

...

The broadest indicator of future activity improved markedly this month, rebounding from its lowest reading in 31 months in June.

Click on graph for larger image in graph gallery.

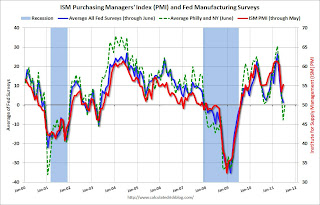

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The averaged Empire State and Philly Fed surveys are back close to zero combined. July was a little better than June for both surveys.