by Calculated Risk on 4/23/2010 01:00:00 PM

Friday, April 23, 2010

Home Sales: Distressing Gap

First a comment on the seasonal adjustment ... on a Not Seasonally Adjusted (NSA) basis, the Census Bureau reported there were 38,000 new homes sold in March. That is up from 31,000 in March 2009.

Some (or all) of the increase was due to a one time event - the tax credit that expires in April. The Census Bureau doesn't know the number of homes sold due to the tax credit, so they report the Seasonally Adjusted Annual Rate (SAAR) assuming this is the underlying rate of sales. It isn't.

The April new home sales headline number will be distorted too, but the key is the actual underlying sales rate is much lower.

Note: remember the tax credit shows up in the new home sales numbers when the contract is signed (March and April), and in the existing home sales numbers when the transactions are closed (April through June).

The following graph shows existing home sales (left axis) and new home sales (right axis) through March. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The spike in existing home sales last year was due primarily to the first time homebuyer tax credit. Notice that there was also a bump last year in new home sales from the tax credit.

We are seeing another bump this year with the expiration of the extension of the tax credit.

The second graph shows the same information as a ratio - new home sales divided by existing home sales - through March 2010. The ratio increased because the tax credit impacts new home sales first. I suspect this ratio will be at or near the all time low later this year.

The ratio increased because the tax credit impacts new home sales first. I suspect this ratio will be at or near the all time low later this year.

Eventually this ratio will return to the historical range of new home sales being around 15% to 20% of existing home sales. However it will probably take a number of years to return to a more normal market.

New Home Sales at 411K in March

by Calculated Risk on 4/23/2010 10:00:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 411 thousand. This is an increase from the revised rate of 324 thousand in February (revised from 308 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2010. In March 2010, 38 thousand new homes were sold (NSA).

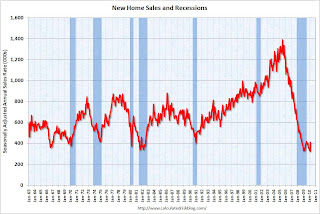

The record low for March was 31 thousand in 2009. The second graph shows New Home Sales vs. recessions for the last 45 years.

The second graph shows New Home Sales vs. recessions for the last 45 years.

Sales of new single-family houses in March 2010 were at a seasonally adjusted annual rate of 411,000 ... This is 26.9 percent (±21.1%) above the revised February rate of 324,000 and is 23.8 percent (±18.7%) above the March 2009 estimate of 332,000.And another long term graph - this one for New Home Months of Supply.

Months of supply declined to 6.7 in March from 8.6 in February. This is significantly below the all time record of 12.4 months of supply set in January 2009, but still higher than normal.

Months of supply declined to 6.7 in March from 8.6 in February. This is significantly below the all time record of 12.4 months of supply set in January 2009, but still higher than normal.The seasonally adjusted estimate of new houses for sale at the end of March was 228,000. This represents a supply of 6.7 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. New home sales are counted when the contract is signed, so this pickup in activity is probably related to the tax credit. Note that that a few thousand extra sales NSA in March can make a huge difference in the SAAR.

Any further pickup in sales because of the tax credit will happen in April and then sales will probably decline again.

Greece Asks for Bailout

by Calculated Risk on 4/23/2010 08:32:00 AM

From Niki Kitsantonis and Matthew Saltmarsh at the NY Times: Greece Calls for Activation of Financial Rescue Package

Describing his country’s economy as “a sinking ship,” the Greek prime minister formally requested an international bailout on Friday ... The plan foresees up to €30 billion, or $40 billion, in loans from Greece’s euro-zone partners, as well as up to €15 billion from the International Monetary Fund.Not exactly a surprise ...

Late Night Greece Update

by Calculated Risk on 4/23/2010 01:36:00 AM

From the WSJ: Bonds Fall as Investors View Bailout and Default as Givens

The European Union's statistical authority said Thursday that Greece's 2009 budget deficit—already yawning—was wider than Athens had estimated. Also Thursday, Moody's Investors Service downgraded Greece's debt rating.And from The Times: Euro suffers as Greek credit rating takes another dive

Those twin developments sent Greek bond prices into a tailspin, a selloff that spread to bond markets in Portugal and Spain.

The euro skidded to its lowest level against the dollar in almost a year last night after Greece suffered another downgrade in its credit rating.The never ending saga ...

...

Sarah Carlson, Moody’s senior analyst for Greece, said: “It is unlikely that the rating will remain at A3, unless the Government’s actions can restore confidence in the markets and counteract the prevailing headwinds of high interest rates and low growth.

Thursday, April 22, 2010

Senate Panel: Rating Agencies Traded Fees for Ratings

by Calculated Risk on 4/22/2010 07:05:00 PM

From Kevin G. Hall and Chris Adams at McClatchy Newspapers:

Senate panel: Ratings agencies rolled over for Wall Street

A Senate panel investigating the causes of the nation's financial crisis on Thursday unveiled evidence that credit-ratings agencies knowingly gave inflated ratings to complex deals backed by shaky U.S. mortgages because of the fees they earned for giving such investment-grade ratings.I'm stunned but not surprised ...