by Calculated Risk on 2/26/2010 02:24:00 PM

Friday, February 26, 2010

Freddie Mac: Delinquencies Increase Sharply in January

Here is the monthly Freddie Mac hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Freddie Mac reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 4.03% in January 2010, up from 3.87% in December - and up from 1.98% in January 2009.

"Single-family delinquencies are based on the number of mortgages 90 days or more delinquent or in foreclosure as of period end ..."

Just more evidence of the growing delinquency problem, although some of these loans may be in the trial modification programs and are still included as delinquent until they are converted to a "permanent mod". If the trial is cancelled, the loan stays delinquent (until foreclosure).

The data from Fannie Mae will be released later ...

Tax Credits: Vehicle and Existing Home Sales

by Calculated Risk on 2/26/2010 01:29:00 PM

By request, here is a graph overlaying light vehicle sales and existing home sales - and showing the impact of "cash for clunkers" and the "first time home buyer" tax credit. (ht Brian) Click on graph for larger image in new window.

Click on graph for larger image in new window.

The red line (left axis) is vehicle sales. The blue line (right axis) is existing home sales since Jan 2008. Both are in millions of units at a Seasonally Adjusted Annual Rate (SAAR).

The Cash for Clunkers program was effective on July 1, 2009, but didn't really start until near the end of July. The program was expanded in early August, and ended on August 24th.

The First Time Home Buyer tax credit was passed in February with an initial deadline to close on the home by November 30, 2009. The home buyer tax credit was extended and expanded at the end of October, and now buyers must sign a contract by April 30, 2010, and close by June 30, 2010.

There will probably be another surge in existing home sales in May and June (reported when sales close). And then sales will probably decline again.

More on Existing Home Sales

by Calculated Risk on 2/26/2010 11:07:00 AM

Earlier the NAR released the existing home sales data for January; here are a few more graphs ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows NSA monthly existing home sales for 2005 through 2010 (see Red column for Jan 2010).

Sales (NSA) in January 2010 were 7% higher than in January 2009, and slightly lower than in January 2008.

The second graph shows existing home sales (left axis) and new home sales (right axis) through January. I jokingly refer to this as the "distressing gap". The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent spike in existing home sales was due primarily to the first time homebuyer tax credit.

The following graph shows the same information as a ratio - existing home sales divided by new home sales - through January 2010. This ratio is just off from the all time high in November when existing home sales were artificially boosted by the first time home buyer tax credit.

This ratio is just off from the all time high in November when existing home sales were artificially boosted by the first time home buyer tax credit.

Eventually this ratio will return to the historical range of around 6 existing home sales per new home sale. Right now this graph shows that the housing market is far from normal.

Existing Home Sales Decline Sharply in January

by Calculated Risk on 2/26/2010 10:00:00 AM

The NAR reports: Existing-Home Sales Down in January

Existing-home sales – including single-family, townhomes, condominiums and co-ops – dropped 7.2 percent to a seasonally adjusted annual rate1 of 5.05 million units in January from a revised 5.44 million in December, but remain 11.5 percent above the 4.53 million-unit level in January 2009.

Total housing inventory at the end of January fell 0.5 percent to 3.27 million existing homes available for sale, which represents a 7.8-month supply at the current sales pace, up from a 7.2-month supply in December.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Jan 2010 (5.05 million SAAR) were 7.2% lower than last month, and were 11.5% higher than Jan 2009 (4.53 million SAAR).

This is a sharp drop from November when many of the transactions were due to first-time homebuyers rushing to beat the initial expiration of the tax credit (that has been extended). That pushed sales far above the historical normal level; based on normal turnover, existing home sales would be in the 4.5 to 5.0 million SAAR range.

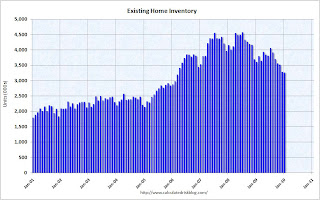

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.27 million in January from 3.29 million in December. The all time record high was 4.57 million homes for sale in July 2008.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.27 million in January from 3.29 million in December. The all time record high was 4.57 million homes for sale in July 2008. This is not seasonally adjusted and this decline is mostly seasonal - inventory should increase in the Spring.

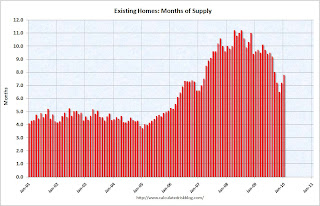

The third graph shows the 'months of supply' metric.

The third graph shows the 'months of supply' metric.Months of supply increased to 7.8 months in January.

A normal market has under 6 months of supply, so this is high - and probably excludes some substantial shadow inventory.

I'll have more later ...

Q4 GDP Revised to 5.9%

by Calculated Risk on 2/26/2010 08:30:00 AM

The headline GDP number was revised up to 5.9% annualized growth in Q4 (from 5.7%), however most of the improvement in the revision came from changes in private inventories. Excluding inventory changes, GDP would have been revised down to around 1.9% from 2.2%.

This table shows the changes from the "advance estimate" to the "second estimate" for several key categories:

| Advance | Second Estimate | |

|---|---|---|

| GDP | 5.7% | 5.9% |

| PCE | 2.0% | 1.7% |

| Residential Investment | 5.7% | 5.0% |

| Structures | -15.4% | -13.9% |

| Equipment & Software | 13.3% | 18.2% |

Changes in private inventories are transitory (only lasts a few quarters at the start of a recovery), and although the headline number was revised up, final demand was weaker than in the advance estimate.