by Calculated Risk on 3/16/2010 03:58:00 PM

Tuesday, March 16, 2010

DataQuick: SoCal Home Sales up slightly in February

From DataQuick: Southern California median price and sales volume up

Note: Ignore the median price. The repeat sales indexes from Case-Shiller and LoanPerformance are better measures. The median is impacted by the mix.

Southern California home sales in February were above year-ago levels for the 20th month in a row as buyers continued to snap up bargain properties with government-backed mortgages and tax incentives. ....DataQuick doesn't list the percentage of short sales, but the total distressed sales is probably over 50%. Also the 38.5% of buyers using FHA insured loans is way above normal levels.

A total of 15,359 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was virtually unchanged from 15,361 in January, and up 0.8 percent from 15,231 in February 2009, according to MDA DataQuick of San Diego.

[CR Note: this is the second month in a row the YoY increase was razor thin.]

The February sales average is 17,983 going back to 1988, when DataQuick’s statistics begin. The sales distribution remains tilted toward lower-cost distressed homes, although not as steeply as most of last year.

...

Foreclosure resales accounted for 42.3 percent of the resale market last month, up from 42.1 percent in January, and down from 56.7 percent a year ago, which was the all-time high.

Government-insured FHA loans, a popular choice among first-time buyers, accounted for 38.5 percent of all home purchase loans in February.

Absentee buyers – mostly investors and some second-home purchasers – bought 18.9 percent of the homes sold in February. Buyers who appeared to have paid all cash – meaning there was no indication that a corresponding purchase loan was recorded – accounted for 29.3 percent of February sales. In January it was a revised 29.7 percent – an all-time high. The 22-year monthly average for Southland homes purchased with cash is 13.8 percent.

When the first time homebuyer tax credit ends, I expect the percent of FHA insured loans to decline sharply - and probably for total sales to decline. The tax credit associated buying will end in April, but the sales are counted when escrow closes - and that could be in May or June.

FOMC Statement: Economic Activity "Continued to strengthen"

by Calculated Risk on 3/16/2010 02:15:00 PM

Information received since the Federal Open Market Committee met in January suggests that economic activity has continued to strengthen and that the labor market is stabilizing. Household spending is expanding at a moderate rate but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software has risen significantly. However, investment in nonresidential structures is declining, housing starts have been flat at a depressed level, and employers remain reluctant to add to payrolls. While bank lending continues to contract, financial market conditions remain supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.The key language about rates stayed the same: "The Committee ... continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period."

With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve has been purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt; those purchases are nearing completion, and the remaining transactions will be executed by the end of this month. The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

In light of improved functioning of financial markets, the Federal Reserve has been closing the special liquidity facilities that it created to support markets during the crisis. The only remaining such program, the Term Asset-Backed Securities Loan Facility, is scheduled to close on June 30 for loans backed by new-issue commercial mortgage-backed securities and on March 31 for loans backed by all other types of collateral.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to the buildup of financial imbalances and increase risks to longer-run macroeconomic and financial stability.

Another key point was that the FOMC reiterated the ending dates for the MBS purchases. The Fed is giving advance warning that these purchases will expire as previously announced.

There is some concern about what will happen when the Fed stops buying agency MBS. The important thing to remember is that there will be buyers; it is just a matter of price. My guess is that mortgage rates will rise about 35 bps relative to the Ten Year treasury over several months after the Fed stops buying MBS. The Fed's Brian Sack and others have argued for 10 bps or less.

Another important point in the Fed statement was the recognition that the housing sector is not as strong as it appeared at the end of last year. Here is the language on housing over the last few statements:

Nov, 2009: "Activity in the housing sector has increased over recent months"

Dec, 2009: "The housing sector has shown some signs of improvement over recent months."

Jan, 2010: No comment.

March, 2010: housing starts have been flat at a depressed level

This was the first one day Fed meeting since September 16, 2008 - and that probably says something too.

Report: FDIC Seeking Buyers for Puerto Rican Banks

by Calculated Risk on 3/16/2010 11:59:00 AM

From Dow Jones: FDIC Seeks Buyers for Three Puerto Rican Banks

According to two people familiar with the matter, the agency has hired an investment bank to try to find capital or outright purchasers for W Holding Co. Inc., R&G Financial Corp. and Eurobancshares Inc., three banks located in Puerto Rico with almost $21 billion in combined assets.This is a follow up to the report last month from José Carmona and John Marino at caribbeanbusinesspr.com: Feds expected to take action against island banks next month

The three banks hold almost 30% of Puerto Rico's $62 billion of deposits, and their bank subsidiaries are operating under enhanced FDIC scrutiny.

Federal regulators are likely to begin taking action against troubled island banks sometime [in March], government and industry sources told CARIBBEAN BUSINESS.Westernbank is a subsidiary of W Holding Company mentioned in the Dow Jones article.

Since the beginning of the year, the Federal Deposit Insurance Corp. (FDIC) has been beefing up its local ranks, recruiting accountants and auditors, leading to speculation about imminent action during this year’s first quarter.

...

There are three local banks operating under FDIC cease & desist orders—R-G Premier Bank, Eurobank and Westernbank.

HAMP Debt-to-income Ratios of "Permanent" Mods

by Calculated Risk on 3/16/2010 11:10:00 AM

Last night I mentioned the astounding DTI (Debt-to-income) of HAMP modification borrowers who were converted to a permanent modification: 2010: REOs or Short Sales?  Click on chart for larger image in new window.

Click on chart for larger image in new window.

If we look at the HAMP program stats (see page 6), the median front end DTI (debt to income) before modification was 45%, and the back end DTI was an astounding 76.4%!

Just imagine the characteristics of the borrowers who can't be converted!

Here is a table putting the numbers in dollars:

| Median Characteristics of HAMP Permanent Modification | ||

|---|---|---|

| Before Modification | After Modification | |

| Monthly Income | $2,702.77 | $2,702.77 |

| Front End (PITI & HOA) | $1,216.25 | $837.86 |

| Back End (total) | $2,064.92 | $1,616.26 |

| After Debt Income | $637.85 | $1,086.52 |

Front end DTI includes Principal, Interest, Taxes and Insurance (PITI) plus any homeowners association fees.

The back end DTI includes PITI and HOA, plus installment debt, alimony, 2nd liens, and other fixed payments.

That left the median borrower before modification with only $637.85 not including payroll taxes ($206.76), income taxes, utilities, food, and other monthly expenses. No wonder the borrowers were delinquent.

Now these median borrowers have $1,086.52 to pay all those expenses after the to 59.8% DTI bank end ratio. Remember this is gross, and is before the $206,76 in payroll taxes and an income taxes). Although this is an improvement, I expect many of these borrowers to redefault.

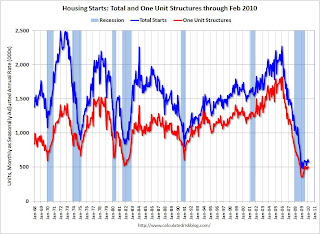

Housing Starts decline in February

by Calculated Risk on 3/16/2010 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 575 thousand (SAAR) in February, down 5.9% from the revised January rate, and up 20% from the all time record low in April 2009 of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for nine months.

Single-family starts were at 499 thousand (SAAR) in February, down 0.6% from the revised January rate, and 40% above the record low in January and February 2009 (357 thousand). Just like for total starts, single-family starts have been at about this level for nine months.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This level of starts is both good news and bad news. The good news is the excess housing inventory is being absorbed - a necessary step for housing (and the economy) to recover.

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 575,000. This is 5.9 percent (±10.0%)* below the revised January estimate of 611,000, but is 0.2 percent (±9.8%)* above the February 2009 rate of 574,000.

Single-family housing starts in February were at a rate of 499,000; this is 0.6 percent (±10.6%)* below the revised January figure of 502,000. The February rate for units in buildings with five units or more was 58,000.

Housing Completions:

Privately-owned housing completions in February were at a seasonally adjusted annual rate of 700,000. This is 5.4 percent (±20.2%)* above the revised January estimate of 664,000, but is 15.5 percent (±13.6%) below the February 2009 rate of 828,000.

Single-family housing completions in February were at a rate of 458,000; this is 4.3 percent (±13.7%)* above the revised January rate of 439,000. The February rate for units in buildings with five units or more was 236,000.

The bad news is economic growth will probably be sluggish - and unemployment elevated - until residential investment picks up.

Note: on the February snow storms, starts were up in the West and Midwest, and down in the Northeast and South (includes D.C. and Virginia), so the snow probably did impact starts. Of course some builders started spec homes to beat the tax credit expiration - and that boosted starts temporarily.