by Calculated Risk on 4/11/2011 12:15:00 PM

Monday, April 11, 2011

Fed's Yellen: Inflation Transitory, will not "impede the economic recovery"

From Fed Vice Chair Janet Yellen: Commodity Prices, the Economic Outlook, and Monetary Policy. Yellen discusses the recent surge in commodity prices and the possible impact on underlying inflation. She doesn't think the increase in commodity prices will impede the economic recovery.

A few excerpts:

[T]he recent run-up in commodity prices is likely to weigh somewhat on consumer spending in coming months because it puts a painful squeeze on the pocketbooks of American households. In particular, higher oil prices lower American income overall because the United States is a major oil importer and hence much of the proceeds are transferred abroad. Monetary policy cannot directly alter this transfer of income abroad, which primarily reflects a change in relative prices driven by global demand and supply balances, not conditions in the United States. Thus, an increase in the price of crude oil acts like a tax on U.S. households, and like other taxes, tends to have a dampening effect on consumer spending.And her conclusion:

The surge in commodity prices may also dampen business spending. Higher food and energy prices should boost investment in agriculture, drilling, and mining but are likely to weigh on investment spending by firms in other sectors. Assuming these firms are unable to fully pass through higher input costs into prices, they will experience some compression in their profit margins, at least in the short run, thereby causing a decline in the marginal return on investment in most forms of equipment and structures. Moreover, to the extent that higher oil prices are associated with greater uncertainty about the economic outlook, businesses may decide to put off key investment decisions until that uncertainty subsides. Finally, with higher oil prices weighing on household income, weaker consumer spending could discourage business capital spending to some degree.

Fortunately, considerable evidence suggests that the effect of energy price shocks on the real economy has decreased substantially over the past several decades. During the period before the creation of the Organization of the Petroleum Exporting Countries (OPEC), cheap oil encouraged households to purchase gas-guzzling cars while firms had incentives to use energy-intensive production techniques. Consequently, when oil prices quadrupled in 1973-74, that degree of energy dependence resulted in substantial adverse effects on real economic activity. Since then, however, energy efficiency in both production and consumption has improved markedly.

Consequently, while the recent run-up in commodity prices is likely to weigh somewhat on consumer and business spending in coming months, I do not anticipate that those developments will greatly impede the economic recovery as long as these trends do not continue much further.

In summary, the surge in commodity prices over the past year appears to be largely attributable to a combination of rising global demand and disruptions in global supply. These developments seem unlikely to have persistent effects on consumer inflation or to derail the economic recovery and hence do not, in my view, warrant any substantial shift in the stance of monetary policy.

Fed's Dudley: Not "enthusiastic about tightening policy too early"

by Calculated Risk on 4/11/2011 08:59:00 AM

From Bloomberg: Dudley Says Fed Shouldn’t Rush to Tighten Policy ‘Too Early’

“We’re probably going to have excess slack in the U.S. labor market at least through the end of 2012, and that’s one reason that colored my view that we shouldn’t be overly enthusiastic about tightening monetary policy too early,” [NY Fed President William] Dudley told a forum in Tokyo today.It is extremely unlikely that the Fed will raise rates this year - and as Dudley notes - there will probably be excess slack in the labor markets next year too.

Weekend:

• Summary for Week ending April 8th

• Schedule for Week of April 10th

Sunday, April 10, 2011

Softer Commodity Prices?

by Calculated Risk on 4/10/2011 08:19:00 PM

A couple of articles:

From the WSJ: Warning Signs for Copper Market (ht Brian)

Copper prices have almost quadrupled after a two-year rally ... evidence has recently surfaced of previously unreported copper stockpiles, a sign that much of the purchased copper hasn't been put to use.And from the WSJ: Steel Price Softens As Supply Solidifies

The world's steelmakers are increasing output despite softer demand, pushing down prices. ... But U.S. prices—especially for hot-rolled steel, a key component used in most steel products—could be headed lower tooLower commodity prices would definitely help - especially oil. Unfortunately WTI futures are up again to over $113 per barrel.

Earlier:

• Summary for Week ending April 8th

• Schedule for Week of April 10th

Economic Outlook and Downside Risks

by Calculated Risk on 4/10/2011 02:45:00 PM

Earlier:

• Summary for Week ending April 8th

• Schedule for Week of April 10th

Just an update: My general outlook for 2011 remains the same ...

• GDP growth slightly above trend and strong than the 2.9% growth rate in 2010 (although Q1 2011 will be sluggish).

• Payroll employment growth to be better in 2011 than in 2010 (940 nonfarm payroll jobs added in 2010, 1.17 million private payroll jobs). My forecast is private payrolls will increase 2.4 million in 2011, although total payroll growth will be less because of state and local government layoffs. With 7.25 million fewer payrolls jobs than before the recession, this is still disappointing payroll growth.

I also watch the downside risks carefully. Here is a brief update to a list from last month with my view if the risk to the economy is increasing or decreasing:

1) Higher oil prices and a possible supply shock. Risk increasing.

U.S. oil prices have risen to $112.79 per barrel. At the moment this appears to the be the top risk to the U.S. economy. With gasoline prices over $4 per gallon in some areas, this has to be starting to hurt.

2) Possible Federal government cutbacks (even shutdown). Risk increasing.

Although there was a budget deal reached on Friday, the fiscal cutting rhetoric has increased. There is even the possibility (remote) of the first default in history because of political ideology. The "debt ceiling" debate is just political grandstanding, but you never know what will happen. Even assuming the debt ceiling is raised, it appears there will be more cutting than originally expected - and that will be a drag on U.S. growth this year.

3) U.S. Housing Crisis. Same.

House prices are at new post-bubble lows and still falling. And there will be many foreclosures and more distressed supply coming on the market. But it does appear the excess supply is being absorbed (based on falling vacancy rates), but there is still a long way to go.

4) The European financial crisis. Same.

Portugal finally requested a bailout. That was expected. From Dow Jones: IMF Will Join In Assessment Of Portugal Tuesday

"Following a request by the Portuguese authorities, IMF experts will join European Commission and European Central Bank teams for a technical assessment of the current situation of the Portuguese economy," the statement said.If another European country, in addition to Greece, Ireland and Portugal, requests a bailout - or any of those countries default - the situation could get worse. Also the second round of bank stress tests might reveal additional problems.

The assessment will serve as the basis for policy discussions scheduled to begin April 18, the IMF said.

European authorities are planning a bailout for Portugal. They are trying to close a deal by mid-May ...

5) State and local government cutbacks. Same.

6) Inflation (a two sided coin). Same.

Although I think core inflation will remain below the Fed's target in 2011, it is possible that inflation could pick up more - or that policymakers will overreact.

7) Risks from the earthquake in Japan. Risk Diminished.

This was a horrible tragedy for the people of Japan, however it appears the risks from the nuclear and supply disruption issues have diminished.

Overall the downside risks have increased over the last few weeks - especially from oil prices and government policy.

Schedule for Week of April 10th

by Calculated Risk on 4/10/2011 08:35:00 AM

NOTE: The Schedule is available all week in the menu bar above.

Earlier:

• Summary for Week ending April 8th

The key reports this week are March Retail Sales on Wednesday, and the Consumer Price Index (CPI) on Friday. The monthly Trade Balance report will be released on Tuesday, and Industrial Production/Capacity Utilization on Friday. Also J.P. Morgan (Weds) and Bank of America (Fri) report Q1 results this week and they might provide comments on foreclosure issues.

12:15 PM ET: Fed Vice Chair Janet Yellen speaks, "Commodity Prices, the Economic Outlook, and Monetary Policy", At the Economic Club of New York Luncheon, New York, New York

7:30 AM: NFIB Small Business Optimism Index for March. This index has been showing some increase in optimism.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the small business optimism index since 1986. The index increased to 94.5 in February from 94.1 in January.

Although still fairly low, this is the highest level for the index since December 2007.

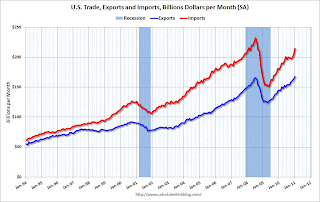

8:30 AM: Trade Balance report for February from the Census Bureau.

This graph shows the monthly U.S. exports and imports in dollars through January 2011.

This graph shows the monthly U.S. exports and imports in dollars through January 2011.Exports are up sharply and are now above the pre-recession peak. Imports have surged over the last two months, largely due to the increase in oil prices.

The consensus is for the U.S. trade deficit to be around $44.0 billion, down from $46.3 billion in January.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales in spring 2011.

7:00 AM: J.P. Morgan First Quarter 2011 Financial Results

8:30 AM: Retail Sales for March.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).Retail sales are up 15.3% from the bottom, and now 1.9% above the pre-recession peak.

The consensus is for retail sales to increase 0.5% in March (0.7% increase ex-auto).

10:00 AM: Manufacturing and Trade: Inventories and Sales for February. The consensus is for a 0.8% increase in inventories.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS. This report has been showing a general increase in job openings, but very little turnover in the labor market.

2:00 PM ET: The Fed Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 380,000 from 382,000 last week.

8:30 AM: Producer Price Index for March. The consensus is for a 1.0% increase in producer prices (0.2% core).

7:00 AM: Bank of America First-Quarter Financial Results

8:30 AM: NY Fed Empire Manufacturing Survey for April. The consensus is for a reading of 17.0, down slightly from 17.5 in March.

8:30 AM: Consumer Price Index for March. The consensus is for a 0.5% increase in prices. The consensus for core CPI is an increase of 0.2%.

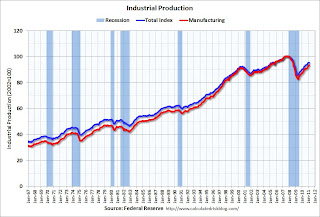

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for March.

This graph shows industrial production since 1967. Production is still 5.2% below the pre-recession levels at the end of 2007.

This graph shows industrial production since 1967. Production is still 5.2% below the pre-recession levels at the end of 2007.The consensus is for a 0.5% increase in Industrial Production in March, and an increase to 77.4% (from 76.3%) for Capacity Utilization.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for April. The consensus is for a slight increase to 69.0 from 67.5 in March.

Best wishes to All!