by Calculated Risk on 4/19/2011 10:00:00 AM

Tuesday, April 19, 2011

State Unemployment Rates little changed in March

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in March. Thirty four states recorded unemployment rate decreases, seven states registered rate increases, and nine states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue, the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 13.2 percent in March. The states with the next highest rates were California, 12.0 percent, Florida, 11.1 percent, and Rhode Island, 11.0 percent. North Dakota reported the lowest jobless rate, 3.6 percent, followed by Nebraska and South Dakota, 4.2 and 4.9 percent, respectively.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

The auto states - led by Michigan - seem to have seen the most improvement (blue area).

Two states are still at the recession maximum (no improvement): Idaho and Louisiana.

Housing Starts increase in March

by Calculated Risk on 4/19/2011 08:30:00 AM

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Total housing starts were at 549 thousand (SAAR) in March, up 7.2% from the revised February rate of 512 thousand (revised up from 479 thousand).

Single-family starts increased 7.7% to 422 thousand in March (February was revised up to 392 thousand from 375 thousand).

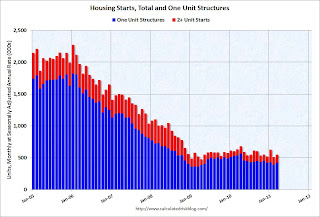

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was above expectations of 525 thousand starts, and there was probably some weather related bounce back in March.

Privately-owned housing starts in March were at a seasonally adjusted annual rate of 549,000. This is 7.2 percent (±18.0%)* above the revised February estimate of 512,000, but is 13.4 percent (±9.1%) below the March 2010 rate of 634,000.

Single-family housing starts in March were at a rate of 422,000; this is 7.7 percent (±15.0%)* above the revised February figure of 392,000. The March rate for units in buildings with five units or more was 117,000.

Building Permits:

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 594,000. This is 11.2 percent (±2.6%) above the revised February rate of 534,000, but is 13.3 percent (±1.3%) below the March 2010 estimate of 685,000.

Single-family authorizations in March were at a rate of 405,000; this is 5.7 percent (±1.1%) above the revised February figure of 383,000. Authorizations of units in buildings with five units or more were at a rate of 173,000 in March.

I expect starts to stay low until more of the excess inventory of existing homes is absorbed. I'll have more on starts later.

Monday, April 18, 2011

Jim the Realtor: Predict the Price of REO

by Calculated Risk on 4/18/2011 10:46:00 PM

Jim the Realtor is having a contest to predict the price of an REO in San Diego. This house is in the Rancho Santa Fe Covenant, 5,835 sq ft and listed for $785,400 ... you'll see why:

Here is Jim's post Covenant Giveaway (put prediction in his comments).

Extend and Pretend Greek Style

by Calculated Risk on 4/18/2011 05:59:00 PM

Landon Thomas at the NY Times discusses how a possible restructuring might work: Talk of Greek Debt Restructuring Just Won't Die

One option that has attracted some attention, though, is a plan that would ask bond holders to trade in their current paper for debt with lower rates and longer maturities.Last week, in a Bloomberg article, German Finance Minister Wolfgang Schaeuble was quoted concerning a report due in June on Greek debt sustainability:

Such a proposal, which was successfully deployed by Uruguay in 2003, would, in theory, minimize banking losses and extend debt payments further into the future, easing Greece’s financing burden in the near term.

“We will have to do something” if the review by the International Monetary Fund and European authorities in June raises doubts about Greece’s “debt sustainability,” Schaeuble was quoted as saying. “Then, further measures will have to be taken.”It seems unlikely that anything will happen until after the report is released in June.

The yield on Greece ten year bonds jumped to 14.5% today and the two year yield is now up to 20.3%. The curve is inverted because investors expect to wake up one morning and own longer maturity debt at lower rates. This possibility hits the price of the 2 year bond more than the 10 year.

Las Vegas adds jobs in March, first time in over 3 years

by Calculated Risk on 4/18/2011 02:54:00 PM

The BLS will release the Regional and State Employment and Unemployment report for March tomorrow ... here is a little good news from Nevada (highest state unemployment rate in the U.S.)

From Cy Ryan at the Las Vegas Sun: Las Vegas jobless rate dips to 13.3 percent in March

Employment in the Las Vegas area increased by more than 10,000 jobs in March -- the first increase in 38 months.It will not be all good news tomorrow. California lost jobs in March, although this follows a record increase in jobs added in February - and the California unemployment rate declined in March. From Alana Semuels at the LA Times: California employers cut a net 11,600 jobs in March

...

The state Department of Employment, Training and Rehabilitation reported today the Nevada jobless rate fell to 13.2 percent, down from 13.6 percent in February [peaked at 14.9% in 2010]. There were 1,114,400 Nevadans with jobs, an increase of more than 10,000 from a month earlier.

”Nevada's labor markets showed signs of life in March, hinting what may be the beginnings of an economic recovery,” says Bill Anderson, chief economist of the department.

The state lost a net 11,600 jobs in March after adding a record 84,600 in February, and the unemployment rate fell to 12% from 12.1%.