by Calculated Risk on 4/06/2011 02:30:00 PM

Wednesday, April 06, 2011

Budgets and Political Grandstanding

• As I noted back in January, the deficit and the debt are real issues, but the "debt ceiling" debate is political posturing. (If you follow the links back a few years, this was originally making fun of Democrats).

I still believe a shutdown will be averted, but if not, here is an article from Michael Shear at the NY Times on the possible consequences: White House Says Shutdown Would Harm the Economy (pay wall)

Administration officials said that nearly 800,000 federal workers would probably be told to stop working if a deal was not reached in the next two days. Small business loans would stop. Tax returns filed on paper would not be processed. Government Web sites would go dark. And federal loan guarantees for new mortgages would become unavailable.This is a real concern, but I don't believe anyone in Congress is THAT stupid.

Speaking to reporters on a morning conference call, a senior administration official said the cumulative impact of the shutdown “would have a significant impact on our economic momentum.”

• Unfortunately the Paul Ryan budget plan is riddled with errors. Here are the original projections (they have been changed without changing the plan - not a good sign). The plan has many unrealistic projections (unemployment, residential investment, and more). Bad math ruins the whole plan, and it isn't even a starting point for discussion.

Also, as I noted earlier in the comments, I'm in the "over 55" group that will not see a change to Medicare under Ryan's plan. I object to this vote buying scheme (older people vote). Whatever plan is good enough for those 25 years old, 35 years old and 45 years old - is good enough for me. I believe in shared sacrifice, and I refuse to ask younger workers to take less while I get more. I understand this plan is DOA if it applies to older workers, then so be it.

Aren't there any leaders in America who can talk shared sacrifice to solve a problem?

Construction Employment Outlook Update

by Calculated Risk on 4/06/2011 11:48:00 AM

By request, here is an update to a graph I posted just over a year ago on construction employment. Last year the outlook for construction employment was grim. This year will be a little better - but not much.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the number of construction payroll jobs (blue line), and the number of construction jobs as a percent of total non-farm payroll jobs (red line).

Construction employment is down 2.2 million jobs from the peak in April 2006, but up 16 thousand jobs so far this year.

Note: Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential building employees in 1985, and residential specialty trade contractors in 2001). Usually residential investment (and residential construction) lead the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usually pickup in residential construction for previous recessions. Of course residential investment didn't lead the economy this time because of the huge overhang of existing housing units.

This table below shows the annual change in construction jobs (total, residential and non-residential).

| Annual Change in Payroll jobs (000s) | |||

|---|---|---|---|

| Year | Total Construction Jobs | Residential Construction Jobs | Non-Residential |

| 2002 | -85 | 88 | -173 |

| 2003 | 127 | 161 | -34 |

| 2004 | 290 | 230 | 60 |

| 2005 | 416 | 268 | 148 |

| 2006 | 152 | -62 | 214 |

| 2007 | -198 | -273 | 75 |

| 2008 | -787 | -510 | -277 |

| 2009 | -1053 | -431 | -622 |

| 2010 | -149 | -113 | -36 |

| March 2011 | 16 | 8 | 8 |

In 2011, for the first time since 2005, I expect residential construction employment to increase - mostly because of multi-family construction. I also expect residential investment to make a small positive contribution to GDP growth this year - also for the first time since 2005.

Reis: Apartment Vacancy Rates fell sharply in Q1, Lowest in almost three years

by Calculated Risk on 4/06/2011 08:55:00 AM

From Reuters: U.S. apartment vacancies fall in Q1, rents edge up

Reis Inc's quarterly report showed the vacancy rate dropped to 6.2 percent in the first three months of the year, down from 6.6 percent in the fourth quarter. It was the steepest fall since the commercial real estate research firm began tracking the market in 1999.And from Bloomberg: Apartment Vacancies in U.S. Fall to Lowest in Almost Three Years

[CR note: the vacancy rate was 8 percent in Q1 2010].

Apartment owners had a net increase in occupied space of more than 44,000 units, the most for a first quarter since 1999 and almost double the number from a year earlier, Reis said. The first quarter tends to be a slow period for rentals since more leases are signed in the warmer months, the company said.This is a very large decline from the record vacancy rate set a year ago at 8%. This decline fits with the recent survey from the NMHC that showed lower apartment vacancies. Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

About 6,000 units came to market during the first quarter, the fewest since Reis began compiling data in 1999.

A few key points we've been discussing:

• Vacancy rates are falling fast (the excess supply is being absorbed). Note: The excess housing supply includes both apartments and single family homes.

• A record low number of multi-family units will be completed this year (2011). Only 6,000 apartments came on the market in Q1 (in the Reis survey area).

• This will push up effective rents. Via Bloomberg:

Effective rents, or what tenants actually pay, increased in 75 of the 82 markets Reis tracks, to an average $991 a month from $967 a year earlier and $986 in the fourth quarter.However, when I was at the NMHC conference earlier this year, it sounded like rent growth is mostly coming from reductions in concessions and not from the top line (i.e. not from rent increases). (my short notes from conference here and here). Still, any increase in effective rents will push down the price-to-rent ratio for homes.

• Multi-family starts are increasing, and that will help both GDP and employment growth this year. These new starts will not be completed until 2012 at the earliest, so vacancy rates will probably decline all year.

MBA: Mortgage Purchase Application activity increases ahead of FHA fee increase

by Calculated Risk on 4/06/2011 07:15:00 AM

The MBA reports: Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6.2 percent to its lowest level since February 25, 2011, on a seasonally adjusted basis. The seasonally adjusted Purchase Index increased 6.7 percent to its highest level of the year

...

“Purchase application volume increased last week reaching the highest level of the year, but remains relatively low by historical standards, at levels last seen in 1997,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “The increase last week was due to a sharp increase in applications for government loans. Borrowers were likely motivated to apply before a scheduled increase in FHA insurance premiums that became effective last Friday.” Fratantoni continued, “Rates were flat last week, but refinance activity fell, as the pool of borrowers who have both the incentive and the ability to qualify for a refinance continues to shrink.”

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.93 percent from 4.92 percent, with points decreasing to 0.70 from 0.83 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

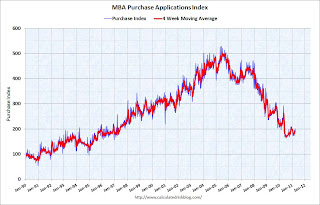

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

As Fratantoni noted, this was the highest level of purchase activity this year - but activity is still at 1997 levels. It appears that the increase in purchase activity was related to the increase in FHA insurance premiums, and activity will probably decline this week.

Tuesday, April 05, 2011

A QE Timeline

by Calculated Risk on 4/05/2011 07:22:00 PM

Note: The Fed mentioned some downside risks today and it is possible there will be a 2nd half slowdown like in 2010:

... downside risks from the banking and fiscal strains in the European periphery, the continuing fiscal adjustments by U.S. state and local governments, and the ongoing weakness in the housing market. Several also noted the possibility of larger-than-anticipated near-term cuts in federal government spending. Moreover, the economic implications of the tragedy in Japan--for example, with respect to global supply chains--were not yet clear. ... Participants judged that the potential for more-widespread disruptions in oil production, and thus for a larger jump in energy prices, posed both downside risks to growth and upside risks to inflation.I'll have some more thoughts on this possibility soon.

Some people point to the end of QE1 as the reason the stock market struggled mid-year 2010. Others point to the economic slowdown and concerns about a double dip recession. Remember this quote from Robert Shiller on July 27, 2010? "For me a double-dip is another recession before we've healed from this recession ... The probability of that kind of double-dip is more than 50 percent. I actually expect it." (via Reuters: Chance of Double-Dip US Recession is High: Shiller)

Here is a look at QE and the S&P 500:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Based on the FOMC minutes today, it is pretty clear that QE2 will end on June 30th with no tapering. Here is a look back at the QE announcements:

• November 25, 2008: $100 Billion GSE direct obligations, $500 billion in MBS

• December 16, 2008 FOMC Statement: Evaluating benefits of purchasing longer-term Treasury Securities

• January 28, 2009: FOMC Statement: FOMC Stands Ready to expand program.

• March 18, 2009: FOMC Statement: Expand MBS program to $1.25 trillion, buy up to $300 billion of longer-term Treasury securities

• March 31, 2010: QE1 purchases were completed at the end of Q1 2010.

• August 27, 2010: Fed Chairman Ben Bernanke hints at QE2: Analysis: Bernanke paves the way for QE2

• November 3, 2010: FOMC Statement: $600 Billion QE2 announced.

• June 30, 2011: QE2 expected to end.

Although I thought we'd avoid a double dip recession last year, I was forecasting a slowdown (here is a post from May 4, 2010: The 2nd Half Slowdown).

Right now I think Q1 2011 was sluggish (based on data so far), and Q2 will probably be a little better. But I'm not confident about the 2nd half of this year (although I'm not forecasting another slowdown yet).

This is NOT investment advice.