by Calculated Risk on 10/12/2010 02:00:00 PM

Tuesday, October 12, 2010

FOMC September Meeting Minutes: "focused on further purchases of longer-term Treasury securities"

From the Fed: Minutes of the Federal Open Market Committee

Staff Economic Outlook

In the economic forecast prepared for the September FOMC meeting, the staff lowered its projection for the increase in real economic activity over the second half of 2010. The staff also reduced slightly its forecast of growth next year but continued to anticipate a moderate strengthening of the expansion in 2011 as well as a further pickup in economic growth in 2012. The softer tone of incoming economic data suggested that the underlying level of demand was weaker than projected at the time of the August meeting. Moreover, the outlook for foreign economic activity also appeared a bit weaker. In the medium term, the recovery in economic activity was expected to receive support from accommodative monetary policy, further improvements in financial conditions, and greater household and business confidence. Over the forecast period, the increase in real GDP was projected to be sufficient to slowly reduce economic slack, although resource slack was anticipated to still remain elevated at the end of 2012.

Monetary policy:

Participants discussed the medium-term outlook for monetary policy and issues related to monetary policy implementation. Many participants noted that if economic growth remained too slow to make satisfactory progress toward reducing the unemployment rate or if inflation continued to come in below levels consistent with the FOMC's dual mandate, it would be appropriate to provide additional monetary policy accommodation. However, others thought that additional accommodation would be warranted only if the outlook worsened and the odds of deflation increased materially. Meeting participants discussed several possible approaches to providing additional accommodation but focused primarily on further purchases of longer-term Treasury securities and on possible steps to affect inflation expectations. Participants reviewed the likely benefits and costs associated with a program of purchasing additional longer-term assets--with some noting that the economic benefits could be small in current circumstances--as well as the best means to calibrate and implement such purchases. A number of participants commented on the important role of inflation expectations for monetary policy: With short-term nominal interest rates constrained by the zero bound, a decline in short-term inflation expectations increases short-term real interest rates (that is, the difference between nominal interest rates and expected inflation), thereby damping aggregate demand. Conversely, in such circumstances, an increase in inflation expectations lowers short-term real interest rates, stimulating the economy. Participants noted a number of possible strategies for affecting short-term inflation expectations, including providing more detailed information about the rates of inflation the Committee considered consistent with its dual mandate, targeting a path for the price level rather than the rate of inflation, and targeting a path for the level of nominal GDP. As a general matter, participants felt that any needed policy accommodation would be most effective if enacted within a framework that was clearly communicated to the public. The minutes of FOMC meetings were seen as an important channel for communicating participants' views about monetary policy.That last sentence indicates that the FOMC views the minutes as an important communication tool - and the earlier sentences strongly suggest QE2 will arrive on Nov 3rd and will consist of purchases of longer-term Treasury securities.

This isn't anything new - but it is quite clear. And this was before the recent weak employment report.

Graphs: Small Business Optimism, Hiring and "Biggest Problem"

by Calculated Risk on 10/12/2010 11:02:00 AM

By request, here are a few graphs based on the NFIB press release: Small Business Optimism Index Remains at Recessionary Level

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the small business optimism index since 1986. Although the index increased slightly in September, it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg who said: "The downturn may be officially over, but small business owners have for the most part seen no evidence of it."

The second graph shows the net hiring plans over the next three months.

The second graph shows the net hiring plans over the next three months.

Hiring plans have turned negative again. According to NFIB: "Over the next three months, eight percent plan to increase employment (unchanged), and 16 percent plan to reduce their workforce (up three points), yielding a seasonally adjusted net negative three percent of owners planning to create new jobs, down four points from August."

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.

Usually small business owners complain about taxes and regulations (that usually means business is good!), but now their self reported biggest problem is lack of demand.

NFIB: Small Businesses slightly less pessimistic, Hiring plans weaken

by Calculated Risk on 10/12/2010 08:03:00 AM

From NFIB: Small Business Confidence inches up

The Index of Small Business Optimism gained 0.2 points in September, rising to 89.0. The increase is certainly not a significant move, but at least it did not fall. Still, the Index remains in recession territory. The downturn may be officially over, but small business owners have for the most part seen no evidence of it.On employment:

Eleven (11) percent (seasonally adjusted) reported unfilled job openings, unchanged from August and historically very weak. Over the next three months, eight percent plan to increase employment (unchanged), and 16 percent plan to reduce their workforce (up three points), yielding a seasonally adjusted net negative three percent of owners planning to create new jobs, down four points from August, The decline in hiring plans is an unexpected reversal in job creation prospects. Hiring plans continue to underperform the recoveries following previous recessions.On capital spending:

The environment for capital spending is not good. ... A net negative three percent expect business conditions to improve over the next six months, a five point improvement from August, but still more owners expect the economy to weaken than strengthen.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

And the key problem: Poor sales.

Monday, October 11, 2010

Duy: The Final End of Bretton Woods 2?

by Calculated Risk on 10/11/2010 09:25:00 PM

Tim Duy is deeply concerned: The Final End of Bretton Woods 2?

The inability of global leaders to address global current account imbalances now truly threatens global financial stability. Perhaps this was inevitable - the dollar has not depreciated to a degree commensurate with the financial crisis. Moreover, as the global economy stabilized the old imbalances made a comeback, sucking stimulus from the US economy and leaving US labor markets crippled. The latter prompts the US Federal Reserve to initiate a policy stance that will undoubtedly resonate throughout the globe. As a result we could now be standing witness to the final end of Bretton Woods 2. And a bloody end it may be.There is much more in the piece.

...

Put simply, the Federal Reserve is positioned to declare war on Bretton Woods 2. November 3, 2010. Mark it on your calendars.

...

Consider the enormity of the situation at hand. The Federal Reserve is poised to crank up the printing press for the sake of satisfying their domestic mandate. One mechanism, perhaps the only mechanism, by which we can expect meaningful, sustained reversal from the current set of imbalances is via a significant depreciation of the dollar. The rest of the world appears prepared to fight the Fed because they know no other path.

...

Bottom Line: The time may finally be at hand when the imbalances created by Bretton Woods 2 now tear the system asunder. The collapse is coming via an unexpected channel; rather than originating from abroad, the shock that sets it in motion comes from the inside, a blast of stimulus from the US Federal Reserve. And at the moment, the collapse looks likely to turn disorderly quickly. If the Federal Reserve is committed to quantitative easing, there is no way for the rest of the world to stop to flow of dollars that is already emanating from the US. Yet much of the world does not want to accept the inevitable, and there appears to be no agreement on what comes next. Call me pessimistic, but right now I don't see how this situation gets anything but more ugly

Back in 2005, I discussed Bretton Woods 2 with Brad Setser (Duy excerpts from one of Brad's pieces). I suggested that the housing bubble would collapse, reducing the U.S. demand for overseas goods and that would bring an end to Bretton Woods 2 - and that led me to predict that the trade deficit would decline in 2007 (a very lonely position!). However I didn't expect the imbalances to return so quickly, and that is very concerning. And I hope Tim Duy is wrong about how it ends.

Rail Intermodal Traffic at 2008 levels, Carload Traffic Lags

by Calculated Risk on 10/11/2010 06:06:00 PM

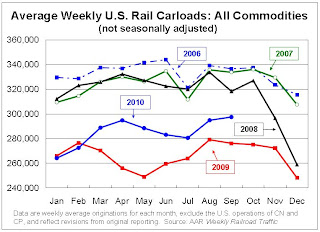

From the Association of American Railroads: Rail Time Indicators. The AAR reports carload traffic in September 2010 was up 7.7% compared to September 2009 - and carload traffic was 7.5% lower than in September 2008. Intermodal traffic (using intermodal or shipping containers) is up up 17.3% over September 2009 and up 0.2% over September 2008.

This graph shows U.S. average weekly rail carloads (NSA). Traffic increased in 16 of 19 major commodity categories year-over-year.

From AAR:

• U.S. freight railroads originated 1,487,511 carloads in September 2010, an average of 297,502 carloads per week. That’s up 7.7% from September 2009 and down 7.5% from September 2008 on a non-seasonally adjusted basis. It’s also the highest weekly average for any month since October 2008.As the graph above shows, rail carload traffic collapsed in November 2008, and now, a year into the recovery, carload traffic has only recovered half way. However ...

• Average unadjusted weekly carloads are typically lower in September than in August because of the Labor Day holiday. This year, though, September’s weekly unadjusted average (297,502) was higher than August’s (294,862). Why? The week with Labor Day was, as usual, one of the lowest-volume weeks of the year, but the other four weeks in September 2010 were all among the six highest-volume weeks of the year. The top two weeks so far in 2010 were in September.

• That explains why seasonally adjusted U.S. rail carloads were up 1.9% in September 2010 over August 2010, reaching their highest level since November 2008.

• U.S. railroads originated 1,165,288 intermodal trailers and containers in September 2010, an average of 233,058 per week on an unadjusted basis. That’s down slightly from August 2010, but that’s just due to Labor Day. The four non-Labor Day weeks in September were four of the top five intermodal weeks so far in 2010. September 2010 intermodal traffic was up 17.3% over September 2009 and up 0.2% over September 2008.The increase in intermodal traffic, along with the increase in West Coast port import traffic, are two of the indicators that suggest retailers might have over-ordered for the holidays. Stephanie Clifford and Catherine Rampell mentioned this possibility in the NY Times article last week: Dim Outlook for Holiday Jobs

• On an unadjusted basis, September is traditionally the second (sometimes third) highest-volume month of the year for intermodal, behind October. Intermodal peaks in the fall as retailers stock up for the holidays.

excerpts with permission

While retailers are just now making plans for Christmas hiring, they had to make plans for Christmas merchandise months ago, and that lag might create some inventory problems.

In the first part of the year, the economic picture looked much brighter. ... That was at about the same time that retailers had to order holiday merchandise because of the time it takes to produce and ship the inventory.

And recent traffic at the nation’s ports suggests that retailers made optimistic bets.