by Calculated Risk on 3/12/2010 08:30:00 AM

Friday, March 12, 2010

Retail Sales increase in February

On a monthly basis, retail sales increased 0.3% from January to February (seasonally adjusted, after revisions), and sales were up 4.5% from February 2009 (easy comparison).

UPDATE: January was revised down sharply. Jan was originally reported at $355.8 billion, an increase of 0.5% from December.

February was reported at $355.5 billion - a decline without the revision to January.

January has been revised down to $354.3 or an increase of 0.1% from December. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

The red line shows retail sales ex-gasoline and shows the increase in final demand ex-gasoline has been sluggish.

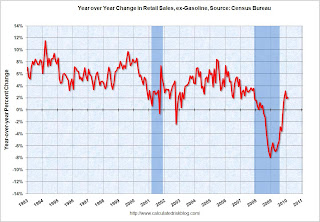

Retail sales are up 6.0% from the bottom, but still off 6.4% from the peak. Retail ex-gasoline are up 3.6% from the bottom and still off 5.4% from the peak. The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 2.1% on a YoY basis (4.5% for all retail sales). The year-over-year comparisons are easy now since retail sales collapsed in late 2008. Retail sales bottomed in December 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $355.5 billion, an increase of 0.3 percent (±0.5%)* from the previous month and 3.9 percent (±0.5%) above February 2009.

...

Gasoline stations sales were up 24.0 percent (±1.5%) from February 2009 and nonstore retailers sales were up 11.8 percent (±1.7%) from last year.

Report: Obama to Nominate Janet Yellen as Fed Vice Chairman

by Calculated Risk on 3/12/2010 12:09:00 AM

From Bloomberg: Yellen Said to Be Obama’s Pick for Fed Vice Chairman

I suggested Dr. Yellen as a possible candidate for Fed Chairman last year, so obviously I think this is a good choice. She was way ahead of most other Fed members in recognizing the housing bubble, and she is apparently well respected by other Fed members. She is also very focused on unemployment (something we need right now).

Yellen served on the Federal Open Market Committee (FOMC) last year - and this would put her back on the Committee (the Fed Presidents rotate each year).

Thursday, March 11, 2010

Examiner: Lehman used undisclosed "balance sheet manipulation"

by Calculated Risk on 3/11/2010 08:21:00 PM

The NY Times Deal Book has posted the Lehman's examiners report online: Court-Appointed Lehman Examiner Unveils Report

There is an interesting excerpt on the apparent use of repo transactions to bolster Lehman's balance sheet:

... former Global Financial Controller Martin ... Kelly believed “that the only purpose or motive for the transactions was reduction in balance sheet”; felt that “there was no substance to the transactions”; ... In addition to its material omissions, Lehman affirmatively misrepresented in its financial statements that the firm treated all repo transactions as financing transactions – i.e., not sales – for financial reporting purposes.From Reuters: Examiner sees accounting gimmicks in Lehman demise

And from the WSJ: Examiner: Lehman Torpedoed Lehman and How Lehman Allegedly Manipulated Its Balance Sheet

Bank Failure #27: LibertyPointe Bank, New York, New York

by Calculated Risk on 3/11/2010 07:04:00 PM

"Spring Forward" .... taken too far

What day is today?

by Soylent Green is People

From the FDIC: Valley National Bank, Wayne, New Jersey, Assumes All of the Deposits of LibertyPointe Bank, New York, New York

LibertyPointe Bank, New York, New York, was closed today by the New York State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....Is it Friday?

As of December 31, 2009, LibertyPointe Bank had approximately $209.7 million in total assets and $209.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $24.8 million. ... LibertyPointe Bank is the 27th FDIC-insured institution to fail in the nation this year, and the first in New York. The last FDIC-insured institution closed in the state was Waterford Village Bank, Williamsville, July 24, 2009.

The Countdown: Federal Reserve MBS Purchases 98.4% Complete

by Calculated Risk on 3/11/2010 05:10:00 PM

Some key points:

Here is the Federal Reserve balance sheet break down from the Atlanta Fed weekly Financial Highlights released today (as of last week):

Click on graph for larger image in new window.

Click on graph for larger image in new window.Graph Source: Altanta Fed.

From the Atlanta Fed:

The balance sheet contracted $6.9 billion for the week ended March 3.Holdings of agency debt and mortgage backed securities shrank $4.7 billion, and other assets declined by $2.2 billion. The balance sheet is expected to peak during the first half of this year after the MBS purchase program is completed and purchases settle on the balance sheet.

The second graph shows the MBS purchases by week. From the Atlanta Fed:

The second graph shows the MBS purchases by week. From the Atlanta Fed: The NY Fed purchased an additional net $10 billion in MBS for the week ending ending March 10th. This puts the total purchases at $1.230 trillion or almost 98.4% complete. Just $20 billion more and three weeks to go ...The Fed purchased a net total of $10 billion of agency-backed MBS through the week of March 3. This purchase brings its total purchases up to $1.22 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 98% complete).

The Fed's balance sheet released today shows "only" $1.029 trillion in MBS on March 10th. As mentioned above, the difference is the NY Fed announces the purchases when they contract to buy; the Federal Reserve places the MBS on the balance sheet when the contract settles.

The countdown ends in 3 weeks, and I don't expect any fireworks ...