by Calculated Risk on 6/01/2010 10:00:00 AM

Tuesday, June 01, 2010

ISM Manufacturing Index Shows Expansion in May

PMI at 59.7% in May, down from 60.4% in April.

From the Institute for Supply Management: May 2010 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in May for the 10th consecutive month, and the overall economy grew for the 13th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.This was close to expectations of 59.5% and suggests continued growth in the manufacturing sector.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector grew for the 10th consecutive month during May. The rate of growth as indicated by the PMI is driven by continued strength in new orders and production. Employment continues to grow as manufacturers have added to payrolls for six consecutive months. The recovery continues to broaden as 16 of 18 industries report growth. There are a number of reports, particularly in the tech sector, of shortages of components; this is the result of excessive inventory de-stocking during the downturn."

...

ISM's Employment Index registered 59.8 percent in May, which is 1.3 percentage points higher than the 58.5 percent reported in April. This is the sixth consecutive month of growth in manufacturing employment. An Employment Index above 49.8 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

emphasis added

Unemployment Rate increases in Europe, Euro Slides

by Calculated Risk on 6/01/2010 08:51:00 AM

The euro is at a four year low this morning at 1.2174 dollars

From Eurostat: Euro area unemployment rate at 10.1%

The euro area1 (EA16) seasonally-adjusted unemployment rate was 10.1% in April 2010, compared with 10.0% in March. It was 9.2% in April 2009. The EU271 unemployment rate was 9.7% in April 2010, unchanged compared with March. It was 8.7% in April 2009.

Eurostat estimates that 23.311 million men and women in the EU27, of whom 15.860 million were in the euro area, were unemployed in April 2010.

Among the Member States, the lowest unemployment rates were recorded in the Netherlands (4.1%) and Austria (4.9%), and the highest rates in Latvia (22.5%), Spain (19.7%) and Estonia (19.0% in the first quarter of 2010).

Compared with a year ago, one Member State recorded a fall in the unemployment rate and twenty-six an increase. The fall was observed in Germany (7.6% to 7.1%), and the smallest increases in Luxembourg (5.3% to 5.4%) and Malta (6.9% to 7.0%). The highest increases were registered in Estonia (11.0% to 19.0% between the first quarters of 2009 and 2010), Latvia (15.4% to 22.5%) and Lithuania (11.2% to 17.4% between the first quarters of 2009 and 2010).

Commodity Prices Decline and Futures

by Calculated Risk on 6/01/2010 12:55:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

From Bloomberg: Commodities’ Biggest Drop Since Lehman Bear Signal

The Journal of Commerce commodity index that includes steel, cattle hides, tallow and burlap plunged 57 percent in May, two years after a decline that foreshadowed the worst recession in half a century. The index of 18 industrial materials declined the most since October 2008 as Europe’s debt crisis widened and China took steps to curb growth.From the WSJ: Steel Prices Under Pressure

From the WSJ: China Bites Into Commodities Reserves

The Dow Jones-UBS Commodity Index last week dropped to its lowest level since July, before recouping some of its losses. The index is down 9.9% this year.The euro is down to 1.226 dollars.

In April, China posted a significant drop in imports for some commodities, leaving many analysts wondering whether China's appetite for commodities has abated.

The Asian markets are off tonight about 0.5% to 1%.

The futures are off somewhat (Dow off 47).

Monday, May 31, 2010

In Foreclosure and ... happy?

by Calculated Risk on 5/31/2010 10:09:00 PM

From David Streitfeld at the NY Times: Owners Stop Paying Mortgages, and Stop Fretting. A few excerpts:

Foreclosure procedures have been initiated against 1.7 million of the nation’s households.Streitfeld provides a few examples. One lady said "The longer I’m in foreclosure, the better."

...

The average borrower in foreclosure has been delinquent for 438 days before actually being evicted, up from 251 days in January 2008, according to LPS Applied Analytics.

...

More than 650,000 households had not paid in 18 months, LPS calculated earlier this year. With 19 percent of those homes, the lender had not even begun to take action to repossess the property ...

This isn't for everyone. Streitfeld quotes Kyle Lundstedt, managing director of Lender Processing Service’s analytics group:

“These people are playing a dangerous game. There are processes in many states to go after folks who have substantial assets postforeclosure.”

Few Jobs for Students this Summer

by Calculated Risk on 5/31/2010 08:54:00 PM

Note: Here is the Weekly Summary and a Look Ahead (it will be a busy week).

From Mickey Meese at the NY Times: Fading Summer Jobs

State and local governments, traditionally among the biggest seasonal employers, are knee-deep in budget woes, and the stimulus money that helped cushion some government job programs last summer is running out. Private employers are also reluctant to hire until the economy shows more solid signs of recovery.

So expect fewer lifeguards on duty at public beaches this summer in California, fewer workers at some Massachusetts state parks and camping grounds and taller grass outside state buildings in Kentucky.

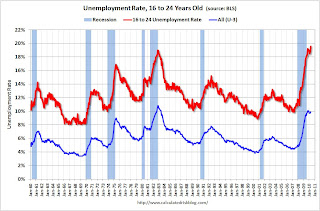

Click on graph for large image.

Click on graph for large image.For summer jobs, this will probably be the worst year since the Great Depression.

This graph shows the unemployment rate for workers 16 to 24 years old (from the BLS), and the headline unemployment rate (blue). The unemployment rate hit a record 19.6% in April for this group.

This probably ties into the recent NY Times article on overwhelming student debt. When I was in college, I was able to find summer jobs that helped me pay my way through college (of course I walked 10 miles through the snow and all that too). Times have really changed ...