by Calculated Risk on 3/25/2011 09:38:00 PM

Friday, March 25, 2011

Liar Loan Prosecution

Joe Nocera at the NY Times has a strange tale: In Prison for Taking a Liar Loan

Mr. Engle’s is a tale worth telling for a number of reasons, not the least of which is its punch line. Was Mr. Engle convicted of running a crooked subprime company? Was he a mortgage broker who trafficked in predatory loans? A Wall Street huckster who sold toxic assets?This sounds more like "fraud for housing" than "fraud for profit" - although from Nocera's description, it doesn't sound much like fraud at all (and the reasons Engle was investigated are bizarre). Read the story ... but it is actually rare for the government to prosecute "fraud for housing" cases. Why this one?

No. Charlie Engle wasn’t a seller of bad mortgages. He was a borrower. And the “mortgage fraud” for which he was prosecuted was something that literally millions of Americans did during the subprime bubble. Supposedly, he lied on two liar loans.

Also this story prompted me to reread Tanta's brilliant piece: Unwinding the Fraud for Bubbles

Bank Failure #26 in 2011: The Bank of Commerce, Wood Dale, Illinois

by Calculated Risk on 3/25/2011 07:07:00 PM

Behavior resulting in

No consequences.

by Soylent Green is People

From the FDIC: Advantage National Bank Group, Elk Grove Village, Illinois, Assumes All of the Deposits of The Bank of Commerce, Wood Dale, Illinois

As of December 31, 2010, The Bank of Commerce had approximately $163.1 million in total assets and $161.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $41.9 million. ... The Bank of Commerce is the 26th FDIC-insured institution to fail in the nation this year, and the third in IllinoisFriday is here.

State Unemployment Rates generally unchanged in February

by Calculated Risk on 3/25/2011 03:14:00 PM

The BLS reported earlier today that state unemployment rates were generally unchanged in February. A few states showed strong increases in employment led by California. The LA Times reported: California adds nearly 100,000 jobs in February

In February, the Golden State added nearly 100,000 new jobs, the highest monthly increase since the current record system began in 1990, state officials said Friday. ... The number of new jobs created in February alone was almost as high as the total created for the previous 11 months, 99,800, the EDD said.Other states with significant increases were Pennsylvania (+23,700), Florida

and Texas (+22,700 each), Illinois (+17,600), North Carolina (+17,400), South Carolina (+16,400), Massachusetts (+15,400), Georgia (+14,900) and Oregon (+9,800). Unfortunately a number of states saw significant declines in employment too; Kansas (-12,800), Missouri (-10,100) and Washington (-8,500).

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in February. Twenty-seven states and the District of Columbia recorded unemployment rate decreases, 7 states registered rate increases, and 16 states had no change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue, the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 13.6 percent in February. The states with the next highest rates were California, 12.2 percent, Florida, 11.5 percent, and Rhode Island,

11.2 percent.

One state, Colorado, set a new series high, 9.3 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

The auto states - led by Michigan - seem to have seen the most improvement (blue area).

Four states are still at the recession maximum (no improvement): Colorado (new high for 2nd month in a row), Idaho, Louisiana, and New Mexico.

Real Gross Domestic Income still below pre-recession peak

by Calculated Risk on 3/25/2011 12:25:00 PM

According to the Bureau of Economic Analysis (BEA), real GDP is now slightly above the pre-recession peak. Real GDP (in 2005 dollars) was at $13,380.7 billion in Q4, just 0.13% above the $13,363.5 billion in Q4 2007.

However real Gross Domestic Income (GDI) is still 0.25% below the pre-recession peak. For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity. An excerpt:

The U.S. produces two conceptually identical official measures of its economic output, currently called Gross Domestic Product (GDP) and Gross Domestic Income (GDI). These two measures have shown markedly different business cycle fluctuations over the past twenty five years, with GDI showing a more-pronounced cycle than GDP. ...Note: The following graph is constructed as a percent of the peak for both GDP/GDI. This shows when GDP/GDI has bottomed - and when GDP/GDI has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

In discussing the information content of these two sets of estimates, the confusion often starts with the nomenclature. GDP can mean either the true output variable of interest, or an estimate of that output variable based on the expenditure approach. Since these are two very different things, using “GDP” for both is confusing. Furthermore, since GDI has a different name than GDP, it may not be initially clear that GDI measures the same concept as GDP, using the equally valid income approach.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph is for real GDP (blue) and real GDI (red) through Q4 2010. This shows real GDP is back to the pre-recession peak. However real Gross Domestic Income (GDI) is still slightly below the pre-recession peak as of Q4 2010. So it now appears that the U.S. economy will reach the pre-recession peak in Q1 2011.

Of course other measures of the economy - especially payroll employment - are still far below the pre-recession peak.

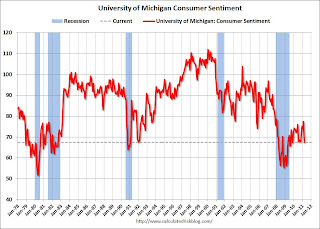

Consumer Sentiment declines in March

by Calculated Risk on 3/25/2011 09:55:00 AM

The final March Reuters / University of Michigan consumer sentiment index declined to 67.5 from the preliminary March reading of 68.2 - and down from 77.5 in February. This is the lowest level since November 2009.

Click on graph for larger image in graphic gallery.

Click on graph for larger image in graphic gallery.

This was below the consensus forecast of 68.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

With higher gasoline prices and the scary world news, a low reading isn't that surprising.