by Calculated Risk on 4/07/2010 12:15:00 PM

Wednesday, April 07, 2010

NY Fed's Dudley: Fed should take "proactive approach" to Asset Bubbles

The Fed's previous view was bubbles were hard to identify and the Fed's role was to clean up after a collapse. Now that view is changing ...

From NY Fed President William Dudley: Asset Bubbles and the Implications for Central Bank Policy

... Today I want to tackle a difficult subject: How should central bankers deal with potential asset price bubbles. ...Dudley discusses the stock market and housing bubbles and the various tool available to the Fed to lean again the bubbles, and then concludes:

As I see it, we need to reexamine how central banks should respond to potential asset bubbles. After all, recent experience has underscored the fact that poorly regulated financial systems are prone to such bubbles and that the costs of waiting to respond to an asset bubble until after it has burst can be very high.

Today, I will try to define some of the important characteristics of asset price bubbles. I will argue that bubbles do exist and that bubbles typically occur after an innovation that has created uncertainty about fundamental valuations. This has two important implications. First, a bubble is difficult to discern and, second, each bubble has unique characteristics. This implies that a rules-based approach to bubbles is likely to be ineffective and that tackling bubbles to diminish their potential to destabilize the financial system requires judgment.

Despite the fact that it is hard to discern bubbles, especially in their early stages, I conclude that uncertainty is not grounds for inaction.

In my view, a proactive approach is appropriate when three conditions are satisfied: First, circumstances should suggest that there is a meaningful risk of a future asset price crash that could threaten financial stability. Second, we have identified tools that might have a reasonable chance of success in averting such an outcome. Third, we are reasonably confident that the costs of using the tools are likely to be outweighed by the benefits from averting the prospective crash. When these three conditions are satisfied, we should be willing to act.

MBA: Mortgage Refinance Actvity Declines as Rates Rise

by Calculated Risk on 4/07/2010 08:52:00 AM

The MBA reports: Mortgage Refinance Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 11.0 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 16.9 percent from the previous week and the seasonally adjusted Purchase Index increased 0.2 percent from one week earlier. ...

The refinance share of mortgage activity decreased to 58.7 percent of total applications from 63.2 percent the previous week, marking the lowest share observed in the survey since the week ending August 28, 2009. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.31 percent from 5.04 percent, with points decreasing to 0.64 from 1.07 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest 30-year rate recorded in the survey since the first week of August 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Although purchase activity was flat week-to-week, the four week average is moving up due to buyers trying to beat the expiration of the tax credit. I expect any increase in activity this year to be less than the increase last year when buyers rushed to beat the expiration of the initial tax credit.

Tuesday, April 06, 2010

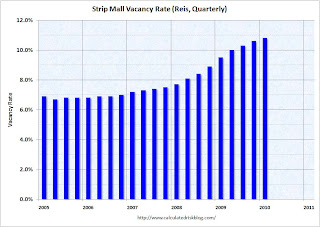

Reis: Strip Mall Vacancy Rate Hits 10.8%, Highest since 1991

by Calculated Risk on 4/06/2010 11:59:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the WSJ: Shopping-Center Malaise

Vacancies at shopping centers in the top 77 U.S. markets increased to 10.8% in the first quarter ... according to Reis.This is up from 10.6% in Q4 2009 and 9.5% in Q1 2009.

It is the highest vacancy rate since 1991, when vacancies reached 11%.

Vacancy rates at malls in the top 77 U.S. markets rose to 8.9% in the January-to-March period ...The 8.9% is the highest since Reis began tracking regional malls in 2000. Lease rates fell for the seventh consecutive quarter.

"The stress might be lessening and rent declines might be moderating," said Reis director of research Victor Calanog. "But we don't see positive rent growth resuming until the middle of next year at the earliest, just because of the typical lag."

FOMC Minutes on Housing

by Calculated Risk on 4/06/2010 07:31:00 PM

I want to highlight the housing comments in the FOMC minutes for the March 16, 2010 meeting:

Participants were also concerned that activity in the housing sector appeared to be leveling off in most regions despite various forms of government support, and they noted that commercial and industrial real estate markets continued to weaken. Indeed, housing sales and starts had flattened out at depressed levels, suggesting that previous improvements in those indicators may have largely reflected transitory effects from the first-time homebuyer tax credit rather than a fundamental strengthening of housing activity. Participants indicated that the pace of foreclosures was likely to remain quite high; indeed, recent data on the incidence of seriously delinquent mortgages pointed to the possibility that the foreclosure rate could move higher over coming quarters. Moreover, the prospect of further additions to the already very large inventory of vacant homes posed downside risks to home prices.And from the staff:

The staff did make modest downward adjustments to its projections for real GDP growth in response to unfavorable news on housing activity, unexpectedly weak spending by state and local governments, and a substantial reduction in the estimated level of household income in the second half of 2009. The staff's forecast for the unemployment rate at the end of 2011 was about the same as in its previous projection.This fits with my comments in response to Minneapolis Fed President Narayana Kocherlakota's speech today: It isn't the size of the sector, but the contribution during the recovery that matters - and housing is usually the largest contributor to economic growth early in a recovery. And as the FOMC notes, there isn't much contribution from residential investment right now (in fact the contribution from RI will probably be negative in Q1 2010).

And on employment, residential investment probably contibuted significantly to employment growth following previous recessions - especially for residential construction employment - although the BLS didn't break out residential construction for the earlier periods.

CNBC's Olick: Foreclosure "Pig in the python is showing its face"

by Calculated Risk on 4/06/2010 03:38:00 PM

From Diana Olick at CNBC: Foreclosures Are Rising

Yes, banks are ramping up loan modifications and ramping up short sales and ramping up deeds in lieu of foreclosure, but the plain fact is that as the systems are oiled, the loans are moving through faster, and the pig in the python is showing its face.The foreclosures are coming! The foreclosures are coming!

We won't get the [foreclosure] numbers until next week, but sources tell me they will likely be a new monthly record.

I don't think there is any question that foreclosures will pick up. And now is a good time to get properties on the market. As an example, Freddie Mac just announced an auction of homes: Freddie Mac, New Vista to Auction Hundreds of Homes on April 24 in Las Vegas, April 25 in California's Inland Empire Before Federal Homebuyer Tax Credit Expires

Freddie Mac (NYSE:FRE) and New Vista today announced plans to auction hundreds of HomeSteps® REO homes to individual homebuyers in Las Vegas on April 24, 2010 and in California’s Inland Empire on April 25, 2010 in support of the federal Neighborhood Stabilization Program (NSP) and to help more first time homebuyers and owner occupants purchase these homes. HomeSteps is the real estate sales unit of Freddie Mac and markets a nationwide selection of Freddie Mac-owned homes.

...

By scheduling these two auctions on April 24 and 25, bidders may still be able to qualify for the federal home purchase tax credit, which is set to expire on April 30, 2010. The tax credit offers eligible first time homebuyers up to $8,000 on qualifying homes.