by Calculated Risk on 3/21/2011 11:14:00 PM

Monday, March 21, 2011

Here comes $4 Gasoline

From Eric Wolff at the North County Times: Analysts see gas headed back to $4 a gallon

The average gas price may reach $4 a gallon by Thursday in San Diego County, and Riverside-San Bernardino counties won't be far behind, gasoline analysts said.California has higher gasoline prices than most of the U.S. - and San Diego is usually near the top in California - but prices are moving higher for everyone (although still below $4 per gallon for most).

The average price Monday for a gallon of regular unleaded was $3.955 in Riverside and San Bernardino counties and $3.977 in San Diego County, according to AAA. Both prices exceeded the price of gas at this point in 2008, when gas prices peaked in June at $4.63.

Last week, Jim Hamilton had a post on consumer sentiment and gasoline prices, including a graph on prices across the country. Note: The final March Reuter's/University of Michigan's Consumer sentiment index will be released on Friday.

Earlier:

• February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

• Existing Home Inventory decreases 1.2% Year over Year

• Existing Home Sales and Inventory Graphs

Two Stories: Treasury to Begin Selling MBS Portfolio, Federal Reserve to Release Discount Window Borrowing

by Calculated Risk on 3/21/2011 06:08:00 PM

A couple of stories ...

• From Treasury: Treasury to Begin Orderly Wind Down of Its $142 Billion Mortgage-Backed Securities Portfolio

Today, the U.S. Department of the Treasury announced that it will begin the orderly wind down of its remaining portfolio of $142 billion in agency-guaranteed mortgage-backed securities (MBS). Starting this month, Treasury plans to sell up to $10 billion in agency-guaranteed MBS per month, subject to market conditions.I don't think this will have much impact on mortgage rates.

“We’re continuing to wind down the emergency programs that were put in place in 2008 and 2009 to help restore market stability, and the sale of these securities is consistent with that effort,” said Mary J. Miller, Assistant Secretary for Financial Markets.

• From Bloomberg: Fed Must Release Data on Emergency Bank Loans as High Court Rejects Appeal

The Federal Reserve will disclose details of emergency loans it made to banks in 2008, after the U.S. Supreme Court rejected an industry appeal that aimed to shield the records from public view.There was probably heavy borrowing by - shock - Citi, BofA and most other big banks. This ruling is for discount window lending, and the Dodd-Frank bill required the Fed to disclose this information with a two year lag - so I'm not sure why the Fed objected. The Fed has already released data on the emergency Credit and Liquidity Facilities. There were no surprises. I support transparency, but I doubt there will be any surprises with the discount window data either.

The justices today left intact a court order that gives the Fed five days to release the records, sought by Bloomberg News’s parent company, Bloomberg LP

Census 2010 Housing Occupancy and Vacancy Data

by Calculated Risk on 3/21/2011 02:50:00 PM

Earlier:

• February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

• Existing Home Inventory decreases 1.2% Year over Year

• Existing Home Sales and Inventory Graphs

The Census Bureau has released data for 42 states so far. These states account for about 83% of the U.S. housing stock based on the 2000 and 1990 Census data. Here is a table of the data released so far - total housing units, Occupied and Vacant - for each state, plus the vacancy rate for 2010, 2000 and 1990. The data is sortable by column.

Here is a spreadsheet of the 2010, 2000 and 1990 for those who want to look at the data.

Once all of the data is released, I'll post some more analysis. This data is useful in estimating the number of excess vacant units, the absorption rate by state, demolitions and more.

The following table shows the increase in percentage points in the vacancy rate by state. This table compares to the 2000 Census and also an average of the 1990 and 2000 Census. (sorted by highest percentage point increase from 2000). The data for the remaining 8 states and D.C. will be released by April 1st.

The "excess units" uses the change in vacancy rate times the total number of housing units.

Some states like Vermont always have a high vacancy rate because of the number of summer homes (the Census is an estimate as of April 1, 2010), so it is important to compare to previous Census vacancy rates.

We can also calculate an absorption rate (not included) by using the increase in occupied units between 2000 and 2010 - as an example, even though Nevada saw the largest increase in vacancy rate, it is a faster growing state than say Ohio - so the excess housing units may be absorbed quicker (of course Nevada also has the highest percentage of borrowers with negative equity - another problem!)

| Change from: | 2000 Census | Average 2000 and 1990 | ||

|---|---|---|---|---|

| Change Vacancy Rate in Percentage Points | Excess Units | Change in Percentage Points | Excess Units | |

| Nevada | 5.1% | 59,338 | 4.6% | 53,996 |

| Florida | 4.2% | 380,887 | 2.9% | 263,512 |

| Georgia | 3.9% | 160,129 | 3.0% | 121,064 |

| Ohio | 3.2% | 162,506 | 3.4% | 176,515 |

| Arizona | 3.1% | 89,502 | 1.0% | 27,463 |

| Wisconsin | 2.9% | 77,083 | 2.4% | 61,696 |

| Tennessee | 2.9% | 80,489 | 2.8% | 79,932 |

| Minnesota | 2.8% | 65,900 | 1.5% | 35,579 |

| Indiana | 2.8% | 76,999 | 2.6% | 72,745 |

| Delaware | 2.7% | 11,135 | 1.9% | 7,666 |

| Illinois | 2.7% | 141,182 | 2.3% | 121,780 |

| Colorado | 2.6% | 56,688 | 0.1% | 2,420 |

| Mississippi | 2.5% | 32,221 | 2.6% | 33,107 |

| North Carolina | 2.3% | 101,068 | 2.6% | 110,489 |

| Missouri | 2.3% | 62,267 | 2.0% | 52,948 |

| Vermont | 2.2% | 7,208 | 0.2% | 640 |

| California | 2.2% | 305,515 | 1.6% | 213,702 |

| Idaho | 2.2% | 14,781 | 1.4% | 9,089 |

| New Jersey | 2.1% | 75,520 | 1.3% | 45,243 |

| Virginia | 2.1% | 71,336 | 1.6% | 52,278 |

| Montana | 2.1% | 10,072 | 1.0% | 4,886 |

| Washington | 1.9% | 54,065 | 1.6% | 46,283 |

| Iowa | 1.8% | 24,589 | 1.7% | 23,357 |

| Connecticut | 1.8% | 26,300 | 1.4% | 20,652 |

| Arkansas | 1.7% | 22,950 | 1.8% | 24,071 |

| Alabama | 1.7% | 37,409 | 2.6% | 56,385 |

| Louisiana | 1.7% | 33,304 | 0.5% | 10,753 |

| Maryland | 1.7% | 40,080 | 1.7% | 41,387 |

| Nebraska | 1.7% | 13,385 | 1.2% | 9,391 |

| Utah | 1.7% | 16,215 | 0.9% | 9,086 |

| Kentucky | 1.6% | 30,786 | 2.0% | 37,740 |

| Kansas | 1.6% | 19,395 | 0.9% | 11,564 |

| Texas | 1.2% | 119,793 | -0.8% | -80,526 |

| Oregon | 1.2% | 19,385 | 1.5% | 24,654 |

| South Dakota | 1.1% | 4,090 | 0.5% | 1,867 |

| Oklahoma | 0.9% | 14,776 | -0.6% | -9,198 |

| Pennsylvania | 0.8% | 47,067 | 0.9% | 48,483 |

| Alaska | 0.8% | 2,592 | -1.0% | -3,080 |

| North Dakota | 0.2% | 657 | -0.6% | -1,890 |

| Hawaii | -0.1% | -469 | 1.8% | 9,499 |

| Wyoming | -0.2% | -393 | -1.9% | -4,956 |

| New Mexico | -0.9% | -8,495 | -1.4% | -12,962 |

| District of Columbia | NA | NA | NA | NA |

| Maine | NA | NA | NA | NA |

| Massachusetts | NA | NA | NA | NA |

| Michigan | NA | NA | NA | NA |

| New Hampshire | NA | NA | NA | NA |

| New York | NA | NA | NA | NA |

| Rhode Island | NA | NA | NA | NA |

| South Carolina | NA | NA | NA | NA |

| West Virginia | NA | NA | NA | NA |

Existing Home Inventory decreases 1.2% Year over Year

by Calculated Risk on 3/21/2011 11:30:00 AM

Earlier the NAR released the existing home sales data for February; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Although inventory increased from January to February (as usual), inventory decreased 1.2% YoY in February. This is a small YoY decrease and follows six consecutive month of year-over-year increases in inventory.

Inventory should increase over the next few months (the normal seasonal pattern), and the YoY change is something to watch closely this year. Inventory is already very high, and further YoY increases in inventory would put more downward pressure on house prices.

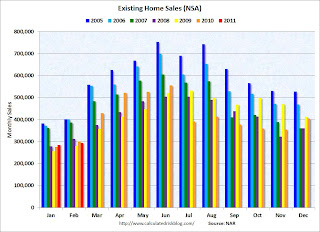

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns in January and February are for 2011.

Sales NSA were about the same level as the last three years. February is usually the second weakest month of the year for existing home sales (close to January). The real key is what happens in the spring and summer - and March sales and inventory will give a clearer picture of existing home sales activity.

The bottom line: Sales decreased in February (using the old method to estimate sales), possibly due to a decrease in investor purchases of distressed properties at the low end and possibly some weather factors. The NAR noted "Investors accounted for 19 percent of sales activity in February, down from 23 percent in January; they were 19 percent in February 2010."

The NAR also mentioned: "Distressed homes – sold at discount – accounted for a 39 percent market share in February, up from 37 percent in January and 35 percent in February 2010." A higher percentage of distressed sales probably means lower prices - and we should expect the repeat sales indexes to show further price declines in February.

Note: The Case-Shiller prices index will be released next Tuesday (March 29th), and will be for January (average of three months) - and the NAR report suggests further price declines in February.

March is the beginning of the selling season for existing homes, so the next report will be much more important.

February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

by Calculated Risk on 3/21/2011 10:00:00 AM

The NAR reports: February Existing-Home Sales Decline

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, dropped 9.6 percent to a seasonally adjusted annual rate of 4.88 million in February from an upwardly revised 5.40 million in January, and are 2.8 percent below the 5.02 million pace in February 2010.

...

Total housing inventory at the end of February rose 3.5 percent to 3.49 million existing homes available for sale, which represents an 8.6-month supply at the current sales pace, up from a 7.5-month supply in January.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February 2011 (4.88 million SAAR) were 9.6% lower than last month, and were 2.8% lower than February 2010.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.49 million in February from 3.37 million in January.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall and winter. Inventory will probably increase significantly over the next several months.

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply increased to 8.6 months in February up from 7.5 months in January. The months of supply will probably increase over the next few months as inventory increases. This is higher than normal.

Special Note: Back in January, I noted that it appeared the NAR had overestimated sales by 5% or so in 2007, and that the errors had increased since then (perhaps 10% or 15% or more in 2009 and 2010). I reported in January that the NAR was working on benchmarking existing home sales for earlier years with other industry data, and I expected "this effort will lead to significant downward revisions to previously reported sales". The numbers reported today were estimated using the old method and will probably be revised down significantly, but they are still useful on a month-to-month basis.

These sales numbers were below the consensus of 5.15 million SAAR, and are slightly below what I expected (Lawler's forecast was 5 million). I'll have more soon.