by Calculated Risk on 4/26/2010 10:00:00 AM

Monday, April 26, 2010

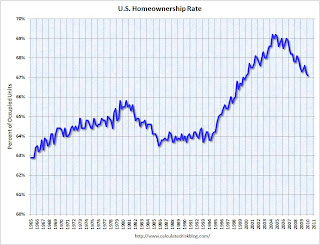

Q1 2010: Homeownership Rate Lowest Since Q1 2000

The Census Bureau reported the homeownership and vacancy rates for Q1 2010 this morning. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate declined to 67.1%. This is the lowest level since Q1 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I've been expecting the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.  The homeowner vacancy rate was 2.6% in Q1 2010.

The homeowner vacancy rate was 2.6% in Q1 2010.

A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.9% above normal. This data is not perfect, but based on the approximately 75 million homeowner occupied homes, we can estimate that there are close to 675 thousand excess vacant homes.

The rental vacancy rate was 10.6% in Q1 2010.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 41 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, there would be 2.6% X 41 million units or over 1 million units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 41 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, there would be 2.6% X 41 million units or over 1 million units absorbed.

This suggests there are still about 1.7 million excess housing units, and these excess units will keep pressure on housing starts, rents and house prices for some time.

Greece: 10-Year debt yield spread widens to new record

by Calculated Risk on 4/26/2010 08:36:00 AM

From The Times: Pressure mounts on Greek Government as cost of borrowing rises above 9 per cent

The bond markets hammered Greek government debt this morning, raising the cost of borrowing for the eurozone nation above 9 per cent.From the WSJ: Cost of Insuring Greek Debt Soars

[T]he gap in yields between 10-year debt from Greece and Germany—the euro-zone's most solid borrower—swinging out to a new record of 6.11 percentage points. That yield spread stood at 5.63 percentage points after Greece asked to activate the aid package Friday.On May 19th, €8.5bn of Greece's bonds mature - so there is very little time left to work out the details of a loan package.

Sunday, April 25, 2010

Krugman: "Berating the Raters"

by Calculated Risk on 4/25/2010 11:59:00 PM

From Paul Krugman in the NY Times: Berating the Raters

[T]he e-mail messages you should be focusing on are the ones from employees at the credit rating agencies, which bestowed AAA ratings on hundreds of billions of dollars’ worth of dubious assets, nearly all of which have since turned out to be toxic waste. And no, that’s not hyperbole: of AAA-rated subprime-mortgage-backed securities issued in 2006, 93 percent — 93 percent! — have now been downgraded to junk status.The rating agencies played a key role in the housing bubble. They used models based on historical performance for mortgages, and didn't account for the "innovations" in lending such as the entire chain of the originate-to-distribute model: automated underwriting, reliance on FICO scores instead of the 3 Cs (creditworthiness, capacity, and collateral), agency issues with the widespread use of independent mortgage brokers, expanded securitization, non-traditional mortgage products, etc.

What those e-mails reveal is a deeply corrupt system.

...

The Senate subcommittee has focused its investigations on the two biggest credit rating agencies, Moody’s and Standard & Poor’s; what it has found confirms our worst suspicions. In one e-mail message, an S.& P. employee explains that a meeting is necessary to “discuss adjusting criteria” for assessing housing-backed securities “because of the ongoing threat of losing deals.” Another message complains of having to use resources “to massage the sub-prime and alt-A numbers to preserve market share.”

Of course the rating agencies just offered "opinions", and unknown to investors, those valued opinions were apparently quite malleable.

How does the new financial regulation fix this problem?

China Real Estate

by Calculated Risk on 4/25/2010 09:08:00 PM

First - here is the weekly summary and a look ahead ...

From David Pierson at the LA Times: In China, real estate fever is rising

Hundreds of miles inland from the booming real estate markets of Beijing and Shanghai, an unlikely property fever is gripping this middling industrial outpost.And on speculators:

...

Taxi drivers boast of owning multiple flats for investment. Billboards hawk developments with names such as Villa Glorious and Rich Country. Frenzied crowds pack sales events with bags of cash, buying units that exist only on blueprints. Average home values in Hefei soared 50% last year.

...

"No one had any idea real estate would get this hot here," said Huang Qingyuan, a sales agent for one of Hefei's most expensive housing estates — they go for about $120,000 per apartment.

While pricey by local standards, that's still a fraction of what homes cost in the capital.

[In a building that is sold out, Guo Hongbing, a marketing consultant for several developers] was interested in estimating how many were left empty by investors. His unscientific method? Looking for curtains.A few key points:

"See, less than half that building is occupied," he said, pointing to one block with several bare windows. "These speculators want to buy as many possible."

Of course the rules could change. From Esther Fund at the WSJ: China Considers U.S.-Style Property Tax

China is considering introducing new or higher taxes on real estate, possibly even a U.S.-style property tax, which would mark a significant escalation of its struggle to cool down a booming property market now widely being described as a bubble.This is different than the loose credit driven bubble in the U.S. Per my friend Michael in China:

How authorities handle any kind of property tax—the prospect of which is fiercely opposed by some property developers—will have significant implications for China's economy ...

The majority of homes in China are purchased with down payments between 30-40%, which is required by the banks, and nearly 25% of homes are purchased with all cash. Only those qualifying for low-cost housing can purchase a home with a minimum down payment as low as 20%.If anything the lending is stricter now. But this property tax proposal (or something similar) could have a real impact.

Sunday afternoon Greece: "Most important week of Europe’s monetary union"

by Calculated Risk on 4/25/2010 04:04:00 PM

The previous post was the weekly summary and a look ahead ...

On Greece, from the Financial Times: Greek aid depends on budget cut plans

Greece has been told to produce detailed plans this week to meet its budget deficit reduction targets in 2011 and 2012, as well as this year, before it can qualify for a ... rescue package ...And from Wolfgang Münchau at the Financial Times: Greece is Europe’s very own subprime crisis

excerpt with permission

This is going to be the most important week in the 11-year history of Europe’s monetary union. By the end of it we will know whether the Greek fiscal crisis can be contained or whether it will metastasise to other parts of the eurozone.Münchau suggests three things to watch: 1) to see if Greece presents a credible plan (Münchau says what he has heard is "deeply discouraging"), 2) that the loan package has to be substantially more than €45bn (Münchau says €80bn) and 3) the situation in Germany (Angela Merkel is still struggling for support).

Meanwhile from Bloomberg: Papaconstantinou Tells Investors Don’t Attack Greece

[Greek Finance Minister George Papaconstantinou] expressed confidence the talks will be “concluded rather soon” and said his country wouldn’t restructure its debt.A key date is May 19th when €8.5bn of Greece's bonds mature.