by Calculated Risk on 3/25/2011 12:25:00 PM

Friday, March 25, 2011

Real Gross Domestic Income still below pre-recession peak

According to the Bureau of Economic Analysis (BEA), real GDP is now slightly above the pre-recession peak. Real GDP (in 2005 dollars) was at $13,380.7 billion in Q4, just 0.13% above the $13,363.5 billion in Q4 2007.

However real Gross Domestic Income (GDI) is still 0.25% below the pre-recession peak. For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity. An excerpt:

The U.S. produces two conceptually identical official measures of its economic output, currently called Gross Domestic Product (GDP) and Gross Domestic Income (GDI). These two measures have shown markedly different business cycle fluctuations over the past twenty five years, with GDI showing a more-pronounced cycle than GDP. ...Note: The following graph is constructed as a percent of the peak for both GDP/GDI. This shows when GDP/GDI has bottomed - and when GDP/GDI has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

In discussing the information content of these two sets of estimates, the confusion often starts with the nomenclature. GDP can mean either the true output variable of interest, or an estimate of that output variable based on the expenditure approach. Since these are two very different things, using “GDP” for both is confusing. Furthermore, since GDI has a different name than GDP, it may not be initially clear that GDI measures the same concept as GDP, using the equally valid income approach.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph is for real GDP (blue) and real GDI (red) through Q4 2010. This shows real GDP is back to the pre-recession peak. However real Gross Domestic Income (GDI) is still slightly below the pre-recession peak as of Q4 2010. So it now appears that the U.S. economy will reach the pre-recession peak in Q1 2011.

Of course other measures of the economy - especially payroll employment - are still far below the pre-recession peak.

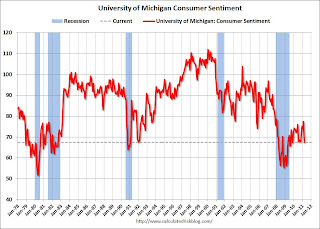

Consumer Sentiment declines in March

by Calculated Risk on 3/25/2011 09:55:00 AM

The final March Reuters / University of Michigan consumer sentiment index declined to 67.5 from the preliminary March reading of 68.2 - and down from 77.5 in February. This is the lowest level since November 2009.

Click on graph for larger image in graphic gallery.

Click on graph for larger image in graphic gallery.

This was below the consensus forecast of 68.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

With higher gasoline prices and the scary world news, a low reading isn't that surprising.

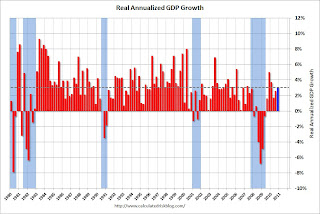

Q4 Real GDP Growth revised up to 3.1%

by Calculated Risk on 3/25/2011 08:52:00 AM

From the BEA: Gross Domestic Product, 4th quarter 2010 (third estimate)

Real GDP growth was revised up to 3.1% in Q4 2010, up from the 2nd estimate of 2.8%. The upward revision came mostly from changes in private inventories; in the 3rd estimate, changes in private inventories subtracted 3.42 percentage points from growth, compared to 3.7 percentage points in the previous estimate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The current quarter is in blue.

The dashed line is the median growth rate of 3.05%. The last quarter was around trend growth - disappointing with all the slack in the economy.

Thursday, March 24, 2011

Hotels: Occupancy Rate improves in Latest Survey

by Calculated Risk on 3/24/2011 10:43:00 PM

Here is the weekly update on hotels from HotelNewsNow.com: STR: U.S. ADR on the rise

“The industry’s performance seems to be strengthening after Valentine's Day and heading into Spring Break season,” said Steve Hood, VP of research at STR. “Last week was the fifth straight week with ADR increases in the 3% range. It was also the first full week since November with a running 28-day revenue per available room percent change in the double digits.”Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

Overall, the U.S. hotel industry’s occupancy increased 5.1% to 64.6% and its RevPAR finished the week up 9.0% to US$66.01.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate.

The 2011 occupancy rate (red) was fairly low in January and February, but appears to be improving recently - and is now closer to the rate in 2008 than in 2010.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

S&P Cuts Sovereign Credit Rating of Portugal

by Calculated Risk on 3/24/2011 07:45:00 PM

From S&P via Reuters:

Standard & Poor's Ratings Services lowered its long-term sovereign credit rating on the Republic of Portugal today to 'BBB' from 'A-' (the 'A-2' short-term sovereign credit rating is unchanged). The long- and short-term ratings on Portugal remain on CreditWatch with negative implications. We believe that this rating action could have a negative impact on the creditworthiness of the five Portuguese banks, and two related subsidiaries, that we rate ...No surprise ... a bailout seems imminent.

Also from the WSJ: Portugal's Woes Turn Spotlight on Spain

Portugal's admission that it will probably need a financial bailout raises a question that will shape the outcome of the euro zone's debt crisis: Is Spain next?I suppose there are two key questions: 1) Is Spain next? and 2) will Ireland, Greece, or Portugal default (and what would be the impact of a default)?

The cost of saving Spain, a €1.1 trillion ($1.56 trillion) economy, would dwarf previous bailouts and could test the financial strength of Europe as a whole.

But if Spain can continue to repair investors' trust, as in recent weeks, then Europe stands a chance of containing the debt crisis to three countries ... whose combined economies are half the size of Spain's.