by Calculated Risk on 4/02/2010 09:18:00 AM

Friday, April 02, 2010

Live Chat with BLS at 9:30 AM ET

Note: See March Employment Report: 162K Jobs Added, 9.7% Unemployment Rate for graphs. I'll post more graphs after the chat.

The BLS will host a live chat starting at 9:30 AM ET. You can follow the chat below (and ask questions).

After the discussion, the chat will be available for replay.

March Employment Report: 162K Jobs Added, 9.7% Unemployment Rate

by Calculated Risk on 4/02/2010 08:43:00 AM

From the BLS:

Nonfarm payroll employment increased by 162,000 in March, and the unemployment rate held at 9.7 percent, the U.S. Bureau of Labor Statistics reported today.

Click on graph for larger image.

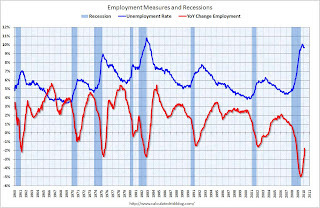

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls increased by 162,000 in March. The economy has lost 2.3 million jobs over the last year, and 8.2 million jobs since the beginning of the current employment recession.

The unemployment rate was steady at 9.7 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Census 2010 hiring was 48,000 (NSA) in March.

This was about at expectations given the level of Census 2010 hiring and some bounce back from the snow storms in February. I'll have much more soon ...

Note: I'll post a live chat with the BLS (starts at 9:30 AM ET), and more graphs around 10:30 AM ET.

Thursday, April 01, 2010

NY Times on Wage Garnishment

by Calculated Risk on 4/01/2010 11:54:00 PM

From John Collins Rudolf at the NY Times: Moves to Garnish Pay Rise as More Debtors Fall Behind (ht Ann)

One of the worst economic downturns of modern history has produced a big increase in the number of delinquent borrowers, and creditors are suing them by the millions.I'm surprised there isn't a move to rework the Orwellian-named "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". We definitely need a consumer financial protection agency. Look at this example from the Times story:

...

Bankruptcy can clear away most debts. Yet sweeping changes to federal law in 2005 — pushed by the banking lobby — complicated that process and more than doubled the average cost of filing, to more than $2,000. Many low-income debtors must save for months before they can afford to go broke.

Ruth M. Owens, a disabled Cleveland woman, was sued by Discover Bank in 2004 for an unpaid credit card. Ms. Owens offered a defense, sending a handwritten note to the court.

“After paying my monthly utilities, there is no money left except a little food money and sometimes it isn’t enough,” she wrote.

Robert Triozzi, a judge at the time, heard the case. He found that over a period of several years, Ms. Owens had paid nearly $3,500 on an original balance of $1,900. But Discover was suing her for $5,564, mostly for late fees, compound interest, penalties and other charges. He called Discover’s actions “unconscionable” and threw the case out.

NY Times: Hu Coming to D.C. suggests possible currency deal

by Calculated Risk on 4/01/2010 10:18:00 PM

From Vikas Bajaj at the NY Times: Coming Visit May Signal Easing by China on Currency

[T]he announcement by Chinese authorities on Thursday that President Hu Jintao will be visiting Washington in two weeks is being seen as the beginning of a possible easing of the friction over the renminbi.There is much more in the article, but I think it is unlikely that China will be named a currency manipulator on April 15th - and likely that China will allow their currency to appreciate.

China experts said it was unlikely that China would have agreed to the visit unless there was at least an informal assurance by the Treasury Department that it would not be named a currency manipulator either on or around April 15 — the deadline for the Obama administration to submit one of its twice-a-year reports on foreign exchange to Congress.

At the same time, economists say the visit, and other Chinese moves, suggest China is finally willing to let the renminbi increase in value.

Countdown: Fed MBS Purchase Program Complete

by Calculated Risk on 4/01/2010 06:14:00 PM

Just to complete the countdown, the NY Fed purchased an additional net $6.074 billion in MBS for the week ending March 31st. That puts the total purchases at $1.25 trillion ... and completes the program right on schedule.

The Fed's balance sheet today shows $1.074 trillion in MBS. As mentioned before, the difference is the NY Fed announces the purchases when they contract to buy; the Federal Reserve places the MBS on the balance sheet when the contract settles. The Fed's balance sheet will probably expand by $150+ billion over the next two months as the remaining contracts settle.

The spread between mortgage rates and treasuries widened slightly, from Bloomberg: Mortgage-Bond Yields That Guide Loan Rates Rise to 3-Month High.

Fannie Mae’s current-coupon 30-year fixed-rate mortgage bonds climbed 0.05 percentage point to 4.56 percent as of 5 p.m. in New York, the highest since Dec. 28, according to data compiled by Bloomberg.Oh boy, a 10 bps widening from the low! I expect the spread to widen slowly and push up mortgage rates a little (at least the spread between the Ten Year and the 30 Year fixed rate).

...

The difference between yields on Washington-based Fannie Mae’s securities and 10-year Treasuries widened for a third day, rising about 0.01 percentage point to 0.69 percentage point, Bloomberg data show.

That spread reached 0.59 percentage point on March 10, the lowest since at least 1984, as the Fed’s purchases of agency mortgage bonds approached their scheduled conclusion. The gap averaged 1.32 percentage points from 2000 through 2009.

On mortgage rates, Freddie Mac reported today:

Freddie Mac (NYSE:FRE) today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.08 percent with an average 0.7 point for the week ending April 1, 2010, up from last week when it averaged 4.99 percent. Last year at this time, the 30-year FRM averaged 4.78 percent.