by Calculated Risk on 3/23/2011 07:27:00 PM

Wednesday, March 23, 2011

Misc: Portugal, Participation Rate, Japan and More

• The CBO has a new report Labor Force Projections Through 2021 (ht Catherine Rampell at Economix). The CBO's estimates are similar to mine (here and here). See Table 1 (on page 3) for their projections of the participation rate over the next decade.

The key is that a large portion of the recent decline in the participation rate is due to demographics, and we shouldn't expect the participation rate to rise back to the pre-recession levels.

• From the BBC: Portugal PM Jose Socrates resigns after budget rejected. This was expected, and it appears Portugal will be next in line for a bailout. The EU leaders meeting starts tomorrow - great timing!

Also, Ireland is expected to complete the next round of bank stress tests by the end of March - and if these show the need for additional capital (expected), then that will put the new Irish government in a difficult situation.

• From the NY Times: New Problems Arise at Japanese Nuclear Plant

The Japanese electricians who bravely strung wires this week to all six reactor buildings at a stricken nuclear power plant succeeded despite waves of heat and blasts of radioactive steam.Progress, but still scary.

... [However] nuclear engineers say some of the most difficult and dangerous tasks are still ahead — and time is not necessarily on the side of the repair teams.

• And the impact on the supply chain continues, from the Detroit Free Press: Toyota and Honda extend auto shutdowns

Toyota ... said in a statement Tuesday that its shutdown of 11 factories would be extended until Saturday because of difficulty securing components, including rubber parts and electronics.Earlier housing posts: Existing Home sales for February:

The shutdown had previously been announced through Tuesday. The automaker has lost production of about 140,000 vehicles since March 14.

...

Honda said its production halt would continue through Sunday

• February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

• Existing Home Inventory decreases 1.2% Year over Year

• Existing Home Sales and Inventory Graphs

New home sales for February:

• New Home Sales Fall to Record Low in February

• Home Sales: Distressing Gap

• New Home Sales and Inventory Graphs

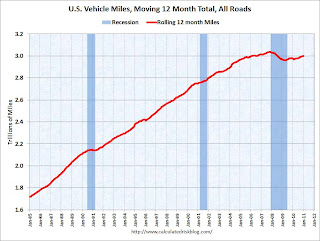

DOT: Vehicle Miles Driven increased slightly in January

by Calculated Risk on 3/23/2011 04:06:00 PM

The Department of Transportation (DOT) reported that vehicle miles driven in January were up 0.2% compared to January 2010:

Travel on all roads and streets changed by +0.2% (0.5 billion vehicle miles) for January 2011 as compared with January 2010. Travel for the month is estimated to be 223.5 billion vehicle miles.Miles driven is barely up from last year, although the northeast was the weakest region in January, and driving in the northeast was probably impacted by the weather.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

• Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 38 months - another record that will be broken in March!

• In January U.S. oil prices averaged $90 per barrel, and we might see $100 oil lead to a decrease in driving in March or April.

Home Sales: Distressing Gap

by Calculated Risk on 3/23/2011 12:49:00 PM

Another update ... this graph shows existing home sales (left axis) and new home sales (right axis) through February. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The gap is due mostly to the flood of distressed sales. This has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

Note: it is important to note that existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

In a few years - when the excess housing inventory is absorbed and the number of distressed sales has declined significantly - I expect existing home-to-new home sales to return to something close to this historical relationship.

Note: The National Association of Realtors (NAR) is working on a benchmark revision for existing home sales numbers. As I noted in January, this benchmarking is expected to result in significant downward revisions to sales estimates for the last few years - perhaps as much as 10% to 15% for 2009 and 2010. Even with these revisions, most of the following "distressing gap" will remain.

Existing Home sales for February:

• February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

• Existing Home Inventory decreases 1.2% Year over Year

• Existing Home Sales and Inventory Graphs

New home sales for February:

• New Home Sales Fall to Record Low in February

• New Home Sales and Inventory Graphs

New Home Sales Fall to Record Low in February

by Calculated Risk on 3/23/2011 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 250 thousand. This was down from a revised 301 thousand in January.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in February 2011 were at a seasonally adjusted annual rate of 250,000 ... This is 16 9 percent 16.9 (±19.1%)* below the revised January rate of 301,000 and is 28.0 percent (±14.8%) below the February 2010 estimate of 347,000.And a long term graph for New Home Months of Supply:

Months of supply increased to 8.9 in February from 7.4 months in January. The all time record was 12.1 months of supply in January 2009. This is very high (less than 6 months supply is normal).

Months of supply increased to 8.9 in February from 7.4 months in January. The all time record was 12.1 months of supply in January 2009. This is very high (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of February was 186,000. This represents a supply of 8.9 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale fell to 76,000 units in February. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In February 2010 (red column), 19 thousand new homes were sold (NSA). This is a new record low for the month of February.

The previous record low for February was 27 thousand in 2010. The high was 109 thousand in 2005.

This was a new record low sales rate and well below the consensus forecast of 290 thousand homes sold (SAAR). Another very weak report ...

MBA: Mortgage Purchase Application activity increases slightly

by Calculated Risk on 3/23/2011 07:43:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 2.7 percent from the previous week. The seasonally adjusted Purchase Index increased 2.7 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.80 percent from 4.79 percent, with points decreasing to 0.96 from 1.07 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is still at 1997 levels, and even with the large percentage of cash buyers recently, this still suggests fairly weak home sales through April. Note: Refinance activity has picked up a little with lower mortgage rates.