by Calculated Risk on 6/11/2010 08:11:00 PM

Friday, June 11, 2010

Bank Failure #82: Washington First International Bank, Seattle, WA

Sucked up TARP funds like sponges

Wrung dry by losses

by Soylent Green is People

From the FDIC: East West Bank, Pasadena, California, Assumes All of the Deposits of Washington First International Bank, Seattle, Washington

As of March 31, 2010, Washington First International Bank had approximately $520.9 million in total assets and $441.4 million in total deposits. ...It wouldn't be Friday without a bank failure ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $158.4 million. .... Washington First International Bank is the 82nd FDIC-insured institution to fail in the nation this year, and the seventh in Washington. The last FDIC-insured institution closed in the state was Frontier Bank, Everett, on April 30, 2010.

Housing Tax Credit Fraud Extension

by Calculated Risk on 6/11/2010 06:20:00 PM

No one could have predicted ...

James Hagerty at the WSJ has the story: Tax Credit Extension Could Help Tax Cheaters. Hagerty discusses comments from two real estate agents: Glenn Kelman, chief executive of Redfin Corp. who noted that some customers who signed contracts after April 30th were pushing to close by June 30th. Kelman suspects fraud. And Schahrzad Berkland, an agent for Fidelity Pacific Real Estate in San Diego who noticed that pending sales for April have continued to rise ... something that is very odd. (Note to FBI: more fraud for you guys!)

I noted yesterday: "I'm sure some people will commit fraud and backdate documents."

Extending the closing date will encourage even more fraud. All the mortgage lenders have been giving priority to purchase applications over refinance applications, and 60 days is more than enough time.

If short sales are a problem, then make the extension very narrow - a 30 day extension for short sales, with the servicer processing the short sale certifying that it was 1) a short sale and 2) that they were in possession of a signed contract by April 30th (with a significant penalty for a false statement).

Otherwise this extension should be titled the "Housing Tax Credit Fraud Extension Amendment". Geesh ...

LA Port Traffic: Imports Surge Year-over-year in May

by Calculated Risk on 6/11/2010 03:58:00 PM

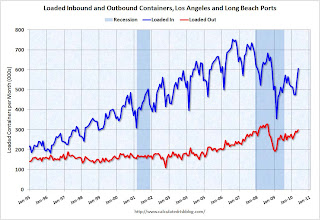

Notes: this data is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports. LA area ports handle about 40% of the nation's container port traffic.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was up 18.3% compared to May 2009. Inbound traffic was still down 5% vs. two years ago (May 08).

Loaded outbound traffic was up 9.4% from May 2009. Just as with imports, exports are still off from 2 years ago (off 7.3%).

For imports there is usually a significant dip in either February or March, depending on the timing of the Chinese New Year, and then usually imports increase until late summer or early fall as retailers build inventory for the holiday season. So this increase in May imports is part of the normal seasonal pattern.

Based on this data, it appears the trade deficit with Asia increased in May. Once again it appears imports are increasing faster than exports and the pre-crisis global imbalances have returned.

Report: FBI to "arrest hundreds of people" next week for Mortgage Fraud

by Calculated Risk on 6/11/2010 01:20:00 PM

From the Financial Times: FBI to target mortgage fraud

The FBI is preparing to arrest hundreds of people across the US as early as next week for offences including encouraging borrowers to falsify income on mortgage applications, misleading home owners about foreclosure rescue programmes, and inflating home appraisals ... The FBI is scheduled to release its 2009 mortgage report on June 17.The FBI usually only arrests people engaged in fraud for profit and not fraud for housing - they typically don't arrest borrowers who misrepresented their income - they arrest mortgage brokers who encouraged people to falsify their income. Although the distinction was blurred during the bubble ...

excerpt with permission

Tanta wrote a great piece on this in 2007: Unwinding the Fraud for Bubbles

There is a tradition in the mortgage business of distinguishing between two major types of mortgage fraud, called “Fraud for Housing” and “Fraud for Profit.” The former is the borrower-initiated fraud—inflating income or assets, lying about employment, etc.—that is motivated by the borrower’s desire to get housing (not the same thing as “real estate”), by means of getting a loan he or she doesn’t actually qualify for. ...The FBI will probably be busy for years.

Fraud for profit is simply someone trying to extract cash—not housing—out of the transaction somewhere. ...

The problem with this traditional distinction is that, recently, we seem to have an epidemic of predator meeting predator and forming an alliance: a borrower willing to commit fraud for housing meets up with a seller or lender willing to commit fraud for profit, and the thing gets jacked up to a whole new level of nastiness.

Here is another scam in Florida from Sally Kestin at the Sun Sentinel: Squatters take over S. Fla. homes in what police call latest fraud in housing crisis (ht Ray).

Manufacturing and Trade Inventory-to-Sales Ratio: Inventory Adjustment Over

by Calculated Risk on 6/11/2010 10:00:00 AM

The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed that the inventory adjustment is over:

Inventories. Manufacturers’ and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,354.3 billion, up 0.4 percent (±0.1%) from March 2010, but down 2.8 percent (±0.3%) from April 2009.

Inventories/Sales Ratio. The total business inventories/sales ratio based on seasonally adjusted data at the end of April was 1.23. The April 2009 ratio was 1.43.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the inventory to sales ratio. This has declined sharply to 1.23 (SA) from the peak of 1.48 back in Jan 2009. This could decline further - the trend is definitely down over time - but clearly the inventory adjustment is over.

This is important because the change in inventory added significantly to Q4 GDP growth and some to Q1 GDP. See BEA line 13: the contribution to GDP in Q4 2009 from 'Change in private inventories' was 3.79 of the 5.9 percent annualized increase in Q4 GDP. In Q1 2010. the 'change in private inventories' was 1.65 of the 3.0 percent annualized increase.

Any boost to Q2 GDP from inventory changes will be minor.

It now appears the inventory adjustment is over. Further growth in inventories will depend on increases in underlying demand. This is part of the 2nd half slowdown forecast.