by Calculated Risk on 3/15/2011 04:09:00 PM

Tuesday, March 15, 2011

February LA Port Traffic: Exports weak year-over-year

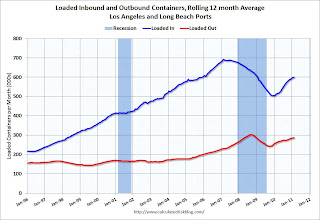

The first graph shows the rolling 12 month average of loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for February. LA area ports handle about 40% of the nation's container port traffic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

To remove the strong seasonal component for inbound traffic, this graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic is up 17% and outbound up 9%.

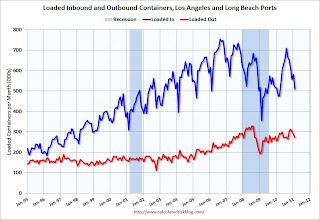

The 2nd graph is the monthly data (with strong seasonal pattern).

The 2nd graph is the monthly data (with strong seasonal pattern).

For the month of February, loaded inbound traffic was up 7% compared to February 2010, and loaded outbound traffic was up less than 1% compared to February 2010 - and down compared to January 2011. This suggests the trade deficit with China (and other Asians countries) probably increased in February.

Earlier:

• Empire State Manufacturing Survey indicates faster growth in March

• NAHB Builder Confidence increases slightly in March, Still depressed

• Residential Remodeling Index shows strong increase year-over-year

FOMC Statement: No Change, "Economic recovery is on a firmer footing"

by Calculated Risk on 3/15/2011 02:15:00 PM

• The target range for the federal funds rate remains at 0 to 1/4 percent

• The policy of reinvestment of principal payments remains

• no change to the plan to purchase an additional $600 billion of longer-term Treasury securities by the end of June 2011.

• the key sentence "likely to warrant exceptionally low levels for the federal funds rate for an extended period" remains

From the Federal Reserve:

Information received since the Federal Open Market Committee met in January suggests that the economic recovery is on a firmer footing, and overall conditions in the labor market appear to be improving gradually. Household spending and business investment in equipment and software continue to expand. However, investment in nonresidential structures is still weak, and the housing sector continues to be depressed. Commodity prices have risen significantly since the summer, and concerns about global supplies of crude oil have contributed to a sharp run-up in oil prices in recent weeks. Nonetheless, longer-term inflation expectations have remained stable, and measures of underlying inflation have been subdued.Inflation "subdued" instead of "trending downward".

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Currently, the unemployment rate remains elevated, and measures of underlying inflation continue to be somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. The recent increases in the prices of energy and other commodities are currently putting upward pressure on inflation. The Committee expects these effects to be transitory, but it will pay close attention to the evolution of inflation and inflation expectations. The Committee continues to anticipate a gradual return to higher levels of resource utilization in a context of price stability.

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to continue expanding its holdings of securities as announced in November. In particular, the Committee is maintaining its existing policy of reinvesting principal payments from its securities holdings and intends to purchase $600 billion of longer-term Treasury securities by the end of the second quarter of 2011. The Committee will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to support the economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Richard W. Fisher; Narayana Kocherlakota; Charles I. Plosser; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen.

Residential Remodeling Index shows strong increase year-over-year

by Calculated Risk on 3/15/2011 12:11:00 PM

The BuildFax Residential Remodeling Index was at 99.0 in January. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax:

The Residential BuildFax Remodeling Index rose 22% year-over-year—and for the fifteenth straight month—in January to 99.0, the highest January number in the history of the index, which starts in 2004.

...

All regions posted year-over-year gains, although the Northeast continues to lag behind the other regions.

...

According to Joe Masters Emison, vice president of research and development at BuildFax, "As of today, the BuildFax Remodeling Index gives clear indication that every region and the nation as a whole is seeing increased remodeling activity from the low point of the recent recession. The Midwest, West, and the nation as a whole have recovered to pre-recession levels or better, while the South and Northeast are still recovering."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Although down month-to-month (off 5% from December) this is the highest level for a January since BuildFax started tracking permit data.

Note: permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 22% from January 2010.

Although new home construction is still moving sideways, it appears that two other components of residential investment are increasing in 2011: multi-family construction and home improvement (based on this index).

Data Source: BuildFax, Courtesy of Index.BuildFax.com

NAHB Builder Confidence increases slightly in March, Still depressed

by Calculated Risk on 3/15/2011 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased slightly to 17 in March. This was at expectations of an increase to 17. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the March release for the HMI and the January data for starts (February housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for over two years.

Press release from the NAHB: Builder Confidence Edges Up One Point in March

After four consecutive months hovering at the same low level, builder confidence in the market for newly built, single-family homes improved by a single point in March, rising to 17 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This is the highest level the HMI has reached since May 2010, when the survey period corresponded with the final days of the federal home buyer tax credit program.Builders are still depressed, and the HMI has been below 25 for forty-five consecutive months - almost 4 years.

...

"While many home buyers are still holding off on making a purchase, builders did indicate slightly increased optimism about the future with a two-point gain in the HMI component gauging sales expectations for the next six months," added NAHB Chief Economist David Crowe. "In fact, prevailing indicators portend some improvement in the overall economy, which should generate modest housing market gains later this year."

...

Two out of three of the HMI's component indexes held unchanged in March, including the component gauging current sales conditions (holding at 17) and the component gauging traffic of prospective buyers (holding at 12). Meanwhile, the component gauging sales expectations in the next six months rose two points in March to 27, its highest level since May 2010.

Empire State Manufacturing Survey indicates faster growth in March

by Calculated Risk on 3/15/2011 08:30:00 AM

from the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to improve in March. The general business conditions index inched up 2 points, to 17.5. The new orders and shipments indexes fell but remained above zero, while the unfilled orders index rose above zero for the first time in a year. Price indexes continued to climb, suggesting that price increases had accelerated.This was slightly above expectations for an increase to 16.0.

...

In addition, employment indexes also gained in March, suggesting an expansion in employment levels and in hours worked. The index for number of

employees rose 5 points to 9.1, and the average workweek index rose 10 points to 15.6.

Note: On Japan, from the WSJ: Japan Makes Progress at Troubled Nuclear Plant

Japanese officials appeared to have regained some control of northeast Japan's troubled nuclear power plant Tuesday afternoon ...

While radiation levels at the plant remain elevated, they have dropped significantly from earlier in the day, ruling out the continuation of unstoppable large-scale leaks.

Radiation levels in downtown Tokyo—which had also risen earlier Tuesday, though they remained well below levels that could damage human health—also fell sharply later in the day.