by Calculated Risk on 3/19/2010 10:15:00 AM

Friday, March 19, 2010

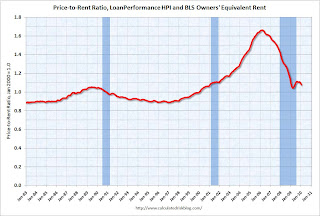

Housing: Price-to-Rent Ratio

Here is an update on the price-to-rent ratio using the First Amercican CoreLogic price index released yesterday for house prices through January.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

The following graph uses the First American data ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the price to rent ratio (January 2000 = 1.0).

This suggests that house prices are still a little too high on a national basis. But it does appear that prices are much closer to the bottom than the top.

Also, OER declined slightly again in February. The price index has declined 6 of the last 8 months, although most of the declines have been very small. With rents still falling, the OER index will probably continue to decline - pushing up the price-to-rent ratio.

Rents Expected to decline through 2011 in Seattle

by Calculated Risk on 3/19/2010 08:28:00 AM

From Vanessa Ho at Seattlepi.com: Renters, rejoice: Apartments are cheap and the iPod is free (ht Patrick)

"We've done holiday specials -- a one-night stay in a downtown hotel - or an iPod nano," said [Craig Dwyer, vice-president of Seattle-based Pinnacle Family of Companies] residential division. "We've done a microwave. We even did a 32-inch flat panel TV."I'm starting to hear stories about vacancy rates stabilizing in some markets, although rents are probably still falling in most areas. This will keep pressure on CPI and house prices.

After peaking in 2006 and 2007, rents in King, Snohomish and Pierce counties tanked over the course of last year by nearly 4 percent, according to [Mike Scott, whose firm, Dupre + Scott, researches the Puget Sound apartment market]. He expects rents will continue to plummet this year by 5 percent, and again in 2011, but less dramatically.

In Seattle, property managers say that trend has been more pronounced, with some rents dropping as much as 15 to 20 percent last year. ... Bart Flora, co-owner of Cornell & Associates, which manages 6,500 properties in the city, said some, in-city, one-bedroom apartment now rent for $800 to $850, instead of roughly $1,000 two years ago.

"It's the steepest drop I've ever encountered in 25 years, certainly in my career," said Flora. He added that he believed the market - at least in Seattle - appears to have hit bottom and is stabilizing.

Thursday, March 18, 2010

WSJ: Supply of Foreclosed Homes Increases

by Calculated Risk on 3/18/2010 10:32:00 PM

From James Hagerty at the WSJ writes about a Barclays Capital report: Supply of Foreclosed Homes on the Rise Again

Hagerty notes that the analysts at Barclays Capital estimate that various lenders held 645,800 REO (Real Estate Owned) in January, up 4.6% from 617,286 in December.

Also Barclays estimated the peak supply was in November 2008 at 845,000, and then declined through 2009. Barclays is projecting the supply will increase to 733,000 in April 2010, and then gradually decline.

The current supply is similar to the analysis from Tom Lawler that I posted yesterday. These number from Barclays are a little higher (Lawler noted he wasn't including everything, but the pattern is the same).

As an aside, here is a video from Steven Russolillo at Dow Jones (posted at the WSJ): Financial Blogs Grow Up

Thanks!

C.A.R. Outlines Possible Criminal Penalties for Undisclosed 2nd Lien Payments

by Calculated Risk on 3/18/2010 07:59:00 PM

In a recent email to agents on March 16th, the California Association of Realtors (C.A.R.) points out that making undisclosed 2nd lien payments in a short sale transaction could be a crime and punishable by up to 30 years in prison.

The email points out that undisclosed payments might violate HUD's RESPA (Real Estate Settlement Procedures Act) and laws against loan fraud.

In addition any agent participating in the scheme might be subject to disciplinary action and could have their license revoked.

Apparently the requests by 2nd lien holders are common. The C.A.R. reported: "Short sale agents have increasingly reported to C.A.R. about requests for agents and their clients to pay junior lienholders and others, often times outside of escrow."

Although the email doesn't address possible criminal activity of 2nd lienholders, it would appear the junior lienholders are soliciting a crime if they ask for a payments and suggest that the payment not be disclosed on the settlement documents. Properly disclosed payments to junior lienholders are perfectly fine and legal.

I doubt law enforcement will pursue individual homeowners, so probably the best way to end this practice is to report the requests for payments outside of escrow by 2nd lien holders (name of person and company holding the junior lien) to either HUD or the FBI.

This possible fraud was first reported by Eric Wolff at the North County Times: Wrinkle raises questions in home short sales, and by Diana Olick at CNBC: Big Banks Accused of Short Sale Fraud

Perhaps this version of short sale fraud is finally getting the attention it deserves ...

Countdown: Fed MBS Purchase Program 99.2% Complete

by Calculated Risk on 3/18/2010 05:34:00 PM

Almost finished ...

For a discussion on how trades settle, and the coming associated expansion of the Fed's balance sheet over the next few months, please see my post last week.

From the Atlanta Fed weekly Financial Highlights released today (as of last week): Click on graph for larger image in new window.

Click on graph for larger image in new window.

Graph Source: Altanta Fed.

This graph shows the cumulative MBS purchases by week. From the Atlanta Fed:

The NY Fed purchased an additional net $10 billion in MBS for the week ending March 17th. This puts the total purchases at $1.240 trillion or 99.2% complete. Just $10 billion and two more weeks to go - and I don't expect any fireworks ...The Fed purchased a net total of $10 billion of agency-backed MBS through the week of March 10. This purchase brings its total purchases up to $1.23 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 98% complete).

Note: The Fed's balance sheet released today shows "only" $1.066 trillion in MBS on March 17th. As mentioned above, the difference is the NY Fed announces the purchases when they contract to buy; the Federal Reserve places the MBS on the balance sheet when the contract settles.