by Calculated Risk on 3/22/2010 05:32:00 PM

Monday, March 22, 2010

Fed's Lockhart: The U.S. Economy and Emerging Risks

From Atlanta Fed President Dennis Lockhart: The U.S. Economy and Emerging Risks. Lockhart reviews his general forecast for a modest U.S. recovery and then discusses risks from Greece (sovereign debt) and fiscal uncertainty - especially for U.S. states and local government:

There are other plausible emerging scenarios that are not factored into my formal outlook. I monitor these for evidence that they're materializing—becoming real—and need to be more formally considered. One such concern is what might be called "fiscal uncertainty."Earlier in his speech, Lockhart notes that "stabilization of the housing sector—especially house prices—is likely a precondition for sustained economic recovery". Housing is probably the major risk to Lockhart's view of a modest recovery.

You've all been reading about Greece and the European Union's handling of the Greek fiscal crisis. At the moment a nexus of fiscal uncertainty is the situation playing out in Greece.

Last October, the government of Greece revised its 2009 fiscal deficit sharply higher to more than 12 percent of GDP. Consequently, the ratio of public debt to GDP was revised up by 17 percentage points this year to 125 percent of GDP.

Investors around the world are concerned about Greece's deficit and rising debt. Market pressures, along with European Monetary Union mandates, have forced the government to present a credible plan to tame its deficit. As of today, how this will play out is not clear.

It's worth considering whether this is just a distant development or one with relevance to us here in the United States. What do fiscal problems in Greece have to do with my economic outlook for the United States?

I see three ways the Greek crisis might directly affect the U.S. economy. First, adjustment across the EU to fiscal problems could dampen euro area growth and constrain U.S. exports to that region. The European Union as a whole is this nation's largest export market. Second, related to this, safe haven currency flows from the euro into dollar assets could cause appreciation of the dollar and hurt U.S. export competitiveness. Third is the possibility that the Greek fiscal crisis could lead to a broad shock to financial markets. This could play out in the banking system or in the form of a general retreat from sovereign debt.

At this point, these possibilities are not factored into my outlook in any way. But developments around the Greek situation deserve rapt attention.

We have our own set of fiscal uncertainties in this country—at all levels of government. The National League of Cities projects that municipal governments will face a shortfall of $56 billion to $83 billion from 2010 to 2012. Local governments in this country are pressured by lower sales tax revenues and shrinking property tax digests along with other demands.

On average, state-level governments began fiscal year 2010 with a revenue-expenditure gap of 17 percent. Three states had expected budget gaps in excess of 40 percent. ...

Across the country, state governments have responded to these strains by drawing down rainy day funds, raising taxes, cutting budgets, and furloughing employees.

To date, some amount of spending cuts and tax increases at the state level have been avoided thanks to the federal stimulus package, but that infusion of money is temporary. It appears state budgets next year will need to shrink considerably to get to balance.

I'm sure you're familiar generally with the situation at the federal level. According to the Congressional Budget Office, under current law federal budget deficits rose from an average of about 2.4 percent of GDP in the period from 1970 to 2008 to 10 percent in 2009. No budget path currently under consideration would keep the public debt from growing relative to gross domestic product. Clearly, an ever-rising debt-to-GDP ratio is unsustainable and a matter of great concern.

Government finances are severely strained at all levels. All of these fiscal pressures represent another downside risk for the broad economy.

emphasis added

The Pressure on Malls: More Store Closings

by Calculated Risk on 3/22/2010 02:06:00 PM

Hang Nguyen at the O.C. Register has an interesting post from the Bank of America Merrill Lynch 2010 consumer conference:

Pat Connolly, executive vice president [Williams-Sonoma Inc., which also owns Pottery Barn]: "We are committed to restoring our retail channel profitability to historical levels ... We are working diligently to restructure our portfolio of stores and optimize our sales and costs per square foot. This will be accomplished by selective store closings and lease negotiations ... Over the next three fiscal years, 25 percent of our store leases will reach maturity ... E-commerce is 30 percent of our corporate revenue and it’s very profitable ... even in this environment. The Internet and e-commerce have become the focus on our capital investment."As the leases expire, Williams-Sonoma will be looking to cut the lease rates substantially, or close the stores. This is especially true in multi-store markets.

Sharon McCollam, chief operating officer and chief financial officer: "Every quarter last year, we increased the number of stores that we plan to close ... If we could get the deals (with landlords) done, we would not necessarily want to close stores if you could get to the profitability levels you were historically. ... However, we don’t believe that that is a strategy that can be executed. So there will be additional store closings ...

Other retailers probably have similar plans, and that means that malls will be facing rising vacancies and lower rents for some time.

For Q4 2009, real estate research firm Reis reported that the mall (and strip mall) vacancy rates were the highest since Reis began tracking the data. At the time, Reis economist Ryan Severino said:

"Our outlook for retail properties as a whole is bleak ... we do not foresee a recovery in the retail sector until late 2012 at the earliest."The comments from Williams-Sonoma executives fit with Severino's forecast.

Note: The Q1 mall vacancy rate be released in early April, and I expect more records.

Moody's: CRE Prices increase 1% in January 2010

by Calculated Risk on 3/22/2010 12:55:00 PM

From Bloomberg: U.S. Property Index Rises for Third Straight Month

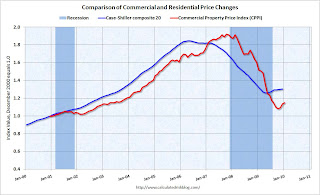

The Moody’s/REAL Commercial Property Price Index climbed 1 percent from December, Moody’s said today in a report. Values are 40 percent lower than the peak in October 2007. The index fell 24 percent from a year earlier.Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

...

The number of transactions fell 8 percent to 376 in January from a year earlier and was lower than December, when buyers and sellers tried to complete deals before the year’s end, according to the report.

“A few months of price gains does not necessarily indicate a sustainable trend, particularly in these difficult times,” Moody’s said.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices peaked in late 2007 and are now 40% below the peak in October 2007. Prices are at about the same level as early 2003.

DOT: Vehicle Miles Driven decline in January

by Calculated Risk on 3/22/2010 09:45:00 AM

Yesterday we discussed the impact of high oil prices on vehicle miles driven.

And today the Department of Transportation (DOT) reported that vehicle miles driven in January were down from January 2009:

Travel on all roads and streets changed by -1.6% (-3.7 billion vehicle miles) for January 2010 as compared with January 2009. Travel for the month is estimated to be 222.8 billion vehicle miles.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent change from the same month of the previous year as reported by the DOT.

As the DOT noted, miles driven in January 2010 were down -1.6% compared to January 2009, and miles driven have declined 2.9% compared to January 2008, and are down 4.7% compared to January 2007. This is a multi-year decline, and miles driven appear to be falling again.

Chicago Fed: Economic Activity index decreased in February

by Calculated Risk on 3/22/2010 08:30:00 AM

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity slowed in February

Led by declines in production-related indicators, the Chicago Fed National Activity Index decreased to –0.64 in February, down from –0.04 in January. Three of the four broad categories of indicators that make up the index deteriorated, and only the sales, orders, and inventories category made a positive contribution.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.39 in February from –0.13 in January, but for the second consecutive month, it was higher than at any point since December 2007. February’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend.

...

Most of the weakness in the index continued to stem from the consumption and housing category. ... Employment-related indicators also made a negative contribution to the index, contributing –0.16 to the index in February compared with –0.02 in January.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A CFNAI-MA3 value below –0.70 following a period of economic expansion indicates an increasing likelihood that a recession has begun. A CFNAI-MA3 value above –0.70 following a period of economic contraction indicates an increasing likelihood that a recession has ended. A CFNAI-MA3 value above +0.20 following a period of economic contraction indicates a significant likelihood that a recession has ended.According to Chicago Fed, it is still too early to call the official recession over - but with the three month average CFNAI-MA3 above -0.70, the likelihood that a recession has ended is increasing.