by Calculated Risk on 4/09/2010 08:49:00 AM

Friday, April 09, 2010

Bank Failures and Puerto Rico

It appears the FDIC is getting closer to taking action in Puerto Rico.

Back in February, José Carmona and John Marino at caribbeanbusinesspr.com wrote: Feds expected to take action against island banks next month and last month from Dow Jones: FDIC Seeks Buyers for Three Puerto Rican Banks

Joe Adler explains some of the complications in Puerto Rico writing in American Banker: Puerto Rico Forces FDIC to Scramble

Three banks on the island holding more than $20 billion of assets are in trouble ... The banks — $12 billion-asset Westernbank Puerto Rico, $6 billion-asset R-G Premier Bank of Puerto Rico and $2.6 billion-asset Eurobank — account for nearly a quarter of the assets on the island ...It appears the remaining healthy banks in Puerto Rico don't have the capacity to acquire these troubled banks - and most banks not in Puerto Rico just aren't interested.

Many observers said the FDIC cannot afford to deal with each failure individually. ... if the FDIC needs to resolve all three institutions at the same time, it may face a shortage of buyers. ...

Moreover, the large mainland banking companies ... have all but abandoned Puerto Rico. ... "There hasn't been a lot of interest from banks who aren't already in Puerto Rico," said Joe Gladue, an analyst with B. Riley & Co. Inc.

Thursday, April 08, 2010

Bernanke: Economic Policy: Lessons from History

by Calculated Risk on 4/08/2010 08:46:00 PM

From Fed Chairman Ben Bernanke: Economic Policy: Lessons from History

I thought that I would speak to you about the parallels--and differences--between [the Great Depression] and the [great recession], particularly regarding the responses of policymakers. I draw four relevant lessons from the financial collapse of the 1930s ...CR Note: Bernanke goes on to argue the first "lesson has been learned". Maybe. I think financial stability means being proactive, not reactive. And I think NY Fed President William Dudley was on the right track when he discussed identifying bubbles, and the possible tools available to policymakers to pop bubbles early.

The first lesson--economic prosperity depends on financial stability--seems obvious, but this connection was not always well understood. After the stock market crash of 1929, many thought a financial and economic crisis was necessary--even desirable--to wring out speculative excesses that had built up in the 1920s. Remarkably, despite the fact that the Federal Reserve had been founded to mitigate financial panics, the central bank made essentially no effort to prevent the wave of bank failures that paralyzed the financial system at the start of 1930s. ...

Economists themselves have not always fully appreciated the importance of a healthy financial system for economic growth or the role of financial conditions in short-term economic dynamics. ... In contrast, more recent work on the subject, to which I contributed, showed that the health of the financial system and the performance of the broader economy are closely interrelated, both in the short run and in the long run.

[T]he second [lesson]--policymakers must respond forcefully, creatively, and decisively to severe financial crises. Early in the Depression, policymakers' responses ran the gamut from passivity to timidity. They were insufficiently willing to challenge the orthodoxies of their day--such as the liquidationist doctrine of Mellon and others, or the rigid adherence to the variant of the gold standard adopted after World War I. ...CR: Bernanke deserves praise for his creative and aggressive response - once he finally understood what was happening.

In the Depression, effective policy responses came only after three to four years of financial crisis and economic contraction. In our own time, policymakers acted sooner and with greater force than in the 1930s. For example, in October 2008, just weeks after the sharp intensification of the crisis, the Congress authorized the Troubled Asset Relief Program (TARP) to support stabilization of the financial system. It was far from perfect legislation, but it was essential for preventing an imminent financial collapse. For its part, the Federal Open Market Committee, the monetary policymaking arm of the Federal Reserve, sharply and proactively cut its target for short-term interest rates from the fall of 2007 through 2008. After the target could go no lower, the Committee embarked on an unprecedented (for the United States) program of long-term securities purchases, recently completed, to support private credit markets, including the mortgage market.

[T]he third lesson: International crises require an international response. ... In the recent episode, policymakers, bankers, and business people recognized that the world's economies and financial systems would sink or swim together.Excuse my snark, but it is refreshing to hear Bernanke speaks about monetary policy issues.

...

I'll conclude with the cautionary fourth lesson--history is never a perfect guide. ... [O]ur traditional tools, developed in an earlier era, were of little use in addressing panic in the shadow banking system or in the money market mutual fund industry. So, we engaged in what I call "blue sky thinking"--generating many ideas. Most were discarded, but, crucially, some led to the development of new ways for the Federal Reserve to fulfill the traditional stabilization function of central banks. Using emergency authority last employed during the Depression, we created an array of new facilities to provide backstop liquidity to the financial system (and, as a byproduct, coined many new acronyms). Thus, we were able to help restore the flow of credit to American families and businesses by shoring up important financial markets, such as those for commercial paper and securities backed by consumer loans.

Euro Bonds Spreads: Greece at Record

by Calculated Risk on 4/08/2010 05:20:00 PM

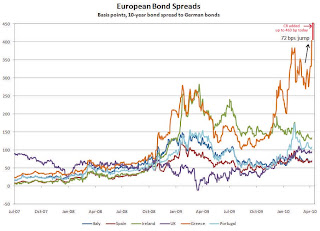

Here is a graph from the Atlanta Fed weekly Financial Highlights released today (graph as of April 6): Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

European bond spreads (over German bonds) reflectAccording to The Times: Greece on the brink as bond rates surge to record highs the Greek Bond spread increased to an all time record 463 bps today (shown on graph in red).

investors’ worries about Greece’s sovereign credit risk.

On April 6, the spread of the 10-year Greek bond over its German counterpart widened by 72bps to 404.5 bps, the widest since 1998, according to the Wall Street Journal.

There is very little change for the other PIIGS (Portugal, Italy, Ireland, and Spain), although the UK spreads suggest we might need to add a "U" to "PIIGS".

Report: Distressed Home Sales Increasing

by Calculated Risk on 4/08/2010 02:33:00 PM

First American Corelogic released their first distressed sales report this morning: Distressed Sales Again on the Rise, Reaching 29% in January

First American CoreLogic today released its first monthly report on distressed sales activity. The report below indicates that distressed home sales – such as short sales and real estate owned (REO) sales – accounted for 29 percent of all sales in the U.S. in January: the highest level since April 2009. The peak occurred in January 2009 when distressed sales accounted for 32 percent of all sales transactions (Figure 1). After the peak in early 2009, the distressed sale share fell to 23 percent in July, before rising again in late 2009 and continuing into 2010.Here are a couple of graphs from the report:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Credit: First American Corelogic.

This graph shows the total percent of distressed sales broken down by REO and Short Sales. Notice that the percent short sales has increased significantly over the last year - that trend will probably continue.

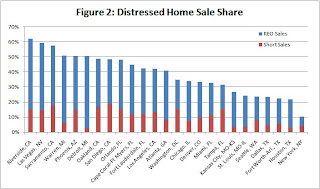

The second graph shows the breakdown by certain metropolitan areas.

The second graph shows the breakdown by certain metropolitan areas. Among the largest 25 markets, Riverside, CA, had the largest percentage of distressed sales in January (62 percent), followed closely by Las Vegas (59 percent) and Sacramento (58 percent) (Figure 2). The top REO market was Detroit where the REO share was 48 percent, followed closely by Riverside (47 percent) and Las Vegas (45 percent). San Diego’s short sale share was 19 percent in January, making it the highest ranked short sale market, followed by Sacramento (18 percent) and Oakland (16 percent). Although the top 10 markets for foreclosures are all located in Florida, only two Florida markets, Orlando and Cape Coral, made the top 10 distressed sale list. The most likely reason: Florida is a judicial state where foreclosures process through the courts and take quite a bit longer than in California, Arizona or Nevada, where non‐judicial foreclosures are the norm.I've been following the Sacramento market as an example of a distressed market - and the Sacramento Association of REALTORS® reported that almost 69% of sales were distressed in January, with 24% short sales, and 45% REOs. The FACL data shows about 58% as distressed. The difference is probably in the methodology.

The exact numbers probably aren't as important as the trend - and this will be an interesting trend to follow in 2010.

Hotel Occupancy declines compared to same week in 2009

by Calculated Risk on 4/08/2010 11:32:00 AM

From HotelNewsNow.com: STR: Luxury leads weekly performance

Overall, the U.S. industry’s occupancy ended the week with a 3.6-percent decrease to 54.1 percent, ADR dropped 4.4 percent to US$94.45, and RevPAR was down 7.9 percent to US$51.05.The following graph shows the occupancy rate by week for 2009 and 2010, and the median for 2005 through 2007.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change, and the holidays don't always line up.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

The decline in occupancy this week breaks a streak of six consecutive weeks with higher year-over-year occupancy rates. Remember that last year (2009) was the lowest occupancy rate since the Great Depression - the average for this week is around 66%, so the current 54.1% is far below normal.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com