by Calculated Risk on 9/03/2010 10:56:00 PM

Friday, September 03, 2010

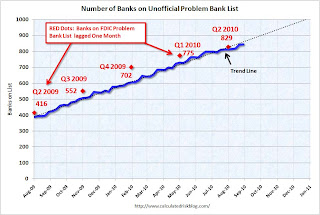

Unofficial Problem Bank List increases to 844 institutions

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 3, 2010.

Changes and comments from surferdude808:

It was a comparatively quiet week for the Unofficial Problem Bank List as there were only four additions and no removals with the FDIC taking the long holiday weekend off from closures.

The additions include First National Bank of Chester County, Chester, PA ($1.2 billion Ticker: FCEC); Lafayette Savings Bank, FSB, Lafayette, IN ($379 million Ticker: LSBI); Oregon Community Bank & Trust, Oregon, WI ($195 million); and Hull Federal Savings Bank, Baltimore, MD ($27 million). Other changes include Prompt Corrective Action Orders issued by the Federal Reserve against First Community Bank ($2.6 billion Ticker: FSNM) and Sunrise Bank ($134 million) and OTS against AnchorBank, fsb ($4.0 billion Ticker: ABCW).

The Unofficial Problem Bank List includes 844 institutions with aggregate assets of $412 billion. This week the FDIC released its official count of problem institutions at 829 with assets of $403 billion as of June 30th.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the number of banks on the unofficial list. The number of institutions has more than doubled since we started the list in early August 2009 - even with all the bank failures (failures are removed from the list). The number of assets is up 50 percent over the last year.

On August 7, 2009, we listed 389 institutions with $276 billion in assets, and now the list has 844 institutions and $412 billion in assets.

The red dots are the number of banks on the official problem bank list as announced in the FDIC quarterly banking profile for Q2 2009 through Q2 2010. The dots are lagged one month because of the delay in announcing formal actions.

The unofficial count is close to the official count (the difference is mostly timing issues), and the FDIC will probably have close to 1,000 banks on the list by the end of the year.

NFIB: Small Businesses Still Not Hiring

by Calculated Risk on 9/03/2010 08:15:00 PM

From NFIB: Small Businesses Still Not Hiring

William C. Dunkelberg, chief economist for the National Federation of Independent Business [said] “In August, most firms did not change employment, but for those that did, 11 percent (up one point from July) increased average employment by 2.3 employees, but 13 percent (down two points) reduced their workforces by an average of 3.5 workers. Job creation still has not crossed the 0 line in the small business sector.Note: A large percentage of small businesses are in real estate related fields and that will keep hiring down for some time. The August survey will be released on Sept 14th, but once again the key problem is "weak sales".

...

“Over the next three months, 13 percent plan to reduce employment (up three points), and 8 percent plan to create new jobs (down one point), yielding a seasonally adjusted net 1 percent of owners planning to create new jobs, a point worse than July, but at least it’s positive.

“Overall, the job creation picture is still bleak. Weak sales and uncertainty about the future continue to hold back any commitments to growth, hiring or capital spending."

Earlier employment posts today (with many graphs):

Rail Traffic increases 5.7% in August compared to August 2009

by Calculated Risk on 9/03/2010 04:12:00 PM

From the Association of American Railroads: Rail Time Indicators. The AAR reports traffic in August 2010 was up 5.7% compared to August 2009 - and traffic was 11.6% lower than in August 2008.

However traffic declined 1.6% from July on a Seasonally Adjusted (SA) basis.

This graph shows U.S. average weekly rail carloads (NSA). Traffic increased in 16 of 19 major commodity categories year-over-year.

From AAR:

• U.S. freight railroads originated 1,179,447 carloads in August 2010, an average of 294,862 carloads per week. That’s up 5.7% from August 2009 though down 11.6% from August 2008 on a non-seasonally adjusted basis. It’s also the highest weekly average for any month since November 2008 and reverses a string of three straight months in which average unadjusted carloads fell in absolute terms.As the graph above shows, rail traffic collapsed in November 2008, and now, a year into the recovery, traffic has only recovered part way.

• However, on a seasonally adjusted basis, U.S. rail carloads fell 1.6% in August 2010 from July 2010. As the chart below ... shows, on an unadjusted basis rail traffic almost always increases from July to August. In that chart, note the upward slope of the line segment from July 2010 to August 2010. That slope is not as steep as the line segments for the same period in most other years on the graph, or for most prior years not shown on the chart. In a nutshell, that explains why seasonally adjusted rail traffic in August 2010 is down a bit when unadjusted traffic is up.

excerpts with permission

Employment Diffusion Indices

by Calculated Risk on 9/03/2010 02:03:00 PM

A few more comments:

Click on graph for larger image.

Click on graph for larger image.The BLS diffusion index for total private employment declined to 53.0 from 56.7 in July. For manufacturing, the diffusion index declined to 47.0 from 53.0 in July, and down sharply from 67.1 in April.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The increases in the diffusion indices in 2009 and earlier this year, was a clear positive in the monthly employment reports. However the decrease in the diffusion indices over the last few months (falling below 50% for manufacturing in August), is disappointing.

Earlier employment posts today (with many graphs):

ISM Non-Manufacturing Index declines in August

by Calculated Risk on 9/03/2010 11:23:00 AM

Earlier employment posts:

The August ISM Non-manufacturing index was at 51.5%, down from 54.3% in July - and below expectations of 53.0%. The employment index showed contraction in August at 48.2%. Note: Above 50 indicates expansion, below 50 contraction.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

The overall ISM index, and the employment index, are both at the lowest level since January.

From the Institute for Supply Management: August 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the eighth consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Worldwide. "The NMI (Non-Manufacturing Index) registered 51.5 percent in August, 2.8 percentage points lower than the 54.3 percent registered in July, indicating continued growth in the non-manufacturing sector but at a slower rate. The Non-Manufacturing Business Activity Index decreased 3 percentage points to 54.4 percent, reflecting growth for the ninth consecutive month, but at a slower rate than in July. The New Orders Index decreased 4.3 percentage points to 52.4 percent, and the Employment Index decreased 2.7 percentage points to 48.2 percent, reflecting contraction after one month of growth.

emphasis added