by Calculated Risk on 5/31/2010 04:02:00 PM

Monday, May 31, 2010

ECB reports on financial stability, warns of "contagion"

The ECB released the twice yearly Finanical Stability Review report today. Here are couple of articles about the report:

From the Financial Times: ECB warns of ‘hazardous contagion’

The eurozone’s financial sector and economy are facing “hazardous contagion” effects from the region’s debt crisis, according to the European Central Bank ... Taking into account writedowns already reported and loan loss provisions, some €90bn of writedowns have yet to feed through, it said. For 2011, it expected banks would have to make additional loan-loss provisions of about €105.There is also a video discussion with Martin Wolf and Richard Haass, president of the Council on Foreign Relations.

except with permission

From the NY Times: Europe’s Banks at Risk From Slower Growth, Report Says

... the E.C.B. expressed particular concern about banks’ need to refinance some €800 billion, or $980 billion, in long-term debt by the end of 2012. Borrowing costs could rise as the banks compete with governments in the bond market “making it challenging to roll over a sizeable amount of maturing bonds by the end of 2012,” the report said.

Chicago: Shadow Condo Inventory

by Calculated Risk on 5/31/2010 12:39:00 PM

Just continuing a theme ...

From Eddie Baeb at Crain's Chicago Business: Nearly vacant condo tower goes back to lender

The 35-story Lexington Park, near Michigan Avenue and Cermak Road, was surrendered last week by its Irish developer through a deed-in-lieu of foreclosure. The private-equity venture that now owns the property acquired Corus Bank’s the distressed condo loans after the Chicago-based lender failed last fall.Hey, they closed on 1% percent of the units!

Just three buyers have closed on Lexington Park’s 333 units, according to property records. The tower, 2138 S. Indiana Ave., was supposed to be ready for occupancy in 2008.

Note that the developer just "walked away" (deed-in-lieu) and the original lender was Corus, the "Condo King". Unless listed for sale, these units are not included in the new or existing home inventory reports - real shadow inventory!

Real PCE Growth in Q2

by Calculated Risk on 5/31/2010 09:13:00 AM

Note: Here is the Weekly Summary and a Look Ahead (it will be a busy week).

On Friday, the BEA released the Personal Income and Outlays report for April. The report showed that Real PCE increased less than 0.1 percent in April (compared to March).

Even though the month-to-month increase was small, this was fairly large increase from January (comparing the first month of Q2 to the first month of Q1).

In calculating PCE for the GDP report, the quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

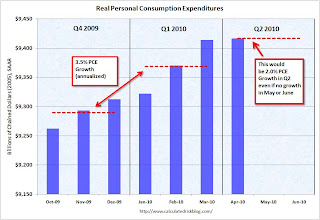

The following graph illustrates how this is calculated. Note that the y-axis doesn't start at zero to better show the change. Click on graph for large image.

Click on graph for large image.

The blue columns show real PCE by month, and the dashed red lines are the quarterly average.

PCE didn't increase much in January compared to December either, but there was strong growth in February and March. This resulted in PCE growing at an annualized rate of 3.5% for Q1.

Even if PCE was flat in May and June compared to April (preliminary reports suggest growth in May), real PCE would grow at 2.0% in Q2. More likely - with some growth in May and June - PCE will grow closer to 3% in Q2.

This is just a reminder that PCE growth (and GDP growth) is pretty much already baked into Q2.

Best to all.

Sunday, May 30, 2010

Condo Shadow Inventory

by Calculated Risk on 5/30/2010 10:13:00 PM

From Buck Wargo at the Las Vegas Sun: CityCenter condo closings slow in down economy

Through the end of April, MGM Mirage and Dubai World, the owners of the project, have closed on 78 of 1,543 units at the Vdara condo-hotel, according to SalesTraq.This is a reminder that unless these condos are listed, they do not show up as either existing or new home inventory (the new home report doesn't include high rise condos).

... Houston-based Metrostudy reported that Las Vegas has more than 8,200 condominium units that are sitting empty, including those still vacant in CityCenter.

There are some areas - like Las Vegas and Miami - that have a huge number of vacant high rise condos. But there are also many smaller buildings that are mostly vacant in a number of cities (like in New York, Raliegh, N.C. and Irvine, Ca). This is part of the shadow inventory ...

Percent Job Losses During Recessions, aligned at Bottom

by Calculated Risk on 5/30/2010 05:17:00 PM

By request ... here is an update through April with the impact of Census hiring added. Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - but this time aligned at the bottom of the recession. This assumes that the 2007 recession has reached bottom.

The current recession has been bouncing along the bottom for a few months - so the choice of bottom is a little arbitrary (plus or minus a month or two).

Notice that the 1990 and 2001 recessions were followed by jobless recoveries - and the eventual job recovery was gradual. In earlier recessions the recovery was somewhat similar and a little faster than the decline (somewhat symmetrical).

The dotted line shows the impact of Census hiring.

In April, there were 154,000 temporary 2010 Census workers on the payroll. This barely shows up on the graph.

The number of temporary workers will jump to around 573,000 in May - and the dotted line will be well below the red line. Starting in June, the number of Census workers will decline - and the two lines will meet later this year.