by Calculated Risk on 3/18/2010 12:51:00 PM

Thursday, March 18, 2010

Hotel Occupancy increases compared to same week in 2009

From HotelNewsNow.com: STR: New Orleans tops weekly numbers

Overall the industry’s occupancy ended the week with a 4.6-percent increase to 57.7 percent, ADR dropped 1.9 percent to US$97.80, and RevPAR was up 2.6 percent to US$56.44.The following graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

It appears that occupancy rates have bottomed and even started to increase, but the level is still well below normal - the average occupancy rate for this week is close to 62%, well above the current 57.7%. This low occupancy rate is still pushing down room rates (on a YoY basis) although revenue per available room (RevPAR) increased.

As mentioned last week, the other good news for the industry (although bad news for construction employment) is that the pipeline of new hotel projects has slowed sharply, see: STR: US pipeline for February 2010

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

First American CoreLogic: House Prices Decline 1.9% in January

by Calculated Risk on 3/18/2010 10:46:00 AM

The Fed's favorite house price indicator from First American CoreLogic’s LoanPerformance ...

From LoanPerformance: January Home Price Index Shows Narrowing Annual Decline

National home prices, including distressed sales, declined by 0.7 percent in January 2010 compared to January 2009, according to First American CoreLogic and its LoanPerformance Home Price Index (HPI). This was a significant improvement over December’s year-over-year price decline of 3.4 percent. Excluding distressed sales, year-over-year prices declined in January by 0.4 percent; while in December the non-distressed HPI fell by 3.3 percent year-over-year. Compared to a year ago, the month-to-month rate of decline is lessening – in January 2009, the HPI showed the largest one month decline in its more than 30-year history. On a month-over-month basis, the national average home price index decline accelerated, falling by 1.9 percent in January 2010 compared to 0.8 percent in December 2009, indicating the housing market still remains weak.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

The index is off 0.7% over the last year, and off 29% from the peak.

The index has declined for five consecutive months.

Banks failing to pay TARP dividends increases to 82

by Calculated Risk on 3/18/2010 09:24:00 AM

From Binyamin Appelbaum and David Cho at the WaPo: Small banks lag in repaying Treasury for bailout funds

[H]undreds of community banks have yet to return their bailouts. More than 10 percent of the 700 banks that got federal bailouts and are still holding the money even failed to pay the government a quarterly dividend in February. The list of 82 delinquent banks is significantly longer than the 55 banks that failed to make payments in November, according to an analysis by Linus Wilson, a finance professor at the University of Louisiana at Lafayette.Here is the report from the Treasury.

Wilson calculated that the missed payments totaled $78.1 million in February and that banks now have missed a total of $205 million in dividend payments to the government.

Many of the community banks still holding aid from the Troubled Assets Relief Program are struggling with losses on real estate development loans.

And in excel format under Dividend and Interest Reports.

There are three permanent deadbeats on the list: CIT Group (filed bankruptcy and wiped out its $2.3 billion in TARP debt), UCBH Holdings Inc. was seized by the FDIC (TARP lost $298.7 million), and Pacific Coast National Bank was also seized by the FDIC (TARP lost $4.1 million).

Weekly Initial Unemployment Claims Decline Slightly

by Calculated Risk on 3/18/2010 08:26:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 13, the advance figure for seasonally adjusted initial claims was 457,000, a decrease of 5,000 from the previous week's unrevised figure of 462,000. The 4-week moving average was 471,250, a decrease of 4,250 from the previous week's unrevised average of 475,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending March 6 was 4,579,000, an increase of 12,000 from the preceding week's revised level of 4,567,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 4,250 to 471,250.

The dashed line on the graph is the current 4-week average. The current level of 457,000 (and 4-week average of 471,250) is still very high, and suggests continuing job losses through the middle of March. Note: There is no way to compare directly between weekly claims, and net payrolls jobs.

Wednesday, March 17, 2010

Previous Business Cycle: "Bad by any measure"

by Calculated Risk on 3/17/2010 11:59:00 PM

We've seen all the statistics from the aughts - declining employment, declining stock prices, and weak income.

Andrew Flowers, economic research analyst at the Atlanta Fed, points out that decades are arbitrary, and that the previous decade started with a recession and ended with the great recession. He suggests looking at periods as trough-to-trough: Bad by any measure

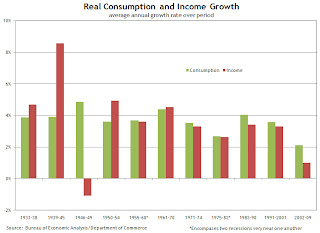

Flowers provides graphs of GDP, personal income and consumption, and payrolls for each trough-to-trough period. As an example, on income and consumption: Click on graph for larger image in new window.

Click on graph for larger image in new window.

Flowers writes:

[F]or real consumption and income growth, the 2002–09 period is also bleak. Average annual consumption and income growth had averaged 3.81 percent and 3.79 percent, respectively, going into 2002. But during this recent trough-to-trough period, income growth was very weak at 1 percent, with only the 1946–49 period doing worse (–1.09 percent). But consumption growth in 2002–09 was the lowest on record, averaging only 2.12 percent growth annually.The 1946-49 period isn't surprising since there was a flood of workers from the military (keeping income down), but people had significant savings from WWII when income far outpaced consumption. Of course, in the recent period, consumption was higher than income primarily because of mortgage equity extraction (The Home ATM).

Another interesting observation is the spread between average annual consumption and income growth. The 1946–49 and 2002–09 periods are where it's the largest, at 5.9 percent and 1.1 percent, respectively. These large imbalances could possibly reflect growth in household debt and/or lower saving rates, as consumption growth far outstrips income growth. Indeed, debt grew and savings declined notably during 2002–09.

The previous business cycle was "bad by any measure".