by Calculated Risk on 7/21/2011 08:30:00 AM

Thursday, July 21, 2011

Weekly Initial Unemployment Claims increase to 418,000

The DOL reports:

Special Factor: Minnesota has indicated that approximately 1,750 of their reported initial claims are a result of state employees filing due to the state government shutdown.This is the 15th straight week with initial claims above 400,000, and the 4-week average is at about the same the level as in January.

In the week ending July 16, the advance figure for seasonally adjusted initial claims was 418,000, an increase of 10,000 from the previous week's revised figure of 408,000. The 4-week moving average was 421,250, a decrease of 2,750 from the previous week's revised average of 424,000.

The following graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased slightly this week to 421,250.

This increase was about at expectations. With all the recent layoff announcements (Borders, Cisco, etc), there is some concern that weekly claims will rise over the next couple of months. From the WSJ:

Companies are laying off employees at a level not seen in nearly a year, hobbling the job market and intensifying fears about the pace of the economic recovery.

Cisco Systems Inc., Lockheed Martin Corp. and troubled bookstore chain Borders Group Inc. are among those that have recently announced hefty cuts

Wednesday, July 20, 2011

Report: Germany and France Agree on Greek Bailout

by Calculated Risk on 7/20/2011 09:31:00 PM

Details tomorrow ...

• From the Financial Times: Germany and France reach Greek accord

• From the WSJ: German-French Harmony on Greece

[German Chancellor Angela Merkel and] French President Nicolas Sarkozy [with] European Central Bank President Jean-Claude Trichet ... managed to find a mutually acceptable formula for how to involve Greece's bondholders in the expected new rescue package, according to a senior official present at the talks.Earlier today:

The official didn't give details of the joint proposal ...

• AIA: Architecture Billings Index indicates declining demand in June

• Moody's: Commercial Real Estate Prices increased in May

• From NY Fed VP Brian Sack: The SOMA Portfolio at $2.654 Trillion. Note: Dr. Sack outlined two possible methods for further accomodation: 1) additional asset purchases (like "QE2"), or 2) "shifting the composition of the SOMA portfolio rather than expanding its size." An interesting comment.

And on Existing Home Sales:

• Existing Home Sales in June: 4.77 million SAAR, 9.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

NY Fed's Brian Sack: The SOMA Portfolio at $2.654 Trillion

by Calculated Risk on 7/20/2011 07:00:00 PM

From NY Fed VP Brian Sack: The SOMA Portfolio at $2.654 Trillion. Sack discusses previous actions, and then discusses possible future actions:

Future Evolution of the SOMA PortfolioCurrently the Fed is engaged in Quantitative Neutrality (hold the balance sheet steady by reinvesting). If they decide to launch QE3, they could either 1) buy more assets, or 2) change the composition.

While I am sure you are happy to hear more about our actions to date, I realize that you may be even more interested in the evolution of the SOMA portfolio going forward. Just to be clear, I will not be saying anything about the likelihood of prospective policy actions beyond what has been conveyed in FOMC communications. However, I would like to make a few points about the portfolio under those prospective actions.

As noted earlier, the current directive from the FOMC is to reinvest principal payments on the securities we hold in order to maintain the level of domestic assets in the SOMA portfolio. This approach can be interpreted as keeping monetary policy on hold. Indeed, one can generally think of the stance of monetary policy in terms of two tools—the level of the federal funds rate, and the amount and type of assets held on the Federal Reserve's balance sheet. The FOMC has decided to keep both of these tools basically unchanged for now.

Given the considerable amount of uncertainty about the course of the economy, market participants have observed that the next policy action by the FOMC could be in either direction. If economic developments lead the FOMC to seek additional policy accommodation, it has several policy options open to it that would involve the SOMA portfolio, as noted by Chairman Bernanke in his testimony last week. One option is to expand the balance sheet further through additional asset purchases, with the just-completed purchase program presenting one possible approach. Another option involves shifting the composition of the SOMA portfolio rather than expanding its size. As noted earlier, a sizable portion of the additional risk that the SOMA portfolio has assumed to date came from a lengthening of its maturity, suggesting that the composition of the portfolio can be used as an important variable for affecting the degree of policy stimulus. Lastly, the Chairman mentioned that the FOMC could give guidance on the likely path of its asset holdings, as the effect on financial conditions presumably depends on the period of time for which the assets are expected to be held.

Alternatively, economic developments could instead lead to a policy change in the direction of normalization. The FOMC minutes released last week provided valuable information on the sequence of steps that might be followed in that case. The minutes indicated that the removal of policy accommodation was expected to begin with a decision to stop reinvesting some or all of the principal payments on assets held in the SOMA. If all asset classes in the SOMA were allowed to run off, the portfolio would decline by about $250 billion per year on average over the first several years.

Under the interpretation of the policy stance noted earlier, this shrinkage of the balance sheet would amount to a tightening of policy. However, one should realize that this step represents a relatively gradual and limited policy tightening. Indeed, using the mapping that has been discussed by Chairman Bernanke, this path for the balance sheet would, in terms of its effects on the economy, be roughly equivalent to raising the federal funds rate by just over 25 basis point per year over the course of several years.

The minutes also described asset sales as part of the strategy, indicating that this step would likely occur relatively late in the normalization process. From the perspective of the balance sheet and the stance of monetary policy, sales accomplish the same thing as redemptions, as they also shrink the balance sheet over time. The minutes indicated that such sales are likely to be gradual and predictable, which makes them even more similar in nature to redemptions.

Together, the combination of asset redemptions and asset sales, once underway, should put the size of the portfolio on a path to a more normal level over several years. Thus, they represent an important part of the normalization of the policy stance. However, if the approach follows the gradual and predictable path described by the minutes, one can think of this adjustment as a relatively passive part of the policy tightening. In these circumstances, adjustments to the federal funds rate would generally be the active policy instrument, responding as needed to economic developments.

The sequence of policy steps described in the minutes indicates how the size of the SOMA portfolio is likely to be normalized. However, simply reducing the size of the portfolio would still leave its duration at historically elevated levels. The FOMC might decide it was happy with this outcome, or it could decide at some stage to renormalize the duration of the portfolio as well. Depending on the precise timing of the steps that will occur in the exit sequence, there will likely be opportunities to do so. For example, there is a good chance that the Desk will still be selling MBS at the time when the SOMA portfolio gets back to its normal size. In such circumstances, the Federal Reserve would have to then engage in sizable Treasury purchases to offset the ongoing sales of MBS and to expand the SOMA portfolio as needed to meet currency demand and other factors. This period of Treasury purchases would allow the FOMC to rebuild its Treasury portfolio with the maturity structure that it sees as optimal.

If they decide to normalize, the first step would be to stop reinvesting.

Earlier on Existing Home Sales:

• Existing Home Sales in June: 4.77 million SAAR, 9.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

European Commission president: Now is the Time to Act

by Calculated Risk on 7/20/2011 04:05:00 PM

The emergency EU summit in Brussels on Thursday is viewed as critical. The Finance Ministers will meet in the morning, and the European leaders later in the day. I don't expect an announcement until late in the evening (probably well after U.S. markets close tomorrow).

From Bloomberg: Barroso Says Summit Failure on Greece Would Cause Global Damage

“Nobody should be under any illusion; the situation is very serious. It requires a response. Otherwise, the negative consequences will be felt in all corners of Europe and beyond.From the WSJ: Pressure Mounts on Greece Meeting

...

“The minimum we must do tomorrow is to provide clarity on the following: measures to ensure the sustainability of Greek public finances; feasibility and limits of private-sector involvement; scope for more flexible action through the European Financial Stability Facility, the EFSF; repair of the banking sector still needed; and measures to ensure the provision of liquidity to our banking system.”

“Most of the decisions to be taken tomorrow belong to the competence of the member states. They have reserved the instruments to themselves and they have said they will do what it takes to ensure the stability of the euro area. Well, now is the time to make good on that promise.

French Finance Minister François Baroin said euro-zone leaders are expected to deliver a "strong message" at the summit, while Foreign Minister Alain Juppe said on French television he was "convinced" leaders will find an agreement. "There are difficult technical aspects and slowness in the decision process, but on the objective there is a large consensus," said Mr. Juppe.Earlier on Existing Home Sales:

The French optimism contrasts with comments Tuesday from Ms. Merkel, who said there won't be "one spectacular step" at the Brussels summit, and that it would rather be the first of a "step-by-step measures ... with the final goal of finally getting to the roots of (the) problem."

...

"Today we have a historic choice," said Mr. Juppe. "Either we go backwards, and we let what we've built collapse. That would be an absolute catastrophe for every country. Or we go further."

• Existing Home Sales in June: 4.77 million SAAR, 9.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Moody's: Commercial Real Estate Prices increased in May

by Calculated Risk on 7/20/2011 02:14:00 PM

From Bloomberg: U.S. Commercial Property Prices Increased 6.3% in May, Moody’s Says

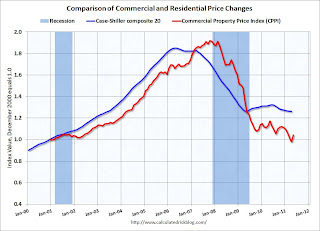

The Moody’s/REAL Commercial Property Price Index rose 6.3 percent from April ... It’s down 11 percent from a year earlier and 46 percent below the peak of October 2007Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

“A number of transactions that were recorded in May had their most recent prior sales in 2009 as the market was beginning to bottom and subsequently traded for substantial returns,” Tad Philipp, director of commercial real estate research at Moody’s, said in a separate statement.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are down 11% from a year ago and down about 46% from the peak in 2007. Prices fell sharply over the previous six months, and this increase only erases part of that decline.

Note: There are few commercial real estate transactions compared to residential, so this index is very volatile.