by Calculated Risk on 3/18/2011 08:54:00 AM

Friday, March 18, 2011

Japan Nuclear Update and Libya Ceasefire

• Libya

From CNBC: Libyan Foreign Minister Declares Immediate Ceasefire

Libya declared a ceasefire in the country to protect civilians and comply with a United Nations resolution passed overnight, Libyan Foreign Minister Moussa Koussa said on Friday.From NY Times: Following U.N. Vote, France Vows Libya Action ‘Soon’

"We decided on an immediate ceasefire and on an immediate stop to all military operations," he told reporters.

• Japan

From Reuters: Japan earthquake LIVE (an excellent site to follow events)

From NY Times: Frantic Repairs Go On at Plant as Japan Raises Severity of Crisis

From the WSJ: U.S. Drone Surveying Japan's Damaged Nuclear Complex

Thursday, March 17, 2011

Hotels: RevPAR up 9.2% compared to same week in 2010

by Calculated Risk on 3/17/2011 08:25:00 PM

I'm still mostly focused on the U.S. economy, although I'm also following the events in Japan and the situation in Libya. And Reuters reported: "Japan has agreed with central banks of the US, Britain and Canada as well as the European Central Bank to jointly intervene in the currency market"

Earlier on U.S. Economy:

• Weekly Initial Unemployment Claims decline to 385,000

• Industrial Production, Capacity Utilization decline in February

• Core Measures show increase in Inflation

• Philly Fed Survey highest since January 1984

Here is the weekly update on hotels from HotelNewsNow.com: STR: Luxury hotels top weekly increases

Overall, the U.S. industry’s occupancy increased 6.0% to 61.1%, ADR was up 3.1% to US$100.93, and RevPAR finished the week up 9.2% to US$61.69.Note: RevPAR: Revenue per Available Room.

Click on graph for larger image in graph gallery.

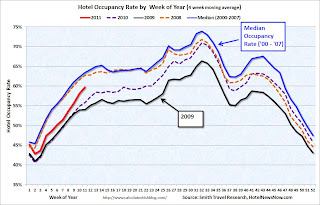

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate.

The occupancy rate was fairly low in January and February, but appears to be improving recently - and is now closer to the rate in 2008 than in 2010.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Libya Update: U.N. Approves "No Fly Zone", Strikes expected soon

by Calculated Risk on 3/17/2011 06:43:00 PM

From the NY Times: U.N. Approves Military Action in Libya to Halt Qaddafi Attacks

The United Nations Security Council approved a measure on Thursday authorizing “all necessary measures” to protect Libyan civilians from harm at the hands of forces loyal to Colonel Muammar el-Qaddafi.

The measure allows not only a no-fly zone but effectively any measures short of a ground invasion to halt attacks that might result in civilian fatalities.

Japan Nuclear Update

by Calculated Risk on 3/17/2011 03:40:00 PM

By request ...

White House: President Obama on Japan 3:30 PM ET

From Reuters: Japan earthquake LIVE (an excellent site to follow events)

From Reuters: Japan nuclear situation reasonably stable: IAEA

The situation at Japan's Fukushima Daiichi nuclear power plant was serious but "reasonably stable" Thursday with no major worsening since the day before, a senior U.N. nuclear watchdog official said.From the IAEA:

"It hasn't got worse, which is positive," Graham Andrew of the International Atomic Energy Agency (IAEA) said. "The situation remains very serious but there has been no significant worsening since yesterday."

But Andrew, a senior aide to IAEA Director General Yukiya Amano, cautioned at a news conference: "It is still possible that it could get worse."

Japanese authorities have informed the IAEA that engineers were able to lay an external grid power line cable to unit 2. The operation was completed at 08:30 UTC.From the WSJ: Japan Claims Modest Gains in Bid to Cool Nuclear Plant

They plan to reconnect power to unit 2 once the spraying of water on the unit 3 reactor building is completed.

From the NY Times: Danger of Spent Fuel Outweighs Reactor Threat

From Chicago Breaking Business: Radiation on O’Hare flights deemed no threat

NHK World English TV stream

Earlier on U.S. Economy:

• Weekly Initial Unemployment Claims decline to 385,000

• Industrial Production, Capacity Utilization decline in February

• Philly Fed Survey highest since January 1984

Best wishes to all.

Core Measures show increase in Inflation

by Calculated Risk on 3/17/2011 01:19:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in February on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.1 percent before seasonal adjustment.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

...

The index for all items less food and energy rose 0.2 percent in February, the same increase as in January, with most of its major components posting increases. The shelter index rose 0.1 percent in February, with rent and owners' equivalent rent both also rising 0.1 percent.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.4% annualized rate) in February. The 16% trimmed-mean Consumer Price Index increased 0.3% (3.8% annualized rate) during the month.Over the last 12 months, core CPI has increased 1.1%, median CPI has increased 1.0%, and trimmed-mean CPI increased 2.1%.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing lately.

Also, all three increased in February at a higher annualized rate: core CPI increased at an annualized rate of 2.4%, median CPI 2.4% annualized, and trimmed-mean CPI increased 3.8% annualized. This is the second consecutive month with the annualized rate for these three key measures at or above the Fed's inflation target. With the slack in the system, I have been expecting these core measures to stay below 2% this year.

Note: You can see the median CPI details for February here.