by Calculated Risk on 6/16/2010 09:29:00 PM

Wednesday, June 16, 2010

Summary and Misc

A quick roundup ...

Remember MERS? From American Banker: Challenges to Foreclosure Docs Reach a Fever Pitch (ht Terry)

From HuffPost: Fannie Mae, Freddie Mac Shares To Be Pulled From NYSE (ht Paulo)

Homebuilder Toll Brothers warns: Demand Choppy, Sales Down

From CNBC: Europe Will Soon Publish Bank Stress Tests: ECB Official

Iceland: Court rules Foreign currency indexed loans illegal

From the NY Times: France and Spain Act to Rein in Budgets

From Bloomberg: Former Taylor Bean Chief Farkas Charged With Fraud

Lee Farkas, the former chairman of Taylor, Bean & Whitaker Mortgage Corp., was accused by the U.S. of helping run a more than $1.9 billion fraud scheme that unsuccessfully attempted to steal money from the government’s Troubled Asset Relief Program.From CNBC: More Than 90 Banks Miss TARP Payments (ht Scott, Ron)

Click on graph for larger image in new window.

Click on graph for larger image in new window.Total housing starts were at 593 thousand (SAAR) in May, down 10% from the revised April rate of 659,000 (revised down from 672 thousand), and up 24% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts collapsed 17.2% to 468,000 in May.

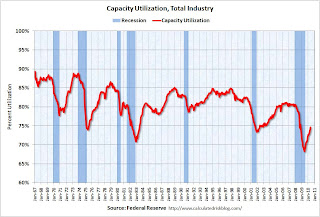

This graph shows Capacity Utilization. This series is up 9.4% from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 9.4% from the record low set in June 2009 (the series starts in 1967). Capacity utilization at 73.7% is still far below normal - and 7.2% below the the pre-recession levels of 80.5% in November 2007.

Best to all.

Toll Brothers: Demand Choppy, Sales Down

by Calculated Risk on 6/16/2010 06:19:00 PM

Just a few weeks ago, new Toll CEO-designate Doug Yearley, Jr. noted:

"With demand increasing in many areas, we are very focused on growth."Uh, nevermind ...

From Toll today (ht Brian):

Joel H. Rassman, chief financial officer, stated: ... "While much of the attention surrounding the recent decline in housing indicators has focused on the expiration of the housing tax credit, we believe our customers' buying decisions have been driven more by consumer confidence than by the tax credit. As we noted in our second-quarter earnings press release of May 26, 2010, we believe the volatility in the financial markets and the high U.S. unemployment rate continue to weigh on the nation's psyche. Additionally, in the past several weeks, concerns about the financial crisis in Europe and escalating regional political tensions, coupled with worries about the oil spill in the Gulf of Mexico and its effects on the economy and the environment have negatively impacted the outlook of American consumers.Slightly ahead on a community bases - with 21% fewer communities. Do the math - they are running close to 20% below last year. And 40% below last year over the last three weeks (20% fewer deposits and 21% fewer communities).

"In the three weeks following our earnings conference call on May 26, 2010, our per-community deposits have been running about 20% behind the comparable period in last year's third quarter and our per-community traffic has been running about 3% behind. Thus, for the first six weeks of our FY 2010 third quarter beginning May 1, 2010, we are slightly ahead of last year's third-quarter pace of contracts signed on a per community basis. However, we have 21% fewer communities than one year ago.

"Although demand in recent weeks has been quite choppy, in general, we continue to believe that the housing market has emerged from its darkest period of late 2008 through early 2009. ... At the moment, consumers view the economic glass as half empty: volatile financial markets, global deficit concerns and the oil spill in the Gulf are all contributing to this gloom. We believe that once the employment picture begins to brighten and the economy stabilizes, consumer confidence will improve and the housing market should begin a steadier recovery."And there you have what might be the popular Q2 meme: blame the oil spill for poor results.

Iceland: Court rules Foreign currency indexed loans illegal

by Calculated Risk on 6/16/2010 04:44:00 PM

Here is a little different story ...

From The Iceland Weather Report: Foreign currency loans deemed illegal (ht Steinn)

The Icelandic supreme court ruled this afternoon that Icelandic loans indexed to a foreign currency are illegal.From The Reykjavík Grapevine: Supreme Court Rules Loans Pinned to Foreign Currency Illegal (ht Warlock)

This is hugely significant for thousands of people in this country.

Two cases were connected to the ruling involving car loans taken from the companies Lýsingu hf. and SP-fjármögnun that were pinned to foreign currency. With the collapse of the Icelandic crown in 2008, many people who took out such loans - at a time when the crown was strong - saw their debts double almost overnight.It was apparently pretty common in Iceland for car and some home loans to be indexed to a basket of foreign currencies. However when the Iceland Krona collapsed, the borrower was stuck with a much higher payment (and debt) than expected. Apparently many borrowers in eastern European countries also borrowed using these "basket of foreign currency" indexes.

Reader Warlock mentions that these loans appeared cheaper than other loans, and were frequently used to buy expensive foreign autos - and the financing was also from abroad. Just another risk for some banks, especially if this ruling spreads to other countries.

WaPo on Foreclosures and Deficiencies

by Calculated Risk on 6/16/2010 01:44:00 PM

From Dina ElBoghdady at the WaPo: Lenders go after money lost in foreclosures

Here is an excerpt:

Carlos Cortez and his wife['s] ... second lender came after them for $70,000 when their short sale was completed on his Manassas Park townhouse in 2008.Tanta (my former co-blogger an a mortgage banker) sent me an email about this in 2007:

Cortez knew that was a possibility, but he went through with the sale because his real estate agent said the lender was engaging in scare tactics.

James Scruggs, an attorney at Legal Services of Northern Virginia, said the lender appears to have backed off after Cortez argued that that the loan officer falsely qualified him and his wife for a home-equity line by fabricating key details about their finances.

Back in my day working for a servicer ... the absolute all time last possible thing you could get me to do is send an attorney barging into court demanding a deficiency judgment if I had any reason whatsoever to fear that my own effing loan officer was implicated in fraud on the original loan application. Any borrower with half a brain will raise that as a defense, and any judge even slightly awake will not only deny the deficiency but probably make the lender pay all costs, or worse. And I'd call that justice.It is unclear how often lenders are pursuing borrowers for deficiencies - but it is clearly happening more often now. This is one reason why people involved in short sales or considering "walking away" should consult an attorney. I suspect this is part of the reason for the recent surge in personal bankruptcy filings.

Spain, Germany agree to release bank "stress test" results

by Calculated Risk on 6/16/2010 12:41:00 PM

From the Financial Times: Spain to reveal bank ‘stress tests’ results

“The Bank intends to make public the results of these stress tests, showing estimated loan losses, the consequent capital requirements and the contribution of promised balance sheet reinforcements, so that the markets have a perfect understanding of the circumstances of the Spanish banking system,” [Miguel Angel Fernández Ordóñez, governor of the Bank of Spain, said on Wednesday].And from the Financial Times: Berlin agrees to release stress test results

excerpt with permission

The German government has dropped its resistance to publishing the results of bank stress tests ... A spokeswoman for the finance ministry said on Wednesday that Berlin was currently “co-ordinating” with its EU partners about how the results of existing annual stress tests could best be presented ...Transparency is helpful - although this might show a number of banks require additional capital. In the U.S., the government provided capital from TARP until the banks could raise private capital.

Note that the EU and the UK conduct annual stress tests - this is just an issue of making the results public. I think the U.S. should conduct annual stress tests of all the largest financial institutions, and make the economic scenarios and results public every year.