by Calculated Risk on 5/10/2010 11:23:00 AM

Monday, May 10, 2010

Report: 11.2 Million U.S. Properties with Negative Equity in Q1

First American CoreLogic released the Q1 2010 negative equity report today.

CoreLogic reported today that more than 11.2 million, or 24 percent, of all residential properties with mortgages, were in negative equity at the end of the f irst quarter of 2010, down slightly from 11.3 million and 24 percent from the fourth quarter of 2009. An additional 2.3 million borrowers had less than five percent equity. Together, negative equity and near-negative equity mortgages accounted for over 28 percent of all residential properties with a mortgage nationwide.From the report:

Negative equity continues to be concentrated in five states: Nevada, which had the highest percentage negative equity with 70 percent of all of its mortgaged properties underwater, followed by Arizona (51 percent), Florida (48 percent), Michigan (39 percent) and California (34 percent). Las Vegas remains the top ranked CBSA with 75% of mortgaged properties being underwater, followed by Stockton (65%), Modesto (62%), Vallejo-Fairfield (60%) and Phoenix (58%). Phoenix had more than 550,000 underwater borrowers, the most households of any metropolitan market in the country. Riverside (463,000), Los Angeles (406,000) Atlanta (399,000) and Chicago (365,000) round out the top five markets.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the negative equity and near negative equity by state.

Although the five states mentioned above have the largest percentage of homeowners underwater, 10 percent or more of homeowners have negative equity in 33 states and the D.C., and over 20% have negative equity or near negative equity in 23 states and D.C. This is a widespread problem.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA on the graph above.

The second graph shows the distribution of homeowners with a mortgage with near or negative equity.

The second graph shows the distribution of homeowners with a mortgage with near or negative equity.The share of borrowers whose mortgage debt exceeds the property value by 25% or more fell slightly to 10.4% or 4.9 million borrowers, down from 10.6% or 5 million borrowers. The aggregate dollar value of negative equity for these deeply underwater borrowers was $656 billion dollars.Research has shown that once negative equity exceeds 25 percent "owners begin to default with the same propensity as investors", and it is these 4.9 million borrowers - with $656 billion in debt - that are most at risk for foreclosure.

Fannie Mae: $11.5 billion loss, sees no profits for "indefinite future"

by Calculated Risk on 5/10/2010 08:58:00 AM

For a EU / ECB summary, please see previous post: Euro Summary

From Fannie Mae:

Fannie Mae (FNM/NYSE) reported a net loss of $11.5 billion in the first quarter of 2010, compared with a net loss of $15.2 billion in the fourth quarter of 2009. Including $1.5 billion of dividends on our senior preferred stock held by the U.S. Department of Treasury, the net loss attributable to common stockholders was $13.1 billion ...Foreclosure activity is increasing:

We acquired 61,929 single-family real estate-owned properties through foreclosure in the first quarter of 2010, compared with 47,189 in the fourth quarter of 2009. As of March 31, 2010, our inventory of single-family real estate owned properties was 109,989, compared with 86,155 as of December 31, 2009.Greg Morcroft at MarketWatch reports:

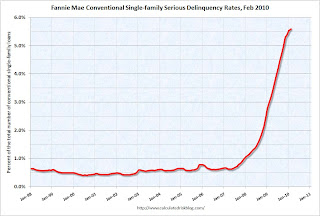

Fannie sees no profits for the "indefinite future" ... financial sustainability uncertain.Here is the monthly Fannie Mae seriously delinquent graph through February ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.Fannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.59% in February, up from 5.52% in January - and up from 2.96% in February 2009.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

It does appear the increases in the delinquency rate have slowed.

Sunday, May 09, 2010

Euro Summary and Futures

by Calculated Risk on 5/09/2010 11:53:00 PM

Just a summary ... Europe and futures.

1) The EU created a €60 billion fund based on article 122 (special circumstances). The IMF will add €30 billion. Press conference archive here (40 minutes)

2) The EU will create a Special Purpose Vehicle (SPV) for 3 years based on inter government agreements. These are potential loan guarantees backed by all Euro Zone countries. This is in addition to €60 billion and will be up to €440 billion - plus a contribution from the IMF up to half of European Union contribution (up to €220 billion). The total of the two is €750 billion.

3) There are apparently agreements from Portugal and Spain to take steps to reduce their deficits.

4) The European Central Bank (ECB) announced "interventions in the euro area public and private debt securities markets (Securities Markets Programme) to ensure depth and liquidity in those market segments which are dysfunctional."

5) The Federal Reserve reopened swap lines to provide dollar liquidity.

Story Links:

From the NY Times: E.U. Details $957 Billion Rescue Package

From the WSJ: World Races to Avert Crisis in Europe

From Bloomberg: EU Crafts $962 Billion Show of Force to Halt Euro Crisis

Futures:

From CNBC, the Dow is up 225 and the S&P 500 is up about 30 points.

Asia is mostly up, the Nikkei is up 1.3% and the Shanghai Composite is off slightly.

And buried in the news, here is the weekly summary and a look ahead (with plenty of graphs).

ECB To Intervene in Euro-Zone Debt Markets, Fed Re-opens Swaps

by Calculated Risk on 5/09/2010 10:01:00 PM

From the ECB: ECB decides on measures to address severe tensions in financial markets

The Governing Council of the European Central Bank (ECB) decided on several measures to address the severe tensions in certain market segments which are hampering the monetary policy transmission mechanism and thereby the effective conduct of monetary policy oriented towards price stability in the medium term. The measures will not affect the stance of monetary policy.From the Fed:

In view of the current exceptional circumstances prevailing in the market, the Governing Council decided:1.To conduct interventions in the euro area public and private debt securities markets (Securities Markets Programme) to ensure depth and liquidity in those market segments which are dysfunctional. The objective of this programme is to address the malfunctioning of securities markets and restore an appropriate monetary policy transmission mechanism. The scope of the interventions will be determined by the Governing Council. In making this decision we have taken note of the statement of the euro area governments that they “will take all measures needed to meet [their] fiscal targets this year and the years ahead in line with excessive deficit procedures” and of the precise additional commitments taken by some euro area governments to accelerate fiscal consolidation and ensure the sustainability of their public finances.

In order to sterilise the impact of the above interventions, specific operations will be conducted to re-absorb the liquidity injected through the Securities Markets Programme. This will ensure that the monetary policy stance will not be affected.

2.To adopt a fixed-rate tender procedure with full allotment in the regular 3-month longer-term refinancing operations (LTROs) to be allotted on 26 May and on 30 June 2010.

3.To conduct a 6-month LTRO with full allotment on 12 May 2010, at a rate which will be fixed at the average minimum bid rate of the main refinancing operations (MROs) over the life of this operation.

4.To reactivate, in coordination with other central banks, the temporary liquidity swap lines with the Federal Reserve, and resume US dollar liquidity-providing operations at terms of 7 and 84 days. These operations will take the form of repurchase operations against ECB-eligible collateral and will be carried out as fixed rate tenders with full allotment. The first operation will be carried out on 11 May 2010.

In response to the re-emergence of strains in U.S. dollar short-term funding markets in Europe, the Bank of Canada, the Bank of England, the European Central Bank, the Federal Reserve, and the Swiss National Bank are announcing the re-establishment of temporary U.S. dollar liquidity swap facilities. These facilities are designed to help improve liquidity conditions in U.S. dollar funding markets and to prevent the spread of strains to other markets and financial centers. The Bank of Japan will be considering similar measures soon. Central banks will continue to work together closely as needed to address pressures in funding markets.

Federal Reserve Actions

The Federal Open Market Committee has authorized temporary reciprocal currency arrangements (swap lines) with the Bank of Canada, the Bank of England, the European Central Bank (ECB), and the Swiss National Bank. The arrangements with the Bank of England, the ECB, and the Swiss National Bank will provide these central banks with the capacity to conduct tenders of U.S. dollars in their local markets at fixed rates for full allotment, similar to arrangements that had been in place previously. The arrangement with the Bank of Canada would support drawings of up to $30 billion, as was the case previously.

These swap arrangements have been authorized through January 2011. Further details on these arrangements will be available shortly.

Europe: Agreement Reached

by Calculated Risk on 5/09/2010 08:32:00 PM

Press Conference has started. Note: 9:03 PM ET: Press conference is over. There will be an archived video soon.

Signed Greek deal. Create €60 billion fund based on article 122 (special circumstances). Plus create Special Purpose Vehicle for 3 years (SPV) based on intergovernment agreement. The additional amount is up to €440 billion, so €500 billion - plus a contribution from the IMF up to half of European Union contribution (up to €220 billion). Plus apparently agreements from Portugal and Spain to take steps to reduce deficit.

UPDATE: ECB to take significant steps (hasn't been announced yet). EU representative said ECB will be buying secondary securities - but wait for ECB for announcement.

UPDATE2: There is a €30 billion IMF portion to the initial fund - so the total is €750 billion. The ECB announcement tonight could be significant.

Links:

Bloomberg: EU Crafts $928 Billion Show of Force to Halt Crisis

WSJ: EU Approves €720 Billion Bailout

Bloomberg: Rehn Says ECB Has Decided to Intervene in Secondary Market

Note: earlier post is the weekly summary and a look ahead.