by Calculated Risk on 4/29/2010 08:30:00 AM

Thursday, April 29, 2010

Weekly Initial Unemployment Claims at 448,000

The DOL reports on weekly unemployment insurance claims:

In the week ending April 24, the advance figure for seasonally adjusted initial claims was 448,000, a decrease of 11,000 from the previous week's revised figure of 459,000. The 4-week moving average was 462,500, an increase of 1,500 from the previous week's revised average of 461,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 17 was 4,645,000, a decrease of 18,000 from the preceding week's revised level of 4,663,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 1,500 to 462,500.

The dashed line on the graph is the current 4-week average. The current level of 448,000 (and 4-week average of 462,500) is still high, and suggests continuing weakness in the labor market.

The 4-week average first declined to this level in December 2009, and has essentially moved sideways for four months.

Wednesday, April 28, 2010

Report: FDIC Receives Bids on Puerto Rico Banks

by Calculated Risk on 4/28/2010 08:02:00 PM

From the WSJ: FDIC Auction of Lenders In Puerto Rico Draws Bids

At least four banks entered bids in a Federal Deposit Insurance Corp. auction ... A deadline passed Tuesday for interested parties to make offers for W Holding Co. Inc.'s Westernbank, R&G Financial Corp.'s R-G Premier Bank and EuroBancshares Inc.'s EuroBank. The FDIC held the auction in case any of the banks fail ...It is possible that one or more of the banks could raise capital and not be seized by the FDIC.

Also there was a rumor today of liquidity problems at one of the banks, and a Thursday seizure is possible. A local source tells me 'there are lots of "Dentists" in town for a Dental convention that doesn't appear to exist' ... nice cover!

How long is an "Extended Period"?

by Calculated Risk on 4/28/2010 04:55:00 PM

Catherine Rampell at the NY Times Economix asks: How Long Is an ‘Extended Period’?

Short answer: Longer than many analysts expect.

First we can compare to the "considerable period" language in 2003:

So "extended period" is probably 6+ months after the language changes - the next meeting is June 23rd and 24th, so the earliest rate hike would probably be in December (barring a significant pickup in inflation or rapid decline in unemployment).June 25, 2003: Lowered Rate to 1%, Unemployment Rate peaked at 6.3% August 12, 2003: “the Committee believes that policy accommodation can be maintained for a considerable period.” Unemployment rate at 6.1% December 9, 2003: Last statement using the phrase "considerable period". Unemployment rate at 5.7% January 28, 2004: the Committee believes that it can be patient in removing its policy accommodation. Unemployment Rate 5.7% May 4, 2004: “the Committee believes that policy accommodation can be removed at a pace that is likely to be measured.” Unemployment Rate 5.6% June 30, 2004: FOMC raised the Fed Funds rate 25 bps. Unemployment Rate 5.6%

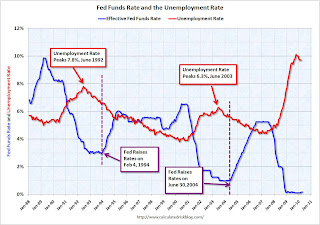

Last September I wrote: Fed Funds and Unemployment Rate. Here is an excerpt with an updated graph:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, if we assume the unemployment rate peaked in October 2009 - and add 18 months - then the Fed would probably wait until early 2011 to raise rates (at the earliest). My guess is the Fed will probably wait until the unemployment rate is closer to 9% before removing the "extended period" language, and it is unlikely they will raise rates until the unemployment rate is below 8%.

FOMC Statement: Economic activity has continued to strengthen

by Calculated Risk on 4/28/2010 02:15:00 PM

Information received since the Federal Open Market Committee met in March suggests that economic activity has continued to strengthen and that the labor market is beginning to improve. Growth in household spending has picked up recently but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software has risen significantly; however, investment in nonresidential structures is declining and employers remain reluctant to add to payrolls. Housing starts have edged up but remain at a depressed level. While bank lending continues to contract, financial market conditions remain supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.The key language about rates stayed the same: "The Committee ... continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period."

With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

In light of improved functioning of financial markets, the Federal Reserve has closed all but one of the special liquidity facilities that it created to support markets during the crisis. The only remaining such program, the Term Asset-Backed Securities Loan Facility, is scheduled to close on June 30 for loans backed by new-issue commercial mortgage-backed securities; it closed on March 31 for loans backed by all other types of collateral.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to a build-up of future imbalances and increase risks to longer run macroeconomic and financial stability, while limiting the Committee’s flexibility to begin raising rates modestly.

The comments on the economy were slightly more positive.

On housing, here is the language over the last several statements:

Nov, 2009: "Activity in the housing sector has increased over recent months"

Dec, 2009: "The housing sector has shown some signs of improvement over recent months."

Jan, 2010: No comment.

March, 2010: housing starts have been flat at a depressed level

April, 2010: Housing starts have edged up but remain at a depressed level

At least this time the Fed didn't confuse an increase in housing activity with accomplishment!

S&P Downgrades Spain, outlook negative

by Calculated Risk on 4/28/2010 11:32:00 AM

S&P downgraded Spain to AA with a negative outlook based on a forecast for an extended period of sluggish growth.

From Bloomberg: S&P Downgrades Spain to ’AA’; Outlook Negative

Update: Quote from MarketWatch:

"We now believe that the Spanish economy's shift away from credit-fuelled economic growth is likely to result in a more protracted period of sluggish activity than we previously assumed," said Marko Mrsnik, an S&P credit analyst. "We now project that real GDP growth will average 0.7% annually in 2010-2016, versus our previous expectations of above 1% annually over this period,"Seven years of pain ... in Spain.