by Calculated Risk on 7/21/2011 03:03:00 PM

Thursday, July 21, 2011

European Summit Statement Approved

UPDATE2: STATEMENT BY THE HEADS OF STATE OR GOVERNMENT OF THE EURO AREA

AND EU INSTITUTIONS

Update: Herman Van Rompuy said "Private sector involvement is for Greece and Greece only" (paraphrase). The lower interest rates are for Greece, Portugal and Ireland.

From Herman Van Rompuy, President of the European Council "Statement by the heads of state or government of the Euro area & EU institutions is approved. More details at the press conference."

Just a few resources ...

• The Guardian is providing live updates.

• The Telegraph is also providing live updates.

• There will be European Council press conference later today. The time is still uncertain. Here is the video feed Meeting of Heads of State or Government of the Euro area - press conference (time TBD).

• European Commission - Audiovisual services

• The press release should be available here.

• Any statement from the ECB will probably be here.

Europe Update: Some Details, More Later

by Calculated Risk on 7/21/2011 12:15:00 PM

The details are sketchy - it appears the EFSF will have new powers, terms will be extended for Greece, Portugal and Ireland at lower rates - and "selective default" for Greece will be allowed.

The announcement will be later today.

From the NY Times: Greek Rescue Plan May Allow for Default on Some Debt

According to the draft declaration, euro zone leaders gathered in Brussels are set to agree on a series of measures to lighten the burden on Greece, Ireland and Portugal ... the euro zone leaders were also being asked to give wide-ranging new powers to the region’s bailout fund, the European Financial Stability Facility, by allowing it to buy government bonds on the secondary market and to help recapitalize banks where necessary.From the WSJ: Euro Zone Moves Toward Greek Deal

...

According to the draft, the maturity of European loans to Greece would be extended from the current 7.5 years to a minimum of 15 years and at interest rates of around 3.5 percent.

Similar help through reduced borrowing costs would be extended to Portugal and Ireland.

Some of the options to ease Greece's debt to bondholders would probably cause losses to banks and others, and trigger a temporary assessment of default against Greece by credit-rating agencies.The Greek 2 year yield is down to 33.8% (was above 39%).

Finance Minister Jan Kees de Jager said Thursday that euro-zone governments seem to have accepted that Greece will be put into "selective default" when the country gets a new financial-aid package.

The Portuguese 2 year yield is down to 17.1% (was above 20%)

The Irish 2 year yield is down to 19.1% (was above 23%).

The Italian 2 year yield is down to 3.6%. And the Spanish 2 year yield is down to 3.8%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Philly Fed Survey: "Regional manufacturing remained weak in July"

by Calculated Risk on 7/21/2011 10:00:00 AM

From the Philly Fed: July 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased to 3.2 from -7.7 [any reading above zero is expansion]. The demand for manufactured goods, as measured by the current new orders index, improved from last month but suggests flat demand: The index rose 8 points to a reading of zero ...This indicates a little expansion in July. This was about at the consensus of 5.0.

Firms’ responses suggest a slight improvement in the labor market compared to June. The current employment index increased 5 points and remained positive for the 11th consecutive month. ...

Diffusion indexes for prices paid and prices received were lower this month and suggest a continued trend of moderating price pressures. The prices paid index declined 2 points, following a sharp drop of 22 points last month.

...

The broadest indicator of future activity improved markedly this month, rebounding from its lowest reading in 31 months in June.

Click on graph for larger image in graph gallery.

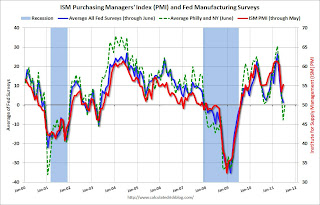

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The averaged Empire State and Philly Fed surveys are back close to zero combined. July was a little better than June for both surveys.

Weekly Initial Unemployment Claims increase to 418,000

by Calculated Risk on 7/21/2011 08:30:00 AM

The DOL reports:

Special Factor: Minnesota has indicated that approximately 1,750 of their reported initial claims are a result of state employees filing due to the state government shutdown.This is the 15th straight week with initial claims above 400,000, and the 4-week average is at about the same the level as in January.

In the week ending July 16, the advance figure for seasonally adjusted initial claims was 418,000, an increase of 10,000 from the previous week's revised figure of 408,000. The 4-week moving average was 421,250, a decrease of 2,750 from the previous week's revised average of 424,000.

The following graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased slightly this week to 421,250.

This increase was about at expectations. With all the recent layoff announcements (Borders, Cisco, etc), there is some concern that weekly claims will rise over the next couple of months. From the WSJ:

Companies are laying off employees at a level not seen in nearly a year, hobbling the job market and intensifying fears about the pace of the economic recovery.

Cisco Systems Inc., Lockheed Martin Corp. and troubled bookstore chain Borders Group Inc. are among those that have recently announced hefty cuts

Wednesday, July 20, 2011

Report: Germany and France Agree on Greek Bailout

by Calculated Risk on 7/20/2011 09:31:00 PM

Details tomorrow ...

• From the Financial Times: Germany and France reach Greek accord

• From the WSJ: German-French Harmony on Greece

[German Chancellor Angela Merkel and] French President Nicolas Sarkozy [with] European Central Bank President Jean-Claude Trichet ... managed to find a mutually acceptable formula for how to involve Greece's bondholders in the expected new rescue package, according to a senior official present at the talks.Earlier today:

The official didn't give details of the joint proposal ...

• AIA: Architecture Billings Index indicates declining demand in June

• Moody's: Commercial Real Estate Prices increased in May

• From NY Fed VP Brian Sack: The SOMA Portfolio at $2.654 Trillion. Note: Dr. Sack outlined two possible methods for further accomodation: 1) additional asset purchases (like "QE2"), or 2) "shifting the composition of the SOMA portfolio rather than expanding its size." An interesting comment.

And on Existing Home Sales:

• Existing Home Sales in June: 4.77 million SAAR, 9.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs