by Calculated Risk on 4/12/2011 08:52:00 AM

Tuesday, April 12, 2011

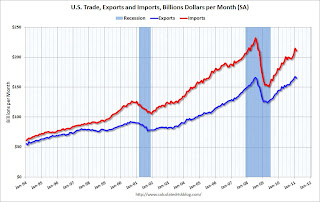

Trade Deficit decreased in February to $45.8 billion

The Department of Commerce reports:

[T]otal February exports of $165.1 billion and imports of $210.9 billion resulted in a goods and services deficit of $45.8 billion, down from $47.0 billion in January, revised. February exports were $2.4 billion less than January exports of $167.5 billion. February imports were $3.6 billion less than January imports of $214.5 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through February 2011.

Both imports and exports declined slightly in February (seasonally adjusted). Still exports are now above the pre-recession peak.

The second graph shows the U.S. trade deficit, with and without petroleum, through February.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit decreased in February as the quantity declined even as import prices continued to rise - averaging $87.17 in February, up from $72.92 in February 2010. Prices will be even higher in March and April. The trade deficit with China was $18.8 billion (NSA) in February. The oil and China deficits are essentially the entire trade deficit.

The trade deficit was larger than the expected $44 billion.

NFIB: Small Business Optimism Index decreases in March

by Calculated Risk on 4/12/2011 07:30:00 AM

From National Federation of Independent Business (NFIB): Hiring Up, But Optimism Down in March

The Index of Small Business Optimism gave up 2.6 points in March, falling to 91.9. Four components rose or were unchanged, while six lost ground. The “hard” components of the Index (job creation, job openings, capital spending plans and inventory plans) added two points while the “soft” components (the other six in the table above) gave up 31 points. Index was driven by weaker expectations for real sales gains and business conditions and a marked deterioration in profit trends. The decline in the percent of owners expecting higher real sales and better business conditions in six months alone account for 76 percent of the decline in the Index.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

Twenty-five (25) percent of the owners reported that weak sales continued to be their top business problem

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the small business optimism index since 1986. The index decreased to 91.9 in March from 94.5 in February.

This has been trending up, although the level is still very low.

This graph shows the net hiring plans for the next three months.

This graph shows the net hiring plans for the next three months.Hiring plans decreased slightly in March. According to NFIB: “The percent of owners reporting hard to fill job openings was unchanged at 15 percent, supporting the modest reductions in the unemployment rate recently observed. Unfortunately, the net percent of owners planning to create new jobs (increasing the total number of workers employed) lost three points, falling to a net 2 percent of all firms, low, but still 12 points better than the recession low reading of negative 10 percent reached in March 2009."

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in March. In good times, owners usually report taxes and regulation as their biggest problems.

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in March. In good times, owners usually report taxes and regulation as their biggest problems.The recovery continues to be sluggish for this index (probably because of the high concentration of real estate related companies). Most of the decline was due to "soft" components, especially future expectations.

Monday, April 11, 2011

$4 Gasoline, Again

by Calculated Risk on 4/11/2011 08:21:00 PM

The average U.S. price is getting close to $4 per gallon.

From Ronald White at the LA Times: Gasoline prices continue climb

The U.S. average for a gallon of regular gasoline jumped 10.7 cents in the week ended Monday to $3.791, or 93.3 cents higher than a year earlier, according to the Energy Department's weekly survey of service stations.I think high gasoline prices are the top risk for the U.S. economy right now. Hopefully prices will decline soon; WTI crude futures declined slightly to $109 per barrel today.

The biggest regional increase was the 12.4-cent jump in the Midwest ... The Midwest average for regular gasoline reached $3.805 a gallon.

California drivers paid $4.161 for a gallon of self-serve regular gasoline ...

Shameless Puff Piece

by Calculated Risk on 4/11/2011 06:21:00 PM

I've been asked for some links to comments about my blog, so I put together this quick and shameless puff piece. I hope you all don't mind ... best to all, Bill (CR)

1) Time.com 25 Best Financial Blogs, March 2011

“If you only follow one economics blog, it has to be Calculated Risk, run by Bill McBride. The site provides concise and very accessible summaries of all the key economic data and developments. One of the reasons McBride is able to do this so well is that he has an almost uncanny knack of recognizing which facts really matter. He began the blog in 2005 because he saw a disaster brewing in the form of the housing bubble, and tried his best to warn the rest of us of what was coming. I've followed him closely ever since, and I don't know if he's ever been wrong. My advice is, if you've come up with a different conclusion from McBride on how economic developments are going to unfold, you'd be wise to think it over again!”

Professor James Hamilton, Economics, University of California, San Diego

2) By John Carney Senior Editor, CNBC.com

"It’s very clear to me that this fact of the extension of unemployment benefits is widely misunderstood—and would have remained widely misunderstood if not for the meticulous and clarifying genius of Calculated Risk."

3) By Alen Mattich at the WSJ: The Best Economics Blogs

"Calculated Risk, produced by Bill McBride, is more focused on U.S. economic developments, particularly in the real-estate market. But investment banking research rarely gets to the nub of the issue as quickly or pithily as McBride following data releases and market developments. If you’re following U.S. macro trends, it’s a blog that demands frequent visits."

4) By David Weidner at the WSJ: Ten Wall Street Blogs You Need To Bookmark Now

5) Nobel economist Paul Krugman in the NY Times:

"Calculatedrisk, my go-to site on housing matters."

6) "[B]y far the broadest, deepest, and smartest coverage of the subprme crisis and housing meltdown comes not from any newspaper but rather from the blog Calculated Risk."

Felix Salmon, Condé Nast (now at Reuters)

7) "Calculated Risk, ... posts not only offer running commentary on the news but also break down the economics of the mortgage game. ... Some of the commentary can be a slog, but no other site offers this level of analysis."

Business Week

8) Recent mention in the NY Times:

"Consider this chart from the Calculated Risk blog (and revisit it regularly). As the picture shows so vividly, we are still waiting for employment to turn back up decisively. Compared with previous recessions, the delay is simply stunning."

9) More recent mentions in the WSJ (just excerpts from my blog):

Here and here.

Housing Starts: Vacant Units and Unemployment Rate

by Calculated Risk on 4/11/2011 02:51:00 PM

An update to a couple of graphs ...

The first graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S.

Back in 2009, I used this chart to argue that there would be no "V shaped" recovery, and that housing starts wouldn't rebound rapidly. See: Housing Starts and Vacant Units: No "V" Shaped Recovery.

Note: Housing starts are through February, and the combined vacancy rate through Q4 based on the Census Bureau HVS vacancy rates for owner occupied and rental housing.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The good news is the total vacancy rate is declining (and based on recent Reis' data, the vacancy rate will fall further in Q1 2011). We know that the homebuilders will complete a record low number of housing units in 2011, and the declining vacancy rate suggests more households are being formed than net housing units added to the housing stock, or in other words, the excess supply is being absorbed.

There will be some increase in building this year (mostly in multi-family), but the recovery in construction will remain sluggish until more of the excess supply is absorbed. I'd like to see this measure of vacancy down to 4.5% or even 4.0%.

Looking at the graph, the vacancy rate continued to climb even after housing starts fell off a cliff. Initially this was because of a significant number of completions. Then some hidden inventory (like some 2nd homes) probably became available for sale or for rent, and also some households doubled up because of tough economic times.

The second graph shows single family housing starts (through February) and the unemployment rate (inverted) through March. Note: there are many other factors too impacting unemployment, but housing is a key sector.

The second graph shows single family housing starts (through February) and the unemployment rate (inverted) through March. Note: there are many other factors too impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) have declined recently - but have mostly moved sideways for the last two years. This is one of the reasons the unemployment rate has stayed elevated compared to previous recoveries.

The good news is residential investment should increase modestly this year, and that will help push down the unemployment rate. But I still think the labor market recovery will be sluggish until the excess housing supply is absorbed.