by Calculated Risk on 3/15/2010 10:56:00 AM

Monday, March 15, 2010

Capital One Credit Card Defaults decline, BofA defaults increase

From Reuters: Capital One Credit Card Defaults Fall, but BofA's Rise

Capital One said the annualized net charge-off rate — debts the company believes it will never collect — for U.S. credit cards fell to 10.19 percent in February from 10.41 percent in January. ...

However, Bank of America said its defaults rate rose in February, up from 13.25 percent in January to 13.51 percent.

Click on graph for larger image in new window.

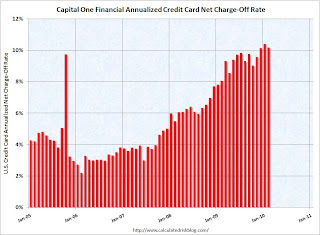

Click on graph for larger image in new window.This graph shows the COF annualized credit card charge-off rate since January 2005.

Notice the spike in 2005 - to 9.75% - associated with a surge in bankruptcy filings ahead of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Capital One's credit card annualized net charge-off rate is now at 10.19% - down slightly from January, but still above that spike in 2005!

As Reuters notes, Capital One is usually the first to report monthly credit card charge-offs - so this is the one I track. The other major credit card issuers will report later today.

Industrial Production, Capacity Utilization increase slightly in February

by Calculated Risk on 3/15/2010 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production edged up 0.1 percent in February following a gain of 0.9 percent in January. Production was likely held down somewhat by winter storms in the Northeast. Manufacturing decreased 0.2 percent in February, with mixed results among its major industries. The output of mines rose 2.0 percent, while the index for utilities rose 0.5 percent. At 101.0 percent of its 2002 average, industrial output in February was 1.7 percent above its year-earlier level. Capacity utilization for total industry moved up 0.2 percentage point to 72.7 percent, a rate 7.9 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 6.5% from the record low set in June (the series starts in 1967).

Capacity utilization at 72.7% is still far below normal - and far below the the pre-recession levels of 80.5% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

Also - this is the highest level for industrial production since Dec 2008, but production is still 10.1% below the pre-recession levels at the end of 2007. Snow is being blamed for industrial production and capacity utilization only increasing slightly.

Krugman: "Time to take a stand" on China Currency Manipulation

by Calculated Risk on 3/15/2010 12:32:00 AM

From Paul Krugman in the NY Times: Taking On China

Tensions are rising over Chinese economic policy, and rightly so: China’s policy of keeping its currency, the renminbi, undervalued has become a significant drag on global economic recovery. Something must be done.This is one of the key imbalances that needs to be resolved.

...

Twice a year, by law, Treasury must issue a report identifying nations that “manipulate the rate of exchange between their currency and the United States dollar for purposes of preventing effective balance of payments adjustments or gaining unfair competitive advantage in international trade.” The law’s intent is clear ... In practice, however, Treasury has been both unwilling to take action on the renminbi and unwilling to do what the law requires, namely explain to Congress why it isn’t taking action. Instead, it has spent the past six or seven years pretending not to see the obvious.

Will the next report, due April 15, continue this tradition? Stay tuned.

... Chinese currency policy is adding materially to the world’s economic problems at a time when those problems are already very severe. It’s time to take a stand.

Sunday, March 14, 2010

Housing Market Index, Housing Starts, Snow and Spec Homes

by Calculated Risk on 3/14/2010 09:33:00 PM

As mentioned in the Weekly Summary and a Look Ahead post, the NAHB Housing Market Index for March, and Housing Starts for February, will both be released early this week.

Here is a graph showing the relationship between the two series: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the January data for single family starts.

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month. Since the NAHB index increased slightly in February (it is released a month ahead of starts), we might expect some increase in February single family housing starts. Of course the snow might be a factor, although few new homes are built in the northeast compared to the rest of the country. Of course D.C. is in the South region (as is Virginia), so it might be hard to tell. Here is a map of states in each region for the Census Bureau report.

Of course the snow might be a factor, although few new homes are built in the northeast compared to the rest of the country. Of course D.C. is in the South region (as is Virginia), so it might be hard to tell. Here is a map of states in each region for the Census Bureau report.

There might also be an increase in speculative starts in some regions (single family) in February since many builders started a few extra homes in anticipation of the expiration of the first time home buyer tax credit. February was probably the last chance to start a spec home to take advantage of the expected buying rush in April - since the builders have to close by the end of June. It usually takes about 6 months to build a home, but 5 months is doable for smaller homes and with so many sub contractors hungry for work.

We will need to look at the details by region this time, but the general trend is sideways ...

Economic Outlook: Review of Possible Upside Surprises to Forecast

by Calculated Risk on 3/14/2010 05:09:00 PM

My general outlook for 2010 is for sluggish and choppy growth. Usually the deeper the recession, the steeper the recovery - however recoveries following economic crisis tend to be sluggish (see: "The Aftermath of Financial Crises", Reinhart and Rogoff, 2009):

An examination of the aftermath of severe financial crises shows deep and lasting effects on asset prices, output and employment. ... Even recessions sparked by financial crises do eventually end, albeit almost invariably accompanied by massive increases in government debt.Also the two usual engines of recovery, consumer spending and residential investment, both remain constrained as households rebuild their balance sheets (constraining consumption), and serious problems remain in the housing market including significant excess inventory and high levels of distressed properties.

Last November I listed a few possible upside surprises and downside risks to the above forecast. Here is an update on the possible upside surprises:

On consumer spending, I wrote:

My expectation has been that the saving rate would rise to around 8% over the next couple of years. The saving rate rose sharply in 2009, however the most recent report from the BEA: Personal Income and Outlays, January 2010 showed the saving rate fell to 3.3% in January.Consumer spending. One of the key reasons I think growth will be sluggish in 2010 is because I expect the personal saving rate to increase as households rebuild their balance sheets and reduce their debt burden. But you never know. As San Francisco Fed President Dr. Yellen said yesterday: "Consumers have surprised us in the past with their free-spending ways and it’s not out of the question that they will do so again." Still, it is hard to imagine much of a spending boom with high unemployment (putting pressure on wages), and limited credit (so some people can spend beyond their income).

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the January Personal Income report.

Although I still expect the saving rate to rise, it is possible that it will not rise as far - or as fast - as I expected. That would mean consumption could grow closer to income growth in 2010.

My comments last year on exports:

Based on the comments of Chinese Premier Wen last night, "don't hold your breath" was probably good advice (although I do expect China to revalue this year). U.S. exports have increased over the last year, but it appears the growth of exports has slowed.Exports. Perhaps we are seeing a shift from a U.S. consumption driven world economy, to a more balanced global economy. An increase in consumption in other countries, combined with the weaker dollar should lead to more U.S. exports. And if China revalued that might lead to a boom in U.S. exports. ... Please don't hold your breath waiting for China!

On Residential Investment:

This has been as weak as expected ...Residential Investment. Those expecting a "V-shaped" or immaculate recovery - with unemployment falling sharply in 2010 - are expecting single family housing starts to rebound quickly to a rate significantly above 1 million units per year. That won't happen. But it is possible for single family starts to rebound to 700 thousand SAAR, even with the large overhang of existing housing inventory.

And on another stimulus:

With unemployment above 10%, there will be significant political pressure for another stimulus package - especially if the economy starts to slow in the first half of 2010. This next package could be several hundred billion (maybe $500 billion) and could increase GDP growth in 2010 above my forecast.It now appears the additional stimulus will be in the $100 billion range, mostly for additional unemployment benefits.

The most likely upside surprise appears to be coming from consumer spending and the lack of an increase in the saving rate. I still think the saving rate will continue to rise - although maybe not as fast as I originally expected.

Also - I still think the recovery will be choppy and sluggish. I'll review the downside risks soon ...